$2 price target in play?

- Stellar’s golden cross and $0.33 assist recommend potential restoration to $0.45 and past.

- Historic 3,162% XLM positive aspects gas $2.19 worth goal as buyers withdraw $3.37 million from exchanges.

Stellar [XLM] has retraced a few of its earlier positive aspects, buying and selling at $0.4255 at press time. This represents a 0.96% drop over the previous 24 hours and a 9.09% decline over the previous week.

With a circulating provide of 30 billion XLM, the crypto holds a market capitalization of $12.79 billion.

Regardless of the short-term pullback, analysts level to historic information and up to date technical indicators as causes to observe the asset intently.

Technical indicators level to potential upside

Current technical evaluation exhibits that Stellar skilled a “golden cross,” the place its 13-day shifting common (crimson) moved above the 49-day shifting common (yellow).

This sample is broadly seen as a bullish sign, indicating potential for upward momentum. Nonetheless, XLM’s worth has retreated from its November excessive of $0.60, consolidating round $0.42.

Supply: TradingView

Help is clear within the $0.33 vary, close to the 49-day shifting common, the place patrons could step in if the value continues to drag again. The Relative Energy Index (RSI) was at 52.40, suggesting impartial momentum.

Patrons stay energetic after the RSI cooled from overbought ranges in November. Analysts recommend that if XLM stays above $0.33 to $0.42, a possible restoration towards $0.45 or increased might unfold.

Historic information fuels optimism for future development

Historic efficiency supplies perception into XLM’s potential worth trajectory. Throughout the 2020–2021 bull run, Stellar rose from roughly $0.025 to $0.79, representing a 3,162.88% acquire.

Analysts have famous the potential for an analogous improve from present ranges. Projections estimate a transfer to $2.19, with an prolonged goal of $2.27, although reaching such positive aspects would depend upon broader market circumstances and investor sentiment.

Supply: X

Crypto analyst EGRAG CRYPTO has compared this potential rally to previous worth actions, stating,

“We’ve simply touched the Mouse’s Moustache, and now it’s time to construct momentum!”

EGRAG additional highlighted the significance of retesting key exponential shifting averages (EMAs) as XLM makes an attempt to shut above increased resistance ranges.

Market sentiment exhibits combined alerts

Current Coinglass data displays a 30.20% drop in buying and selling quantity, now at $614.82 million, and a 4.89% lower in open curiosity, indicating lowered market exercise.

Regardless of this, lengthy/quick ratios on Binance (2.2258) and OKX (1.77) present a bullish bias amongst merchants, with Binance’s prime merchants favoring lengthy positions at a 2.3378 ratio.

Liquidation information reveals $621.13K was liquidated previously 24 hours, with longs dominating ($552.63K), signaling dangers of over-leveraging.

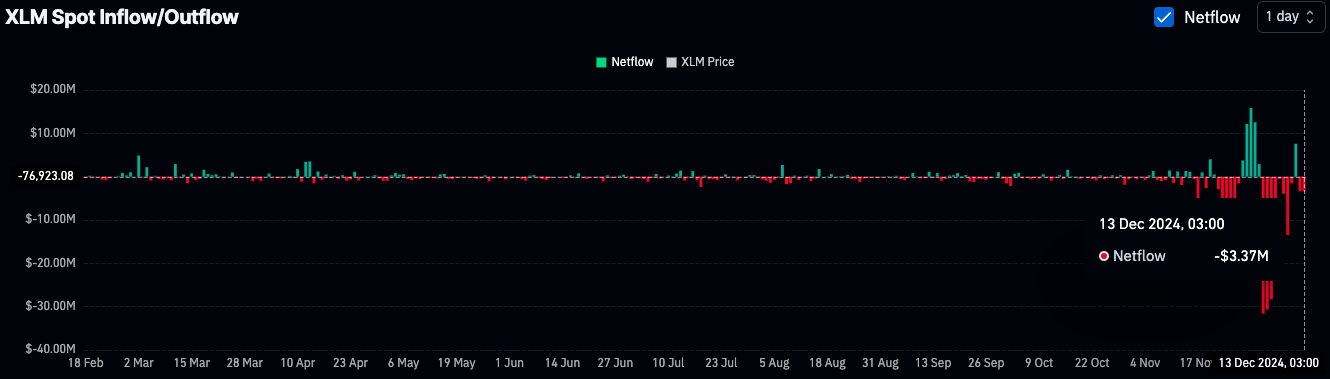

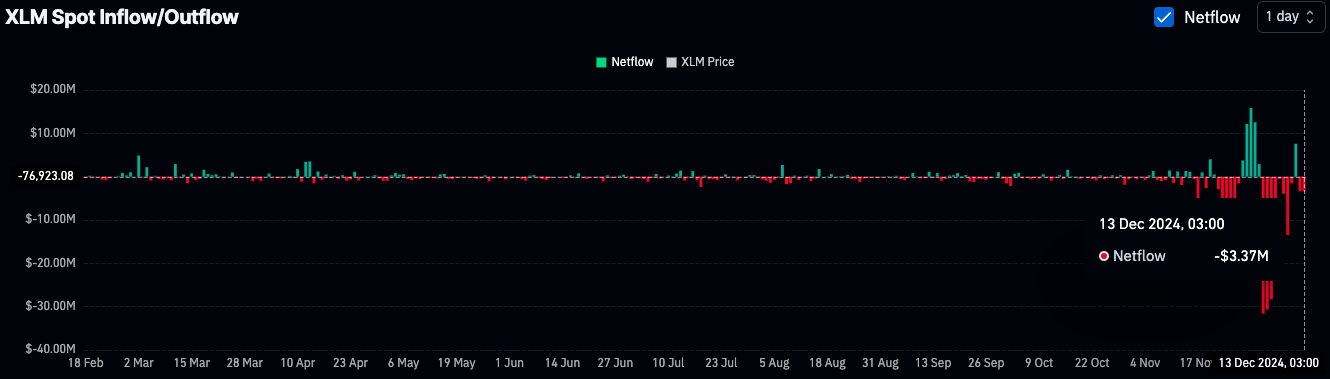

In the meantime, spot market information exhibits $3.37 million in web outflows on thirteenth December, as funds proceed to go away exchanges.

Supply: Coinglass

Learn Stellar’s [XLM] Worth Prediction 2024–2025

Such outflows typically recommend accumulation by buyers, probably decreasing promote stress on XLM.

Whereas XLM has seen current worth declines, historic information, technical indicators, and ongoing accumulation traits recommend potential for renewed momentum.