Bitcoin Faces Judgment Day, Crypto Strategist Warns

Based on Bloomberg Intelligence’s Mike McGlone, Bitcoin has entered a “do-or-die” section as merchants watch a slender value band for indicators of path. From an Oct. 6 degree of $123,500, the coin tumbled virtually 20% to a low of $99,900 on Nov. 4 earlier than recovering to about $106,350. Experiences present the transfer left Bitcoin roughly 14% under its earlier October peak.

Associated Studying

Make Or Break Zone For Bitcoin

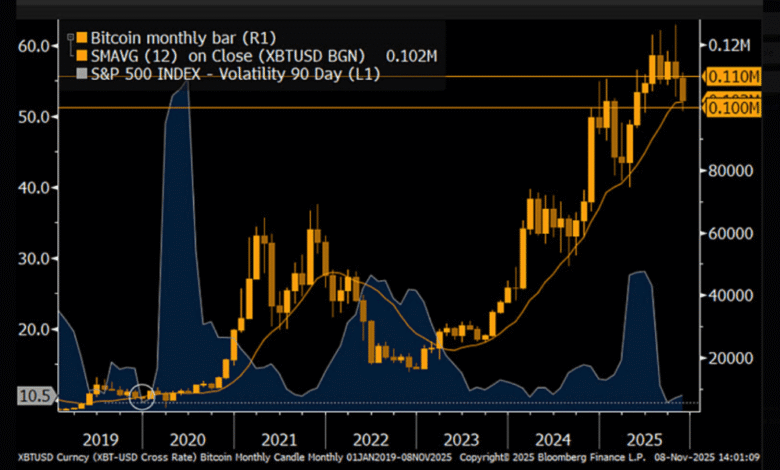

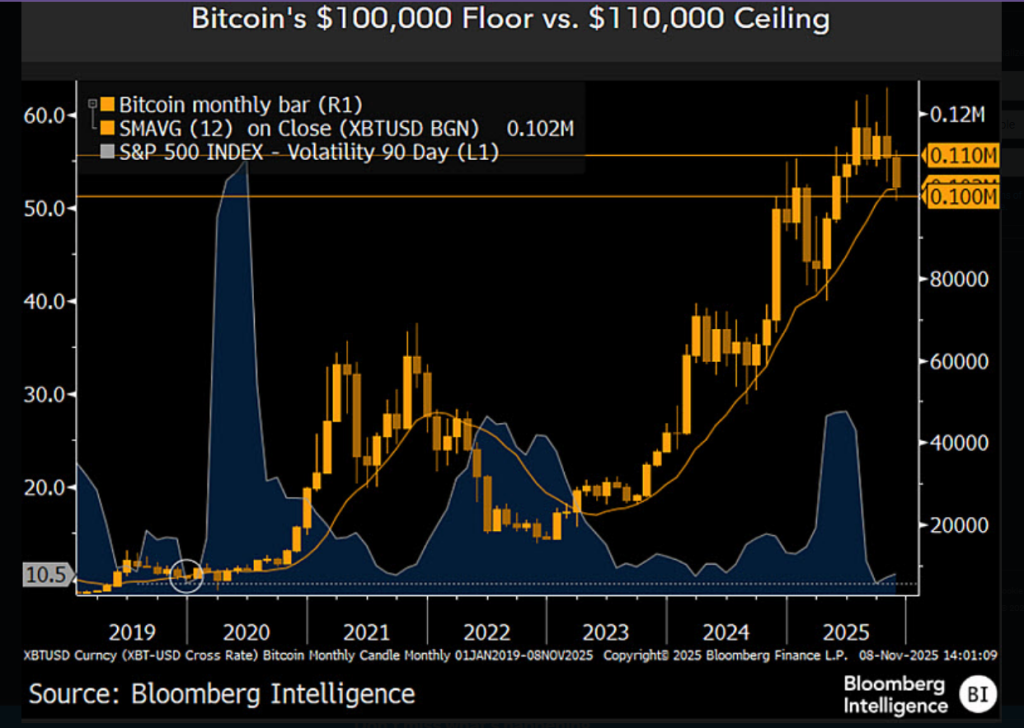

Primarily based on pattern strains and month-to-month charts, McGlone factors to a rollover sample after the months-long climb that culminated in an Oct. 6 excessive marked on some charts at $126,270. The quick technical check is the 200-day shifting common, which sits close to $110,000.

Bitcoin Do or Die: $110,000-$100,000

Bitcoin’s rolling-over sample on month-to-month charts may sign the other of gold’s bull flag to August. The crypto has dropped under its 200-day shifting common at $110,000 to Nov. 7 — a key hurdle to sign restoration.

Full report on the… pic.twitter.com/n4MMZfhuL3— Mike McGlone (@mikemcglone11) November 10, 2025

Based on his view, Bitcoin must push again above that degree to make a transparent case for renewed upside. If it will possibly’t, the chance is that sellers regain management and costs slip additional under the present band between $100,000 and $110,000.

Resistance And Momentum Indicators

Experiences have highlighted different warning indicators. Lengthy higher wicks have appeared on current candles, an indication that patrons had been checked close to the highest. The 12-month easy shifting common has began to flatten after a gradual climb, suggesting the shopping for drive is slowing.

Dealer and analyst Michaël van de Poppe has pointed to sturdy resistance within the $108,000–$110,000 zone. Based on him, breaking by way of that vary might open the door again to the highs, and if that occurs, altcoins could run more durable than Bitcoin.

Institutional Strikes And Market Temper

Institutional patrons stay energetic. Michael Saylor’s agency purchased 487 BTC price near $50 million immediately, bringing reported holdings to 641,692 BTC. On the similar time, exchange-traded funds noticed outflows totaling $1.22 billion final week.

Market sentiment has nudged up: CoinMarketCap’s Concern and Greed Index rose to 29 from 24, and Bitcoin is up about 3.6% prior to now 24 hours after lawmakers superior a US authorities shutdown deal.

Merchants are pricing event-contract chances that place a 28% probability Bitcoin reaches $130,000 or increased this 12 months and a 9% probability it tops $150,000.

Quick-Time period Triggers May Tip The Scale

Close to-term catalysts are in play. US President Donald Trump’s point out of a doable $2,000 tariff “dividend” and progress towards ending the shutdown seem to have helped the current bounce.

Timothy Misir, head of analysis at Blockhead Analysis Community, mentioned the market has cleaner positioning and will see a constructive November if fiscal readability and ETF flows stabilize.

He additionally warned about dangers: continued ETF outflows, supply delays on fiscal measures, and rising market leverage might reverse the restoration.

Associated Studying

What To Watch Subsequent

For now, Bitcoin sits in a good buying and selling vary. Reclaiming $110,000 can be learn as a optimistic sign and may restore shopping for confidence. Falling under $100,000 would possible set off deeper losses, in line with the technical image analysts cite.

Merchants and establishments will watch value motion round these ranges carefully — and people strikes will form whether or not this second is remembered as a brief pause or a significant turning level.

Featured picture from The Dialog/Landmark Media/Alamy, chart from TradingView