Get Ready, The End Of November Will Be Massive For XRP: CEO

Studies from the Ripple Swell 2025 convention present rising curiosity in XRP. Merchants and fund managers are watching November carefully.

Associated Studying

Based on audio system on the occasion, a number of timetabled strikes may push more cash into the token within the brief time period.

Canary Capital ETF Timetable

Canary Capital’s spot ETF is about to go dwell after an up to date S-1 submitting, with a potential automated launch 20 days in a while November 13.

Studies from the stage cited Steven McClurg, CEO of Canary Capital, as confirming the replace. That submitting eliminated an modification clause that might have given the SEC better management over the product’s efficient date.

Based mostly on stories, the timeline may nonetheless shift if the SEC returns questions or if authorities operations change, however for now November 13 stands out as a key date.

Retail And Whale Exercise Cool

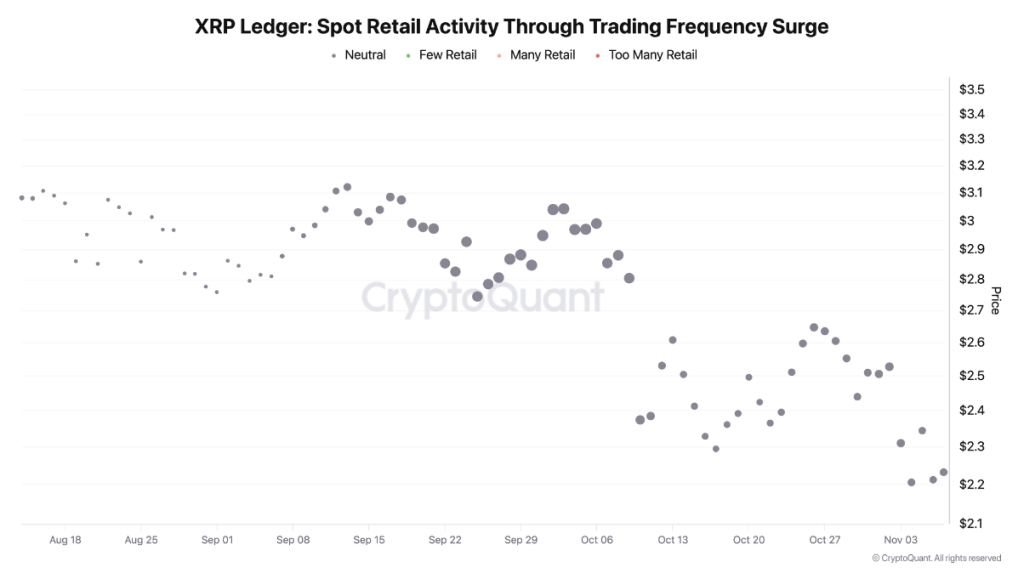

CryptoQuant charts present retail buying and selling exercise has cooled because the large sell-off on October 10, when about $19 billion was worn out in a single day.

Small traders have pulled again right into a impartial zone, which some analysts learn as cautious ready quite than exit. On the identical time, giant on-chain strikes to exchanges have dropped sharply — from roughly 49,000 on October 25 and 44,000 on October 11 to about 800 on a current Friday.

That fall in whale-to-exchange transactions suggests fewer large sellers are transferring funds to exchanges proper now.

“The final half of November goes to be large for $XRP and @Ripple,” mentioned @TeucriumETFs CEO @GilbertieSal throughout a recap of #RippleSwell Day 1. Head on a swivel girls and gents… Consider! ✨ pic.twitter.com/mw9VLuRUCB

— rayfuentes (@RayFuentesIO) November 5, 2025

Institutional Alerts

Audio system at Swell pointed to rising institutional curiosity. Teucrium CEO Sal Gilbertie informed audiences that the final half of November could possibly be crucial for XRP, tying that view to broader developments in tokenization and institutional flows.

Citibank projections cited on the occasion say tokenized property may hit trillions inside 5 years, and different panelists talked about deliberate strikes by conventional finance gamers.

Based mostly on stories, Circle additionally has plans to start buying and selling public equities in early December, which some see as one other nudge towards extra mainstream involvement.

Recommendation From Market Gamers

Gilbertie urged holders to give attention to the long run. “Consider in it. Don’t fear about volatility. It should even out as adoption comes and extra institutional cash enters,” he mentioned.

That view was shared by different commentators who identified that ETF listings and institutional onboarding have traditionally modified how markets worth property.

Associated Studying

What To Watch Subsequent

Market members will monitor the SEC course of, any further filings, and whether or not the federal government calendar impacts the ETF begin date.

On-chain indicators — like whale transfers and trade flows — may also be watched carefully. For now, stories counsel a mixture of wariness amongst retail merchants and rising institution-level curiosity, with November 13 marked as a date many are watching.

Featured picture from Unsplash, chart from TradingView