Litecoin (LTC) Faces 25% Crash? Traders Brace for a Sell-Off

Amid the continuing market uncertainty, whereas the vast majority of cryptocurrencies are witnessing value restoration, Litecoin (LTC) is poised for a large value drop. The potential cause for this bearish hypothesis is the formation of destructive value motion and merchants’ bearish sentiment, as reported by the on-chain analytics agency Coinglass.

Present Worth Momentum

LTC is presently buying and selling close to $127 and has skilled a value drop of over 6% up to now 24 hours. Throughout the identical interval, its buying and selling quantity declined by 23% because of its bearish value momentum, indicating decrease participation from merchants and buyers in comparison with earlier days.

Litecoin (LTC) Technical Evaluation and Worth Prediction

In accordance with knowledgeable technical evaluation, LTC seems bearish because it has been shifting inside a parallel channel sample between $95 and $141 since November 2024. Regardless of bearish market sentiment up to now few days, LTC’s value has surged practically 38%, rising from $95 to $141. Nonetheless, it’s now experiencing promoting stress because of its historical past of value drops and the present market sentiment.

Based mostly on historic patterns, if LTC fails to interrupt above the $141 stage, there’s a sturdy risk it might drop by 25% to succeed in the $95 assist stage. At the moment, the asset is buying and selling above the 200 Exponential Shifting Common (EMA) on the each day timeframe, indicating that LTC is in an uptrend.

Combined On-Chain Metrics

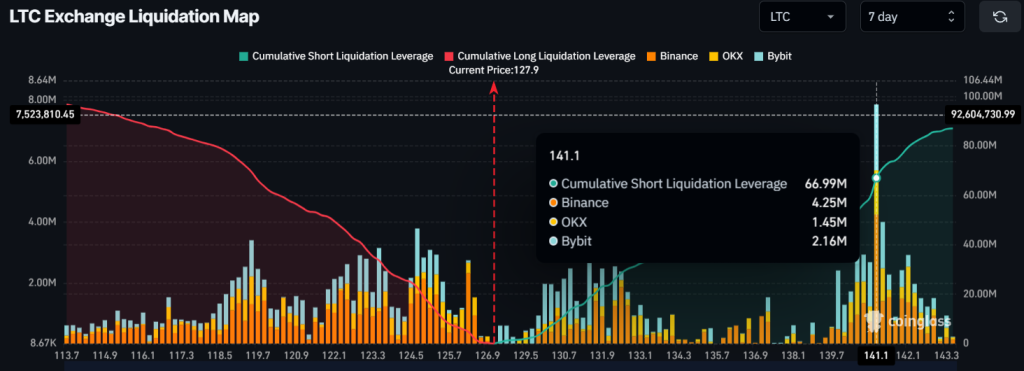

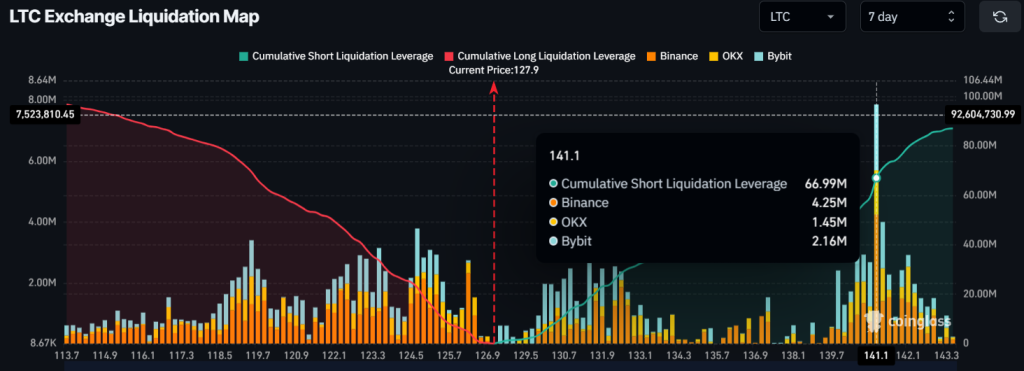

When analyzing the present market sentiment and value on the reversal stage, intraday merchants seem like betting on the bearish facet, as reported by the on-chain analytics agency Coinglass.

Knowledge from the trade liquidation map reveals that merchants betting on the quick facet are over-leveraged on the $141.5 stage and have constructed $67 million price of quick positions up to now week. In the meantime, merchants betting on the lengthy facet appear exhausted, having constructed solely $21 million price of lengthy positions.

These over-leveraged positions replicate the sentiment of each quick and lengthy merchants, as some imagine the value received’t break above that stage. If it does, these positions will likely be liquidated.

Regardless of LTC’s bearish outlook, buyers and long-term holders appear to be accumulating the token. Knowledge from spot influx/outflow reveals that exchanges have witnessed an outflow of $9.41 million price of LTC tokens up to now 24 hours, indicating potential accumulation.

When combining these on-chain metrics with technical evaluation, it seems that short-term gamers are bearish, anticipating the value to say no within the coming days. In the meantime, long-term holders appear to be making the most of the value drop and are considerably accumulating the token.