$9.3 Billion Stablecoin Influx Sparks Bullish Hopes

- Deposits of $9.3 billion in ERC-20 stablecoins into main exchanges may sign a bullish Ethereum rally.

- Elevated exercise in Ethereum’s energetic addresses urged rising retail curiosity within the asset.

Ethereum [ETH] is driving a wave of optimistic momentum, reflecting the broader cryptocurrency market’s latest good points.

Though Ethereum has not but reached its earlier all-time excessive, it has skilled a major upswing. Over the previous few days, the alt coin has surged by greater than 8%, reaching a excessive of $2,872, at press time.

This marks a notable restoration, putting the asset roughly 42.7% beneath its file excessive of $4,878 from November 2021.

The latest good points signaled growing investor curiosity and highlighted the alt coin’s resilience because it continues to draw market consideration alongside Bitcoin’s latest upward motion.

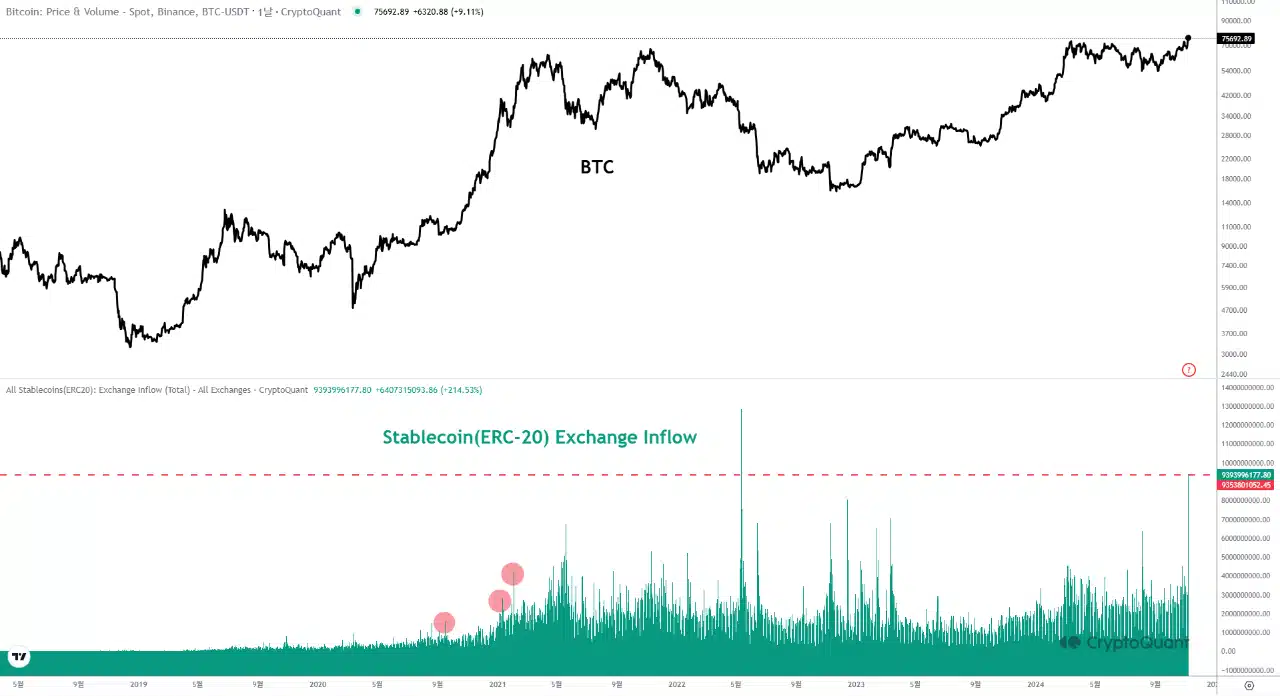

In the meantime, an intriguing development throughout the Ethereum community has been recognized by a CryptoQuant analyst generally known as Mac.D.

In line with the analyst, within the wake of the U.S. presidential election outcomes, a considerable $9.3 billion value of ERC-20 stablecoins flowed into cryptocurrency exchanges.

This represents the second-largest inflow of ERC-20 stablecoins since their inception.

Breaking down these deposits, Binance obtained round $4.3 billion, whereas Coinbase noticed an influx of about $3.4 billion. The rest was distributed amongst smaller exchanges.

Supply: CryptoQuant

Traditionally, giant inflows of this magnitude have correlated with bullish rallies available in the market, as seen throughout the interval between September 2020 and February 2021.

If this sample holds, Ethereum and the broader market could also be poised for an additional upward pattern.

