$2900 or $3500: Which way will Ethereum swing?

- Ethereum bulls have robust assist just under the $2900 mark.

- A rally to $3500 may begin if the bullish sentiment continues to accentuate.

Ethereum [ETH] sailed above the psychological $3000 resistance on the twenty fifth of February. It closed the each day buying and selling session at $3014 on the twentieth, however ETH dipped to the $2900 space within the days that adopted.

The NFT gross sales on the Ethereum community reached their ten-month excessive not too long ago. The gross sales quantity amounted to $400 million, AMBCrypto reported.

The on-chain evaluation highlighted ETH outflows from exchanges price $2.4 billion in 2024, pointing to the buildup of the asset.

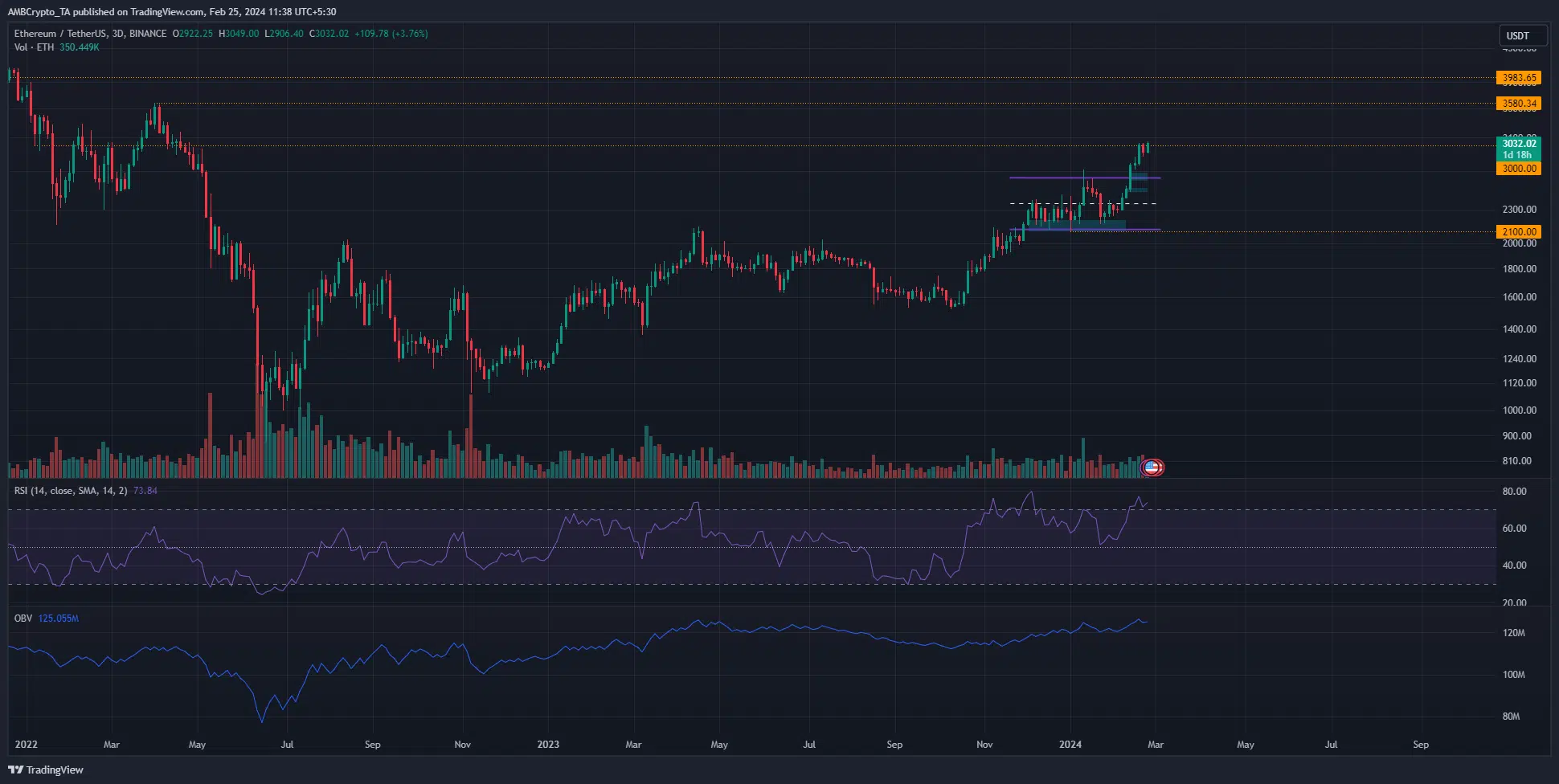

The vary breakout has not but stalled

Highlighted in purple was a spread that ETH exhibited within the second half of January. It prolonged from $2100 to 2600. On the decrease timeframe charts, two demand zones have been recognized at $2500 and $2650.

The value was but to retest both area.

The market construction and momentum on the 3-day chart have been firmly bullish. The rising OBV signaled heavy shopping for quantity. Collectively, they confirmed that Ethereum costs are anticipated to proceed to rally.

