MACD in Crypto Trading: How to Read and Act on the Signals

Most crypto merchants battle with timing. They chase pumps or promote throughout a panic, lacking the actual strikes. Shifting Common Convergence Divergence (MACD) helps you keep away from this lure. It tracks market momentum, so you possibly can cease buying and selling on emotion and begin buying and selling on knowledge.

This information will present you easy methods to use MACD in crypto to enhance your timing and make smarter, sooner selections.

What’s the MACD Indicator?

MACD—quick for Shifting Common Convergence Divergence—is a momentum indicator that mixes two shifting averages and a sign line to detect bullish or bearish momentum adjustments. It was invented by Gerald Appel within the Nineteen Seventies and stays one of the widespread technical indicators in crypto buying and selling right now.

MACD consists of two strains and a histogram. The MACD line reveals the distinction between two exponential moving averages (EMAs): the 12-period and the 26-period. The sign line is a 9-period EMA of the MACD line itself. The histogram measures the hole between these strains. A wider hole means stronger momentum. A narrowing hole indicators weak point.

Why MACD is Highly effective for Crypto Merchants (Volatility, Momentum, Tendencies)

When costs swing wildly, and tendencies change in a single day, MACD helps you narrow by means of the chaos by exhibiting bullish or bearish momentum clearly. MACD focuses on sustained momentum.

MACD doesn’t predict strikes like a number one indicator. As a substitute, as a lagging indicator, it confirms them based mostly on value tendencies. That’s helpful in crypto, the place momentum usually issues greater than short-term predictions.

When Bitcoin or Ethereum beneficial properties upward momentum, the MACD line often crosses above the sign line. If costs stall or drop, the strains converge. A crossover factors to a potential reversal. Merchants watch these shifts to time entries and exits. For instance, a long term of downward momentum reveals up clearly on MACD, even when costs bounce round intraday. This helps you keep affected person and keep away from panicking over small value blips.

In crypto’s 24/7 monetary markets, you want instruments that simplify buying and selling selections. MACD provides you that edge by visualizing momentum instantly on the chart. It’s why many merchants depend on it to journey tendencies as a substitute of guessing them.

MACD Parts

MACD has 4 elements: the MACD line, sign line, histogram, and 0 line. Every reveals a unique view of momentum.

The MACD Line

That is the core of the indicator. It’s the distinction between two exponential shifting averages (EMAs)—the 12-period minus the 26-period. When the MACD line rises, the short-term common strikes sooner than the long-term one. That reveals momentum is rising. On most charts, the MACD line is the blue line.

The Sign Line

It is a 9-period EMA of the MACD line. It smooths out fluctuations and highlights turning factors. When the MACD line crosses above the sign line, you get a bullish sign line crossover. That’s usually an indication to purchase. When it crosses beneath, you see a bearish crossover, which often indicators a possible promote.

