2 Million ETH Staked In May So Far, New ATH

Abstract:

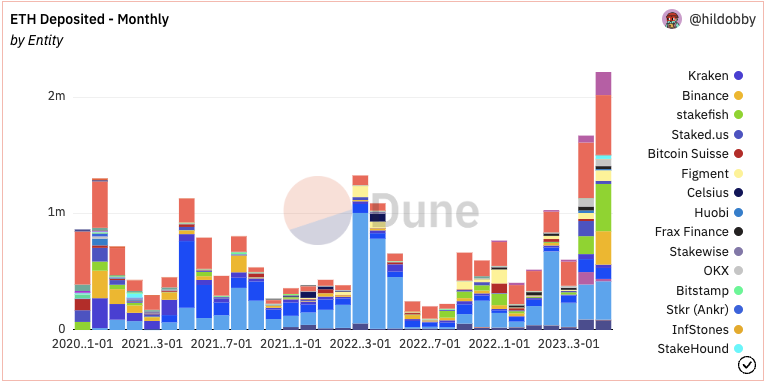

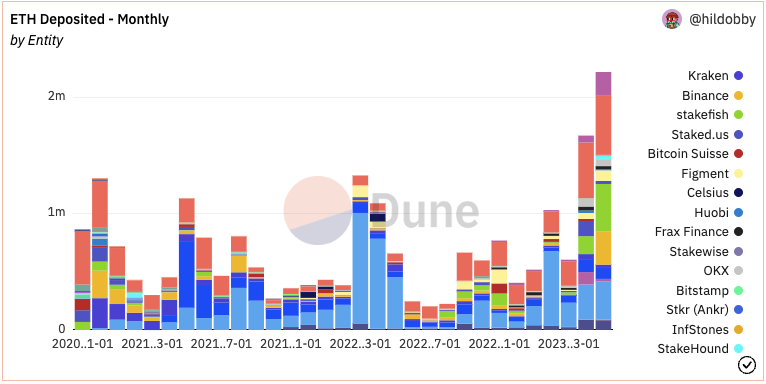

- Ethereum stakers have locked up over 2 million tokens thus far in Might alone, setting a brand new all-time excessive.

- Dune analytics information confirmed that day by day ETH withdrawals have additionally slowed down after Kraken’s huge unlocks.

- Nansen’s Martin Lee famous that staking deposits post-Shanghai point out robust total confidence in each the blockchain and ETH as an asset.

Over 2 million Ether (ETH), the native asset on the Ethereum blockchain, has been staked on the community’s beacon chain thus far this Might 2023.

This variety of tokens locked up this month alerts a brand new all-time excessive for staked ETH (stETH), per Dune analytics information.

The uptick in depositors has continued because the Shapella improve enabled withdrawals. Regardless of fears that over 18 million of unlocked cash would topic ETH to vital promoting strain, deposits have eclipsed withdrawals and rendered falling value considerations a “non-event”.

Nansen information confirmed that almost all of unstakers or withdrawals have been exchanges like Kraken and never customers. Notably, Kraken’s huge unlock was earmarked for inner operations on the crypto change as in opposition to speculations that the platform deliberate to dump its staked holdings after the unlock.

Curiosity In ETH And LSDs Boomed After Shapella

Certainly, the influx of tokens into the beacon chain and liquid staking companies like Lido Finance alerts robust total confidence” in each ETH and the Ethereum community by customers.

Enabling withdrawals has additionally lowered the dangers related to staking into liquid staking derivatives (LSDs), mentioned Nansen information scientist Martin Lee.

With withdrawals enabled, there’s decrease odds of seeing de-pegs between the liquid staking tokens and ETH itself since withdrawals may be facilitated by official mechanisms as a substitute of the psuedo mechanism launched by swapping stETH with ETH in Lido’s case.

Crypto customers are additionally incentivized to stake their ETH versus holding the asset on exchanges or self-custody gadgets like {hardware} wallets because the former may generate yield and returns.