5 key metrics hint at Ethereum’s next big bull run

- Ethereum whales are accumulating whereas decreased promoting stress hints at a possible provide squeeze.

- Rising each day transactions and short-term holder curiosity recommend ETH’s subsequent bullish section is close to.

Ethereum [ETH] is positioned as the subsequent crypto to draw substantial capital inflows, in line with evaluation from blockchain intelligence platform IntoTheBlock.

Whereas Bitcoin [BTC] not too long ago reached a record-breaking all-time excessive of $99,261.30, Ethereum’s value sits at $3,365.66, with a 24-hour buying and selling quantity of over $55 billion.

Regardless of underperforming Bitcoin’s current features, Ethereum could also be poised for a bullish breakout, with key metrics providing insights into its subsequent trajectory.

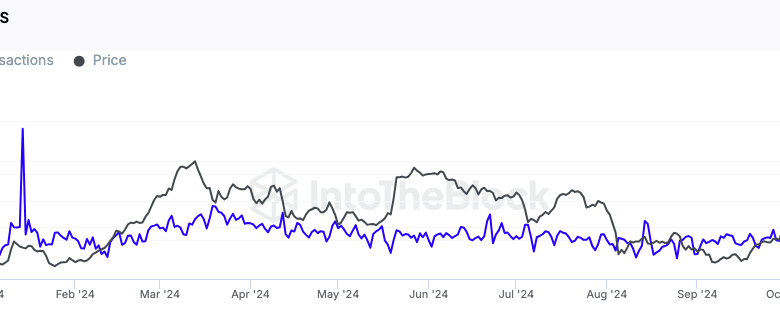

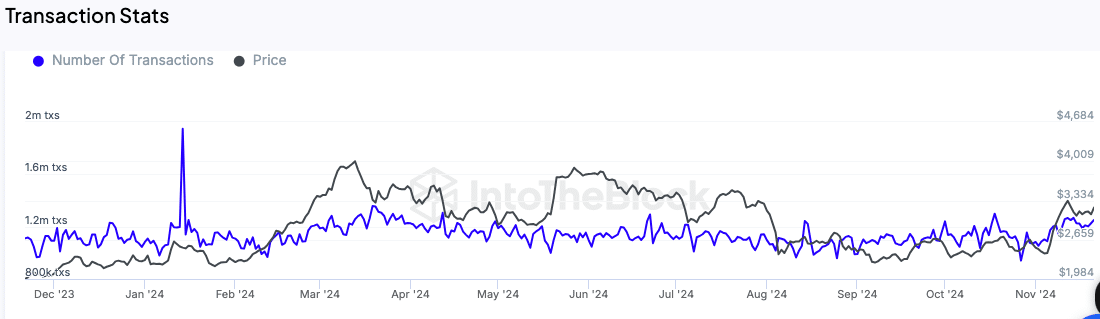

Each day transactions exhibiting regular progress

The variety of transactions on the Ethereum community has elevated notably in current months. IntoTheBlock’s information reveals that each day transactions have grown from 1.1 million to 1.22 million within the final three months.

This regular rise signifies elevated utilization of the Ethereum community, which could possibly be a precursor to higher value exercise.

Supply: IntoTheBlock

An uptick in each day transaction quantity is usually seen as an early sign of heightened curiosity amongst customers and traders, which might gasoline additional momentum in Ethereum’s value.

Massive holders show confidence

Whale exercise is one other essential indicator being monitored. In response to IntoTheBlock, holders of no less than 0.1% of Ethereum’s circulating provide are exhibiting a constructive internet stream, signaling their confidence within the asset.

This sample suggests accumulation by bigger traders, which has traditionally aligned with upward value actions.

The decreased promoting stress from these giant holders signifies that they might be anticipating additional features. Such conduct sometimes signifies optimism amongst institutional and high-net-worth traders, who usually drive substantial market traits.

