1000 BTC moved in the “Satoshi era” / Institutional investors ignore altcoins[Weekly Review: 12/2-12/8]

This week’s consideration!

The opposite day, Satoshi Nakamoto was featured on an NHK program. Though it might be unrelated, “Because the starting of 2023, some “Satoshi period” Bitcoins have began to maneuver.”

Earlier this week, a considerable amount of Bitcoin (BTC) acquired by way of mining throughout the community’s early phases was moved, becoming a member of a uncommon case of “Satoshi-era” Bitcoin being moved.

Greater than 1,000 BTC from early miners was moved to buying and selling desks and custodian companies on December 4, in keeping with on-chain information agency CryptoQuant, which shared with CoinDesk in a December 7 report. These tokens have been moved between August and November 2010, 13 years in the past, and are believed to have been mined from block rewards at an estimated complete value of $100.

Bitcoin worth development

Bitcoin surpassed $40,000 this week. In Japanese yen, on the time of writing this text, it’s round 6.4 million yen.

Bitcoin (BTC) exceeded $40,000 for the primary time in 18 months on December 3 (US Japanese Time), and Ethereum (ETH) exceeded $2,200 as the general market rose modestly.

Bitcoin (BTC) and Ethereum (ETH) have rallied previously 24 hours as optimism round attainable spot exchange-traded fund (ETF) approval within the U.S. continues to develop and gold’s peak worth additionally supplies a tailwind. It rose by 4%.

BTC surpassed the $41,000 mark on December 4th, extending its year-to-date achieve to over 152%.

Bitcoin (BTC) hit a brand new 19-month excessive on the 4th, exceeding $42,000 (roughly 6.09 million yen, equal to 145 yen per greenback), spurred by some “panic shopping for.” Expectations for decrease rates of interest, an impending resolution on a Bitcoin spot ETF, and inflows into digital asset funds supported crypto markets.

Bitcoin (BTC) soared on the fifth, reaching $44,000 (roughly 6.38 million yen, equal to 145 yen to the greenback) for the primary time since early April 2022 on some crypto asset exchanges akin to Coinbase. exceeded. The upside was supported by decrease rates of interest and expectations for approval of a Bitcoin spot ETF (change traded fund) in the USA.

In keeping with information from CoinGlass, brief merchants betting on a fall in Bitcoin costs liquidated about $70 million (roughly 10.2 billion yen, equal to 146 yen per greenback) on December 4th, and solely on the fifth. But it surely misplaced about $90 million (about 13.2 billion yen). These could also be contributing to Bitcoin’s power this week, which noticed it soar from $39,000 to $44,000.

The rise of Bitcoin (BTC) stopped on the seventh. As an alternative, Ethereum (ETH) and Solana (SOL), which soared to a 19-month excessive, led the crypto market rally.

Bitcoin associated

Once we look again on microstrategy and El Salvador years or a long time from now, will we see it as a terrific achievement?

With the worth of Bitcoin rising above $42,000 (roughly 6.09 million yen, equal to 145 yen per greenback), US MicroStrategy’s unrealized positive factors from holding a considerable amount of Bitcoin reached $2 billion (about 6.09 million yen, equal to 145 yen per greenback) on the 4th. 290 billion yen).

El Salvador’s President Nayib Bukele mentioned on X (previously Twitter) on the 4th that Bitcoin (BTC) rose to the extent of $42,000 (roughly 6.09 million yen, equal to 145 yen to the greenback) over the weekend. In response, he introduced that his dwelling nation’s Bitcoin investments are at present producing greater than $3 million in valuation positive factors.

On the 4th, BlackRock, the world’s largest asset administration firm, and Bitwise, a crypto asset funding firm, every filed revised variations of their S1 types with the US Securities and Trade Fee (SEC). offered extra data which will have been identified by the SEC throughout its discussions.

Key derivatives market indicators present that refined merchants are turning from Bitcoin (BTC) to Ethereum (ETH), suggesting ETH might outperform within the coming weeks. ing.

Market developments

Together with BTC throughout the Satoshi period, early traders in Ethereum additionally moved giant quantities of ETH to exchanges. Elon Musk has been within the information associated to crypto property for the primary time shortly.

Cathie Wooden’s funding administration agency, ARK Make investments, bought Coinbase inventory for the third time this week, promoting for about $4.7 million on the Nov. 30 closing worth. 37,377 shares price 1 billion yen (exchanged at 1 greenback = 150 yen) have been bought.

Tokens akin to GFY, TRUCK, and GROK, derived from Elon Musk’s merchandise and up to date statements, have appeared on blockchains akin to Ethereum.

This can be a tiring development that has plagued the crypto trade for years. Opportunistic builders are shortly constructing giant quantities of tokens, impressed by sizzling ideas.

The inventory worth of Nasdaq-listed cryptocurrency change Coinbase has soared practically 300% this yr, far outpacing Bitcoin (BTC), the most important cryptocurrency. In keeping with technical evaluation analysis agency Fairlead Methods, Coinbase has the potential for additional upside as momentum confirms a breakout of its long-term base sample.

Coinbase and MicroStrategy inventory costs soared 9% forward of market open as Bitcoin (BTC) surged 4% previously 24 hours, extending year-to-date positive factors to greater than 150%. It skyrocketed lately.

Institutional merchants are bullish on Bitcoin (BTC), blended on Ethereum (ETH) and skeptical of altcoins, a brand new report from Bybit Analysis reveals.