Ethereum’s rising retail curiosity and community exercise

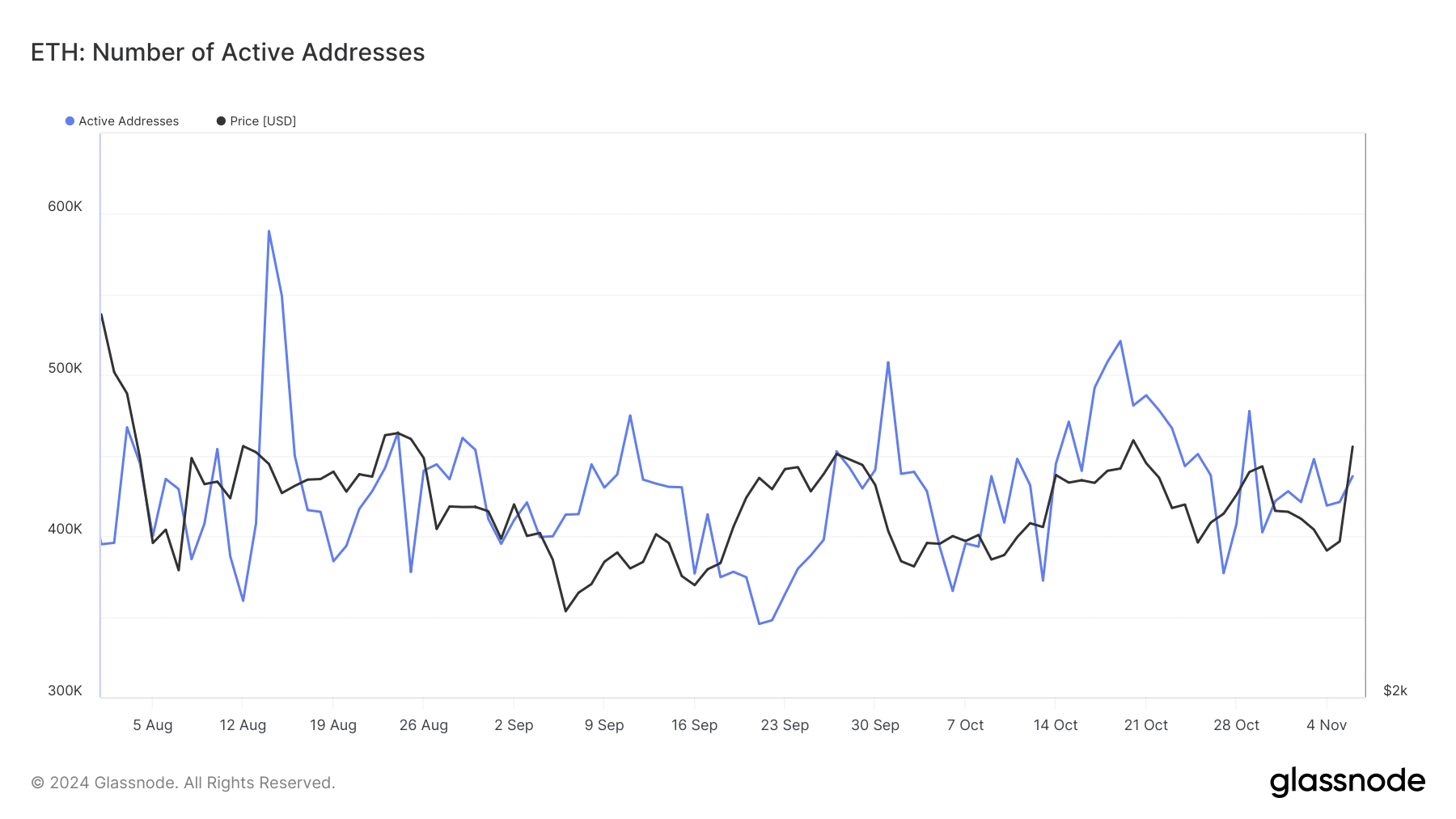

Along with the surge of ERC-20 stablecoin inflows, one other promising pattern for Ethereum has emerged in its retail exercise.

Data from Glassnode indicated an increase in Ethereum’s energetic addresses, a key metric for gauging retail curiosity and community utilization.

Supply: CryptoQuant

Following a dip beneath 400,000 energetic addresses in late October, the quantity has since climbed to over 430,000.

This improve displays heightened exercise on the community, suggesting renewed curiosity from particular person members and a attainable uptick in community demand.

The expansion in energetic addresses can have significant implications for Ethereum’s value trajectory.

Elevated exercise typically indicators greater demand and higher utilization of the community, which may create upward strain on the asset’s worth.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Retail buyers participating extra with Ethereum can drive liquidity and value stability whereas indicating rising confidence available in the market.

This pattern, mixed with rising stablecoin inflows and robust trade exercise, paints an optimistic image of Ethereum’s near-term potential.