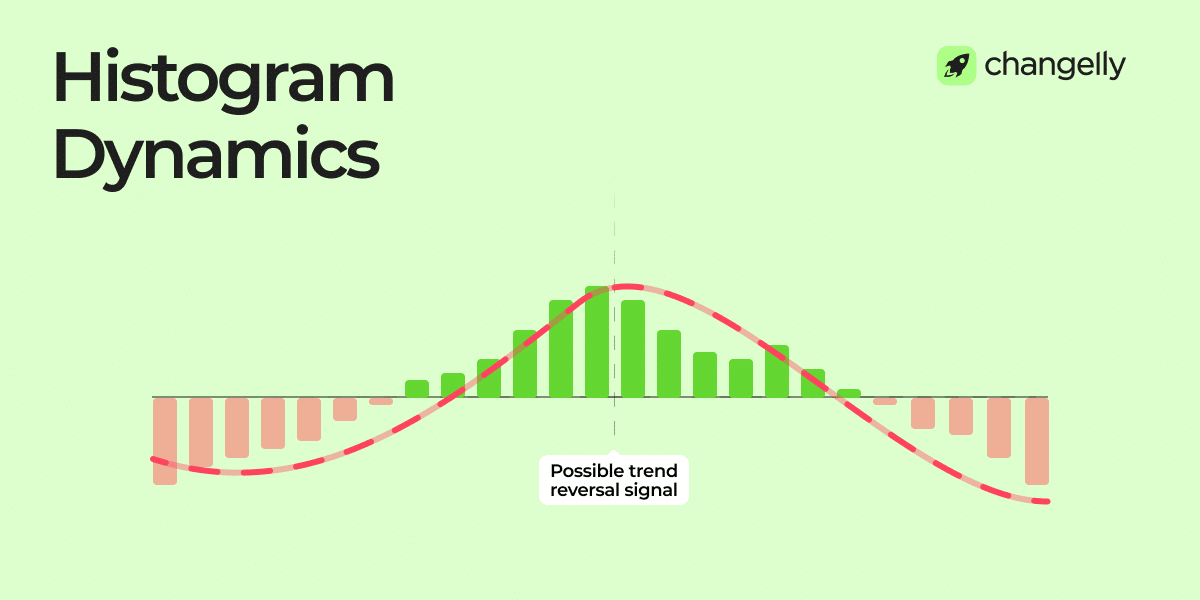

The MACD Histogram

The histogram plots the hole between the MACD line and the sign line. Bars above zero present bullish momentum. Bars beneath zero present bearish momentum.

When the bars shrink, momentum weakens. Merchants name this shedding momentum. A shrinking histogram can warn of an upcoming pattern reversal.

The Zero Line

The zero line is the center floor. When MACD crosses it, the short-term and long-term EMAs are equal. A transfer above zero indicators a bullish pattern. A transfer beneath zero factors to a bearish pattern. Many merchants look ahead to MACD to cross the zero line to substantiate a pattern’s route.

Collectively, these instruments assist you observe momentum shifts and plan higher trades.

Core MACD Indicators and Learn how to Learn Them

MACD sends out a couple of core buying and selling indicators. Studying these helps you time entries and exits with extra confidence.

Sign Line Crossovers

One of the vital frequent MACD indicators is the MACD line crossing the sign line. If the MACD line crosses above, you get a bullish crossover, a traditional purchase sign. If it crosses beneath, that’s a bearish crossover, often seen as a promote sign. Many merchants base purchase or promote indicators on these strikes.

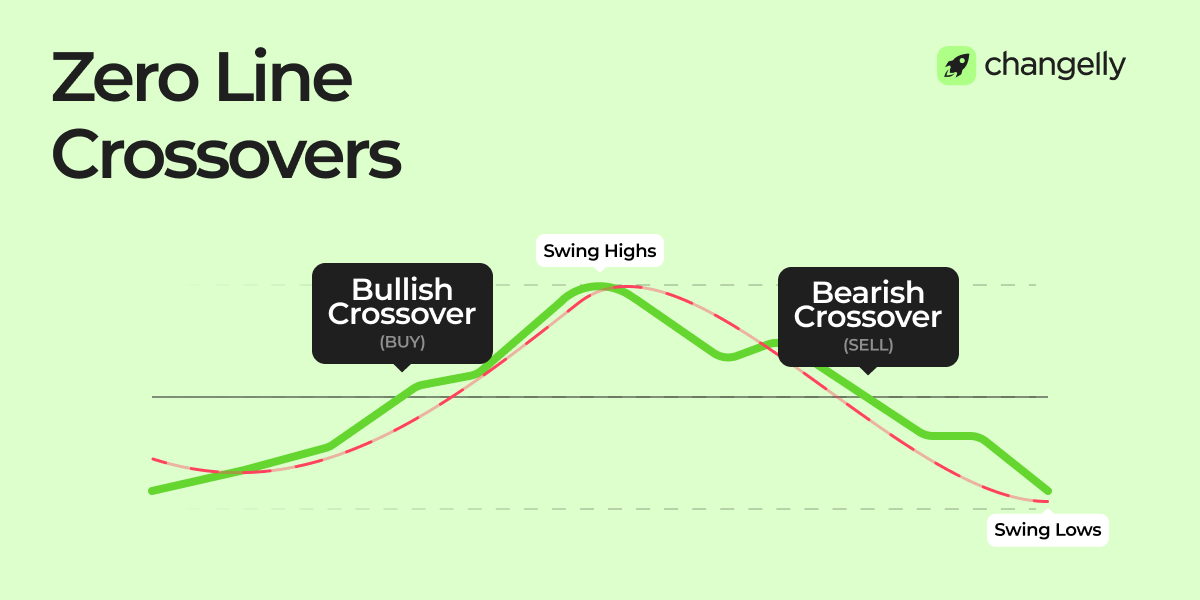

Zero Line Crossovers

A zero line crossover occurs when MACD strikes from detrimental to optimistic, or vice versa. This shifts the general momentum bias. When MACD crosses above zero, it confirms a bullish pattern. When it crosses beneath, it suggests the market is popping bearish. These crossovers sign broader pattern shifts, not simply short-term momentum.

