1inch Investment Fund Just Sold Ethereum, What Do They Know?

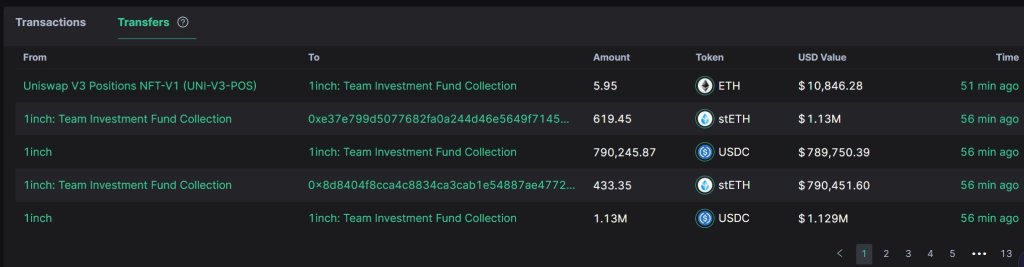

1inch Funding Fund, a fund carefully tied with the crypto trade aggregating platform, 1inch, has sold 4,685 stETH for 8.54 million USDC at $1,823, in accordance with Scopescan, an analytics platform, on October 24. By promoting at spot charges, the fund has netted $1.28 million in income for the reason that stETH was purchased at a median value of $1,550 lower than per week in the past.

1inch Funding Fund Sells stETH

StETH, or staked Ethereum (ETH), is an ERC-20 token representing staked ETH on the Lido Finance protocol. The platform permits anybody to stake their cash and earn rewards with out essentially locking their cash for an prolonged interval.

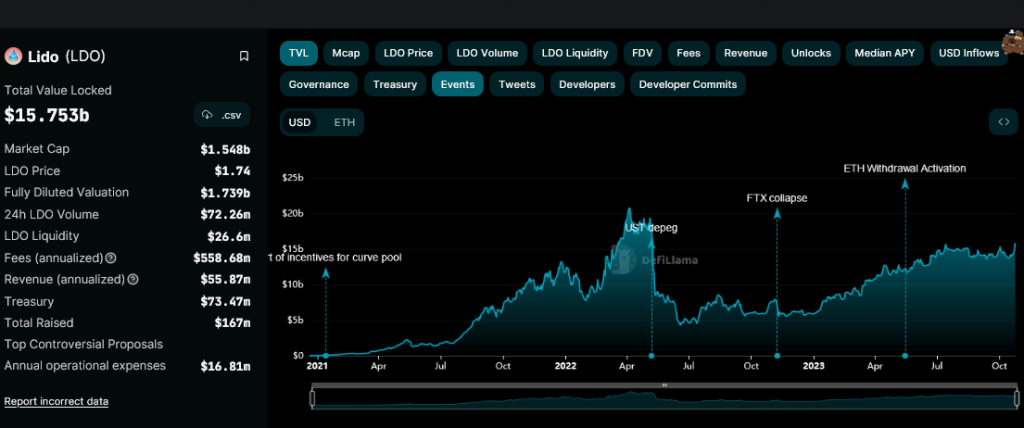

As of October 24, Lido Finance is the most well-liked decentralized finance (DeFi) software taking a look at complete worth locked (TVL). DeFiLlama information exhibits that the protocol manages over $15.7 billion of belongings, of which over 95% are ETH.

Technically, any ETH holder wishing to stake and earn community rewards stake on Lido Finance receives stETH in return, representing the stake quantity. The upper the staked quantity, the extra stETH the protocol issued. This stETH might be traded, transferred, or used to safe loans whereas concurrently incomes community rewards.

Promoting stETH means 1inch Funding Fund mechanically unstaked the identical quantity on Lido Finance and bought the underlying cash. Even so, transferring the underlying ETH can take a number of days when there is likely to be modifications to identify costs.

Curiously, the choice is when the crypto market appears to get well, and Ethereum is roaring again to life in direction of the $2,000 stage. Contemplating that the fund is non-public and doesn’t reveal its technique to the general public, it couldn’t be instantly decided why it sells stETH when market confidence is excessive.

Will Ethereum Costs Break $2,000?

Taking a look at value charts, Ethereum costs are up roughly 17% from H2 2023 lows, rallying at spot charges. The October 23 and 24 growth has seen the coin break greater, registering new October highs. Even so, regardless of the general confidence, the failure of bulls to finish reverse losses of August 17 must be a priority.

Ideally, a complete surge above $1,800 and $2,000 might anchor a leg up towards $2,100 within the coming classes. When the fund bought stETH at $1,823, value information confirmed it exited at round at this time’s peak. There’s an inverted hammer within the ETHUSDT day by day chart, an indicator that costs are inching decrease on growing promoting stress.

Characteristic picture from Canva, chart from TradingView