104K BTC Added As $1M Transfers Surge

Whale-sized Bitcoin holders are piling up extra cash whilst costs wobble. In accordance with blockchain tracker Santiment, wallets holding at the least 1,000 BTC added 104,340 BTC in latest weeks.

Associated Studying

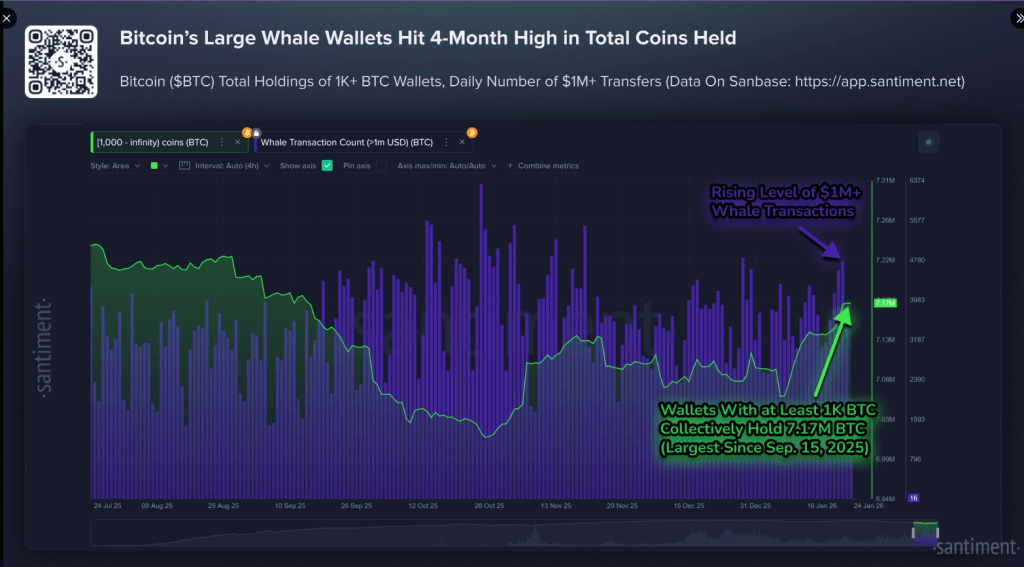

Studies observe that complete provide held by these large wallets hit 7.17 million BTC, the best stage since September 15, 2025. Mid-sized holders joined in too, including roughly $3.21 billion value of Bitcoin between January 10 and January 19. Small retail wallets moved the opposite method, offloading about 132 BTC, value round $11.66 million.

Whales Push Their Stakes Larger

The numbers level to affected person shopping for by large gamers. Massive transfers of $1 million or extra have climbed to a two-month excessive, which suggests heavy members are energetic on the community once more.

In accordance with Santiment, this sort of move is commonly tied to establishments and rich traders shifting cash between custody, exchanges, and personal wallets.

A few of these strikes are pushed by strategic decisions; some are supposed to safe holdings. Both method, a rising pile in whale palms adjustments the place provide sits.

Smaller holders are stepping again, whereas the so-called sensible cash will increase publicity. Studies say mid-sized wallets — these holding between 10 and 10,000 BTC — have been internet patrons in the identical stretch.

🐳 Massive Bitcoin whales are accumulating at an encouraging tempo, wallets with at the least 1K $BTC have collectively accrued 104,340 extra cash (a +1.5% rise). Moreover, the quantity of $1M+ day by day transfers is again as much as 2-month excessive ranges.

🔗 Chart: https://t.co/CJOfiOBbWU pic.twitter.com/4loxDFtUdb

— Santiment (@santimentfeed) January 25, 2026

Worth Motion And Market Indicators

Bitcoin’s price has not matched the upbeat on-chain motion. Buying and selling was round $87,730 at one level, with intraday swings between $86,500 and $87,500.

The alpha crypto asset was down about 0.5% over 24 hours and roughly 5.4% over the prior week. Volumes have ticked up, although, which makes the case that some traders are stepping in at these ranges.

The image is combined: on-chain accumulation suggests a base is being fashioned, however macro headlines hold the market on edge.

On-Chain Energy Versus Headlines

A rising stash by large holders can help a future rally if exterior stress eases. But costs transfer on greater than Bitcoin flows. Massive transfers and rising accumulation imply demand exists underneath the floor, however that demand has but to completely push the market larger.

Macro Dangers And Market Jitters

Geopolitical worries are casting an extended shadow. Studies say US President Donald Trump has moved warships towards areas of tension, and prediction markets present a major likelihood that the US may strike Iran by June.

Trade friction with Canada over latest auto guidelines has raised recent political noise, and Polymarket exhibits the likelihood of a US authorities shutdown above 70%. These are actual dangers that may carry oil, rattle markets, and sap urge for food for danger belongings.

Associated Studying

Featured picture from Unsplash, chart from TradingView