A big Ethereum (ETH) holder held about 90 million {dollars} (roughly 13.5 billion yen, equal to 1 greenback = 150 yen) price of tokens for 5 years on the cryptocurrency change Kraken. Lookonchain, an on-chain evaluation device, introduced on December fifth that it has moved toPosted.

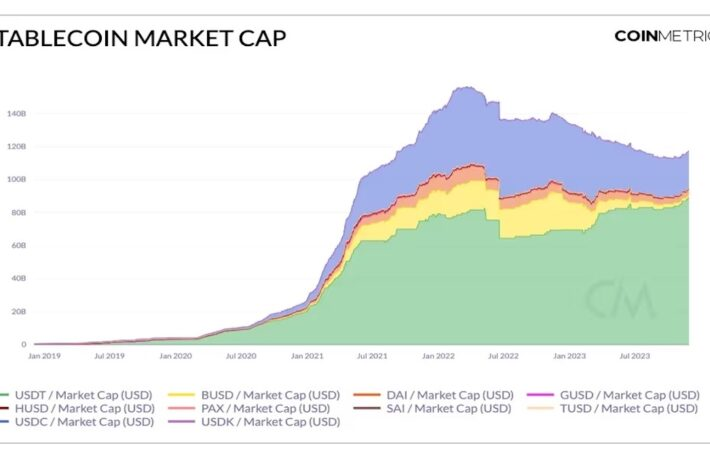

The stablecoin market is increasing for the primary time in additional than 18 months, and new capital is flowing into crypto property, as symbolized by Tether (USDT)’s market capitalization reaching a file excessive of $89 billion.

The overall market capitalization of main stablecoins has elevated by about $5 billion over the previous month to $124 billion, in keeping with information from Glassnode.

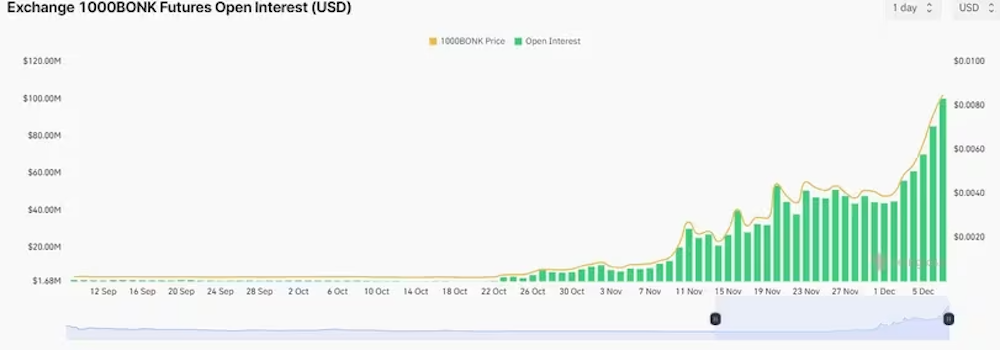

The season for dog-themed tokens is right here once more, with outstanding tokens delivering multi-fold returns to their holders.

First launched final December, the Shiba Inu-themed BONK has grown to 1,000 previously month amid a rise in capital inflows to the Solana blockchain and high-risk bets on the token primarily based on the community’s reputation. recorded a return of greater than %.

Two tokens related to house logistics firm Geometric Vitality are rising forward of the Dogecoin (DOGE)-themed satellite tv for pc DOGE-1’s mission to enter lunar orbit.

Business developments

In Japan, revisions to the end-of-year mark-to-market valuation taxation of crypto property are progressing, and it appears to be like like there shall be extra tailwinds.

In keeping with a report launched by cybersecurity agency Recorded Future on November 29, the Lazarus Group, a hacker group linked to North Korea, has racked up $3 billion (roughly 435 billion yen) over the previous six years. The suspect stole crypto property equal to 145 yen per greenback.

On December 5, the Liberal Democratic Occasion and New Komeito held a tax investigation committee to evaluate requests for tax reform submitted by numerous ministries and businesses. In keeping with the Nikkei Shimbun, the taxation of crypto property (digital forex) on firms shall be reviewed, and changes shall be made to take away crypto property which can be repeatedly held for functions apart from short-term buying and selling from being topic to mark-to-market taxation on the finish of the fiscal yr.

Cathie Wooden’s ARK Make investments shares of crypto change Coinbase hit a 19-month excessive on the again of Bitcoin’s (BTC) latest surge. , and bought the identical inventory price $33 million (roughly 4.8 billion yen, equal to 146 yen = 1 greenback) primarily based on the closing worth on December fifth.

Dogecoin (DOGE) soared within the U.S. on the sixth after tech entrepreneur Elon Musk mentioned his synthetic intelligence (AI) startup xAI was “not elevating funds.” It began to fall again within the morning.

One Extra Issues

RWA tokenization, safety tokens, digital securities…there are numerous names for it, however there isn’t any doubt that efforts on this space are accelerating.

As demand for real-world asset (RWA) tokenization will increase amongst conventional monetary establishments, French banking large Societe Generale is issuing its first tokenized inexperienced bond on the Ethereum community. accomplished.

On December 7, Hitachi introduced that it’ll challenge a complete of 10 billion yen in unsecured company bonds, together with inexperienced digital observe bonds (digital environmental bonds) that use digital applied sciences akin to IoT (Web-of-Issues) and blockchain platforms. He introduced that he had selected yen.

|Written and edited by Takayuki Masuda

|Picture: Shutterstock