XRP Supply In Profit Falls to 58.5% – Lowest Since 2024 Despite Higher Price

XRP is dealing with one in every of its most difficult moments in latest months as promoting strain accelerates and the broader crypto market slips right into a risk-off surroundings. Bitcoin’s collapse under key psychological ranges has dragged altcoins with it, and XRP has not been spared. Analysts are more and more warning that the market could also be coming into a bear part, pointing to tightening liquidity circumstances, rising world financial uncertainty, and a pointy decline in investor urge for food for danger belongings.

Associated Studying

What makes XRP’s scenario extra fragile is the rising variety of holders sitting on unrealized losses. On-chain information reveals that many late patrons — significantly those that entered after the ETF announcement and in the course of the earlier rally — at the moment are underwater as the value continues to slip. This top-heavy market construction is creating strain on holders, amplifying sell-side momentum as concern spreads.

The macro backdrop is including gasoline to the fireplace. With world markets adjusting to price volatility, geopolitical tensions, and tightening greenback liquidity, capital is flowing out of speculative belongings. XRP’s worth is now caught at a crossroads: both it stabilizes at key help zones and absorbs the panic promoting, or a deeper correction unfolds.

XRP Provide in Revenue Alerts Structural Fragility

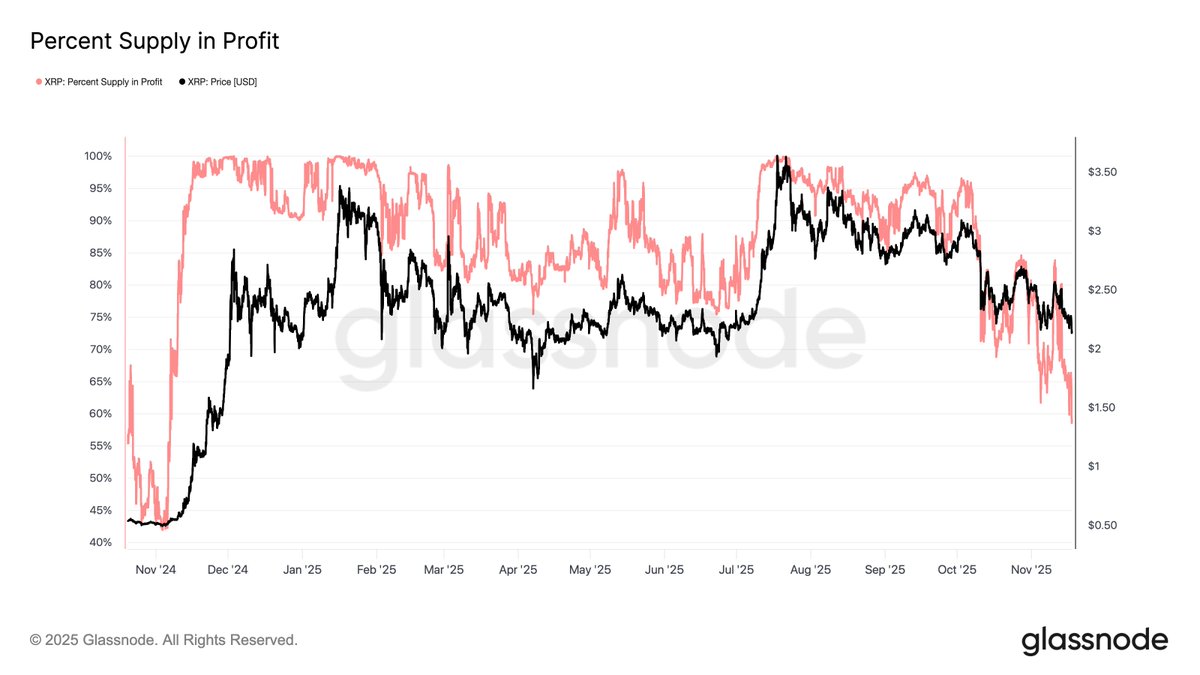

In response to new data from Glassnode, XRP’s market construction is weakening considerably as the most recent sell-off unfolds. The share of XRP provide at present in revenue has fallen to 58.5%, marking its lowest studying since November 2024, when XRP traded at simply $0.53. Regardless of right now’s far greater worth — round $2.15, practically 4 instances final 12 months’s degree — an alarming 41.5% of the circulating provide stays at a loss. That represents roughly 26.5 billion XRP sitting underwater.

This divergence highlights a crucial subject: the market has grow to be top-heavy, dominated by traders who entered late into the rally and acquired at elevated worth ranges. These holders at the moment are feeling acute strain as costs retrace. Making the XRP provide distribution extra fragile and growing the likelihood of panic-driven promoting. Traditionally, such setups usually result in accelerated draw back motion except sturdy demand steps in.

The truth that a lot provide is within the purple even at present elevated costs means that speculative flows, quite than long-term conviction, fueled the earlier surge. As these late patrons face losses, promote strain can intensify, feeding right into a vicious cycle of liquidation.

Associated Studying

XRP Worth Evaluation: Testing Essential Help Ranges

XRP continues to battle as promoting strain intensifies, with the chart exhibiting a transparent downtrend forming since early October. The value is now buying and selling round $2.18, hovering simply above a key horizontal help zone that has been examined a number of instances all year long. Every bounce from this area has grown weaker, suggesting diminishing purchaser energy and rising vulnerability to a deeper breakdown.

The shifting averages reinforce this weakening construction. XRP is buying and selling under the 50-day, 100-day, and 200-day MAs, with all three starting to curve downward. A traditional signal of development deterioration. The failed try and reclaim the 50-day MA in early November marked a major shift, as sellers rapidly regained management and pushed the value decrease. Quantity spikes throughout downswings additional affirm that distribution is ongoing.

Associated Studying

Moreover, the decrease highs forming for the reason that September peak sign that bulls are dropping momentum. Every rally try is being offered into sooner, and the wick rejections close to the $2.50–$2.60 area spotlight sturdy overhead resistance. If XRP loses the present help band, the following liquidity pocket sits close to $1.70–$1.80, the place patrons beforehand defended aggressively.

Featured picture from ChatGPT, chart from TradingView.com