$12k Void Opens Up Possibility Of Crash Toward $75,000

Este artículo también está disponible en español.

Bitcoin has prolonged its correction under the $100,000 psychological degree into the previous 24 hours. On the time of writing, Bitcoin is struggling to carry above the $94,000 mark after recovering briefly from its current crash to $91,000.

Associated Studying

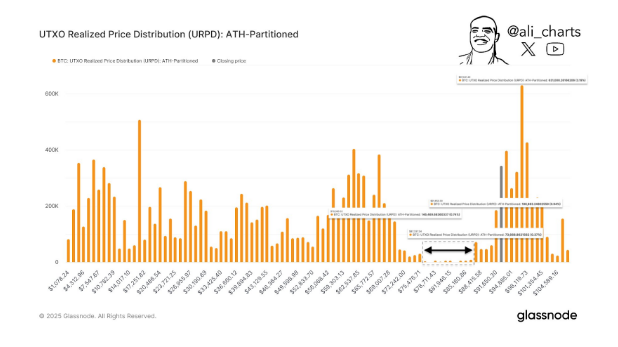

Because it stands, Bitcoin’s value outlook has taken a cautious flip, with crypto analyst Ali Martinez highlighting a $12,000 void between $87,000 and $75,000. The analysis, which is predicated on the Bitcoin UTXO Realized Value Distribution (URPD) ATH-Partitioned, reveals a scarcity of serious assist on this vary and raises considerations over a fast crash in direction of $75,000.

$12,000 Void Reveals Lack Of Assist Between $87,000 And $75,000

Information from Bitcoin’s UTXO Realized Value Distribution (URPD) ATH-Partitioned metric reveals that the vary between $87,000 and $75,000 lacks substantial realized value exercise. The UTXO is a comparatively quiet however necessary technical indicator that gives insights into the distribution of Bitcoin throughout completely different value ranges and focuses on UTXOs (Unspent Transaction Outputs).

Subsequently, analyzing UTXOs helps determine the value ranges at which Bitcoin holders are at the moment sitting on realized beneficial properties or losses.

As famous by Ali Martinez, the vary between $87,000 and $75,000 opens up a $12,000 hole that might simply develop into unfavorable for Bitcoin. It is because this vary represents “little to no assist,” which means there’s inadequate historic shopping for exercise to stabilize Bitcoin’s value if it enters this zone. As such, this void will increase the danger of a pointy correction ought to Bitcoin fall under the higher boundary.

Market Implications Of The $12,000 Void

Because it stands, the $12,000 void menace will be solely legitimate if Bitcoin had been to interrupt under $87,000. Though Bitcoin has largely held up above $90,000 even throughout corrections since November, the current drop to $91,000 opens up the opportunity of an eventual drop under $90,000. This concern is amplified by the Crypto Worry and Greed Index shifting to a impartial zone, accompanied by a surge in bearish sentiment throughout social media.

If Bitcoin had been to interrupt under $90,000, this might open up the opportunity of a continued decline in direction of $87,000. This, in flip, would more than likely result in a swift drop to $75,000. This situation would undoubtedly check the bullish sentiment from traders and Bitcoin’s skill to maintain predictions of a long-term bullish trajectory.

Associated Studying

However, you may simply argue that the continuing consolidation opens up the chance to build up extra BTC. According to an analyst on CryptoQuant, the short-term SOPR indicator is at the moment under 1, which means many short-term traders are promoting Bitcoin at a loss. Nonetheless, historical past reveals this phenomenon usually precedes a significant upward pattern, making it a good time for accumulation.

On the time of writing, Bitcoin is buying and selling at $94,350.

Featured picture from Getty Photographs, chart from TradingView