Bitcoin: Long-term holders sell $41.6B – Assessing the damage now

Key Takeaways

Why is Bitcoin’s value sliding once more?

Lengthy-term holders offered over 400K BTC in October, draining liquidity and strengthening bearish sentiment.

What may shift the BTC pattern?

Analysts count on BTC to stabilize between $107K–$113K if demand rebounds and liquidation strain eases.

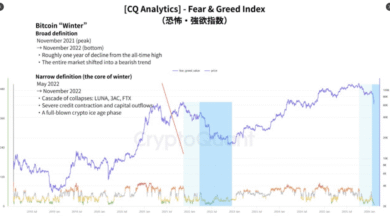

Bitcoin’s [BTC] October optimism fades as capital flight grips the market

The bullish momentum that marked October weakened sharply as capital outflows dominated the market. Bitcoin slid to $103,700 at press time, its lowest degree for the reason that seventeenth of October.

Oversupply drives market weak point

Bitcoin’s preliminary drop on the tenth of October triggered a wave of distribution. Lengthy-term holders—wallets inactive for no less than six months drove a pointy decline by promoting roughly 400,000 BTC, price about $41.6 billion in October.

This shift confirmed that the identical group that gathered through the summer season was now driving the correction.

Supply: CryptoQuant

On high of that, whales compounded the strain. One massive holder offered 13,004 BTC price $1.36 billion, together with 1,200 BTC offloaded on the primary weekend of November.

This massive-scale profit-taking pushed Bitcoin nearer to the $100,000 zone, turning sentiment decisively bearish.

Weak demand provides to the strain

Bitcoin’s demand has weakened considerably, unable to match the tempo of distribution available in the market.

The Obvious Demand Progress over the previous 30 days turned detrimental, indicating inadequate liquidity to soak up the continued sell-offs.

Supply: CryptoQuant

The one-year Obvious Demand band additionally contracted, exhibiting that web inflows from new individuals slowed. In actual fact, this drop in demand left Bitcoin susceptible to additional draw back whilst broader macro circumstances stayed mildly supportive.

Shawn Younger, Chief Analyst at MEXC Analysis, informed AMBCrypto that some restoration could also be on the horizon.

“Accumulation of cash by main market individuals, the commerce settlement between Washington and Beijing, and reasonably optimistic inventory market efficiency are paving the best way for a attainable restoration in November,” he stated.

Quick-term drop nonetheless attainable

Whereas demand is starting to construct, Bitcoin may nonetheless expertise one other dip earlier than stabilizing.

The Liquidation Heatmap confirmed clusters forming close to the aforementioned value ranges, probably dragging the asset all the way down to round $102,000.

These decrease clusters may act as demand zones, setting the stage for a rebound towards the $110,000–$112,000 vary.

Supply: CoinGlass

Farzam Ehsani, CEO and Co-founder of VALR, believes the market stays fragile.

“A ten% transfer in both route may set off huge liquidations—roughly $11.39 billion briefly positions if costs rise, or $7.55 billion in longs in the event that they fall,” he stated.

His outlook aligns with AMBCrypto’s evaluation, which expects Bitcoin to consolidate inside the $107,000–$113,000 vary within the close to time period.