The transfer above the $3000 psychological resistance stage is a big one. It may heighten the bullish fervor already current out there.

The following increased timeframe resistance stage sat at $3580, and ETH might rush to this space earlier than a big retracement arrives.

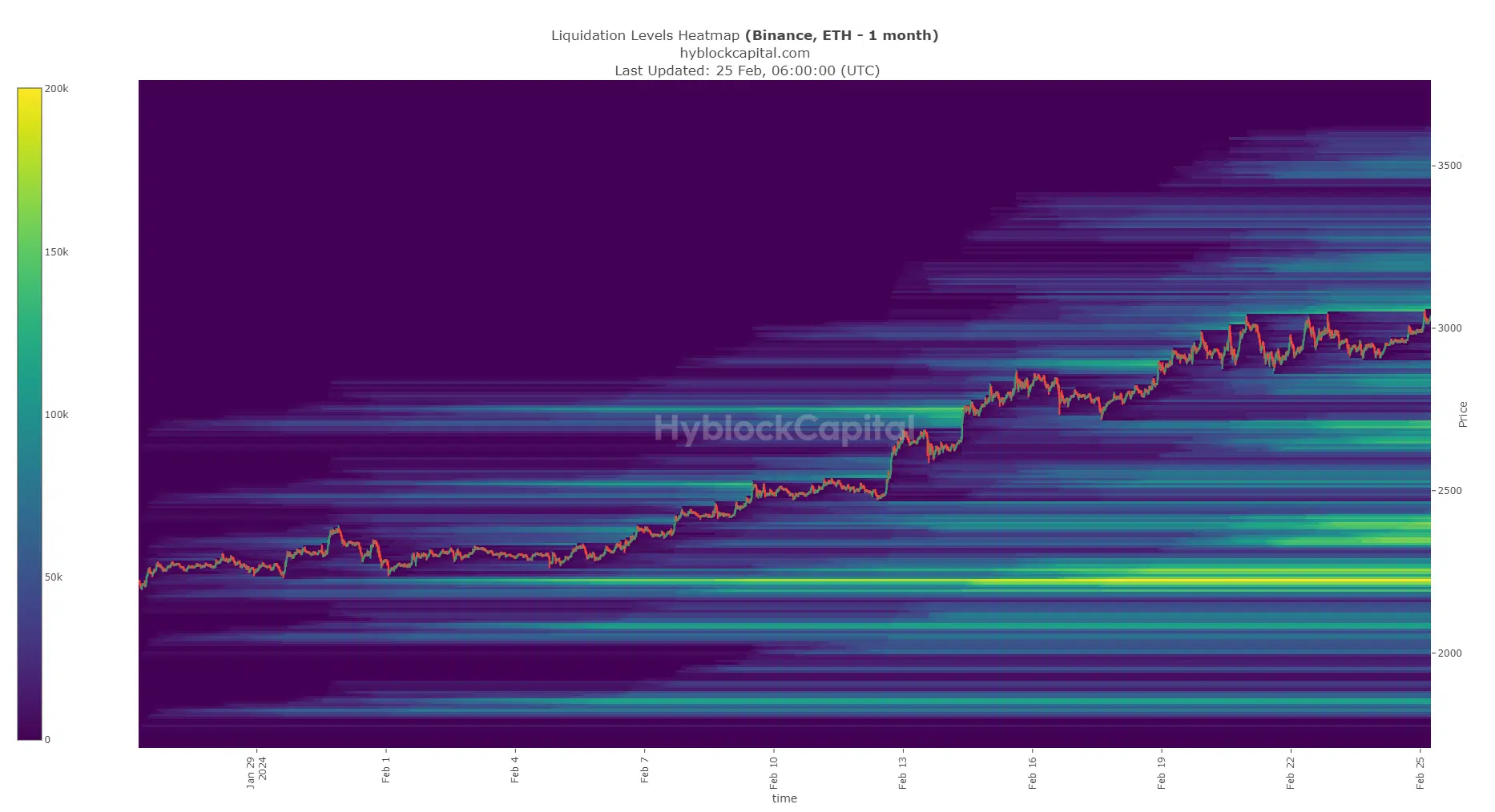

The liquidation heatmap confirmed three key areas of curiosity

Supply: Hyblock

The three-month look again interval liquidation heatmap confirmed that the $3050-$3110 area was estimated to have a number of ranges whose liquidations have been within the $2 billion to $4 billion window.

The $3050 stage has already been examined, however extra liquidity resided until $3100.

Additional north, the $3190-$3225 area was estimated to have a number of liquidation ranges measuring from $1.4 billion to $2.3 billion. Equally, the $3460-$3520 had liquidation ranges within the $2 billion territory.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Therefore, these areas shall be key resistances in the direction of which costs could possibly be attracted earlier than a bearish reversal.

By way of assist, the $2800-$2880 space additionally introduced a big pocket of liquidity. A retest of this space would doubtless see costs rebound.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.