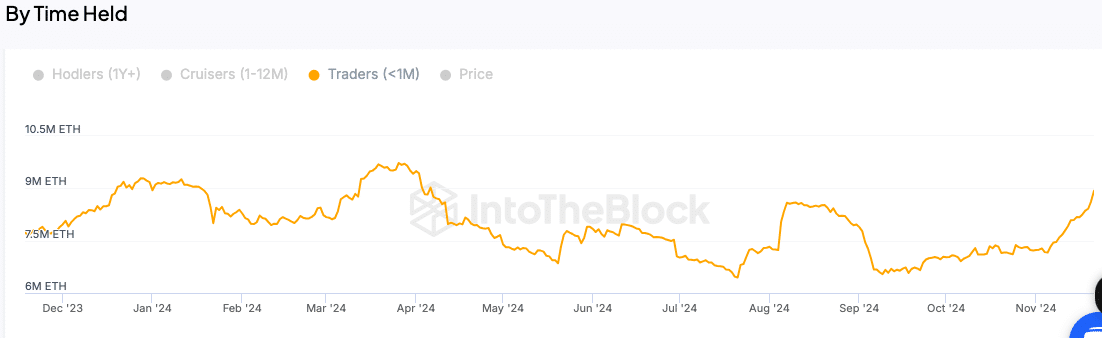

Rising curiosity amongst short-term holders

Quick-term Ethereum holders—those that have held the asset for lower than a month—are additionally being intently watched. A rise within the variety of these holders suggests renewed curiosity from retail traders.

This metric is especially essential as a result of short-term holders usually react to market traits and play a pivotal position in driving buying and selling volumes.

Supply: IntoTheBlock

An increase of their exercise might contribute to a bullish section for Ethereum, particularly if paired with the continued confidence proven by bigger holders.

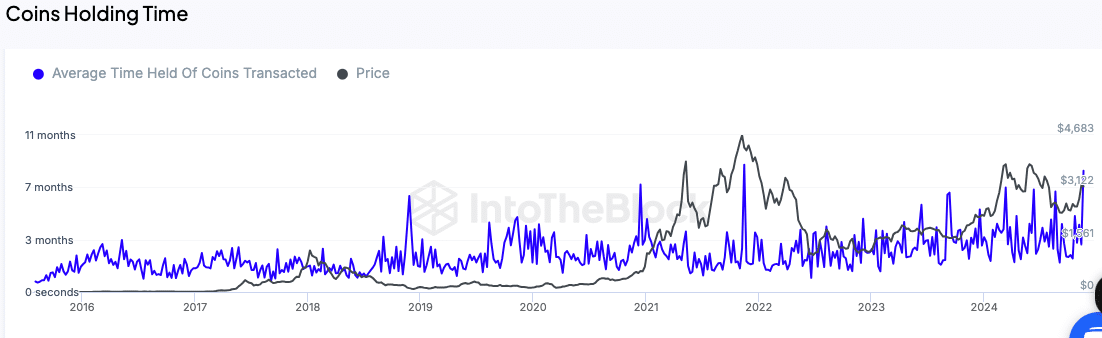

Longer holding occasions point out decreased promoting stress

One other key metric is the typical holding time of transacted cash. In response to the analysis, the holding time has elevated to 11 months, reflecting decreased promoting exercise amongst Ethereum customers.

This development factors to a provide squeeze, as fewer tokens are being circulated out there.

Supply: IntoTheBlock

A decreased willingness to promote usually helps value stability and may create circumstances for an upward value trajectory. Mixed with the rising community exercise, this can be a issue that traders are monitoring intently.

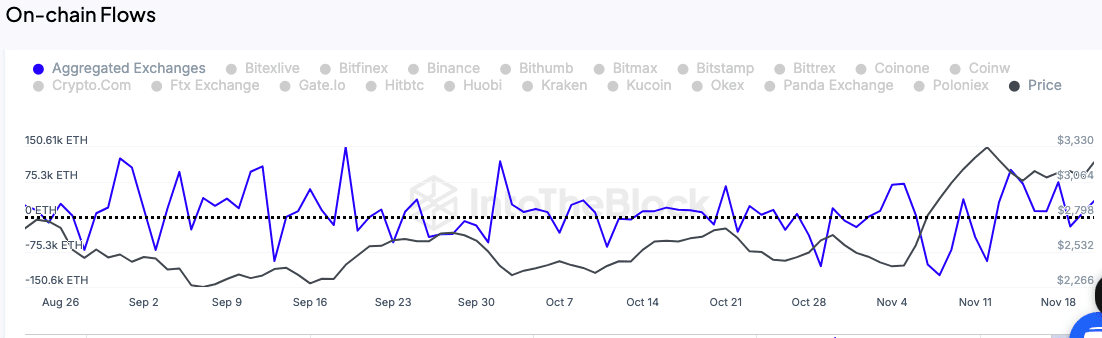

Trade flows replicate accumulation traits

The motion of Ethereum tokens to and from exchanges can also be being tracked as a possible sign of upcoming value motion.

A lower in change inflows sometimes signifies accumulation, as traders transfer their holdings to personal wallets slightly than conserving them on exchanges for potential promoting.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Ethereum’s change inflows stay low, signaling that holders are opting to carry slightly than promote.

In the meantime, this accumulation conduct aligns with expectations of a value enhance within the close to time period, as demand could outpace provide.