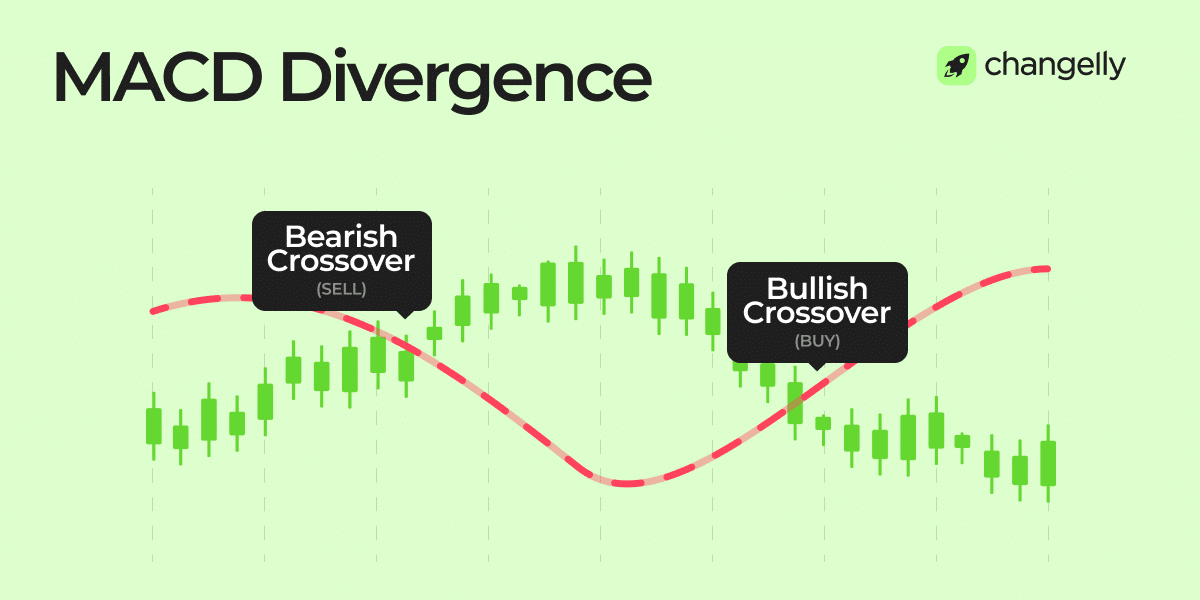

MACD Divergence

A divergence occurs when value and MACD transfer in reverse instructions.

- Bullish divergence: Value makes decrease lows whereas MACD makes larger lows. This usually warns that downward momentum is fading.

- Bearish divergence: Value makes larger highs whereas MACD peaks get decrease. This implies the uptrend is shedding momentum.

Merchants look ahead to divergence to catch early indicators of a potential reversal. However divergences aren’t good. They work higher when confirmed by different indicators.

Histogram Dynamics

The MACD histogram tracks the gap between MACD and the sign line. Rising bars present sturdy momentum. Shrinking bars warn that momentum is slowing. If the bars shrink throughout a downtrend, bearish momentum is perhaps weakening. In the event that they shrink in an uptrend, bullish power might be fading.

These instruments assist you spot pattern shifts earlier than they change into apparent on value charts.

Learn how to Apply MACD to Your Crypto Buying and selling

MACD is a core device in any crypto buying and selling technique. It really works effectively on Bitcoin, Ethereum, and most altcoins.

Figuring out Entry Factors with MACD

A bullish crossover is a typical purchase sign. When the MACD line strikes above the sign line, momentum is shifting upward. Merchants usually purchase right here, particularly if the crossover occurs close to help or after a correction. This MACD buying and selling technique helps you catch the beginning of a possible pattern.

Recognizing Exit Alternatives Utilizing MACD

A bearish crossover occurs when the MACD line crosses beneath the sign line. This warns of weakening momentum. Many merchants take this as a promote sign or use it to set exit factors, particularly if value hits resistance or if different instruments agree.

Adjusting MACD Settings for Totally different Timeframes

On most buying and selling platforms, MACD settings are versatile. The usual is (12,26,9), which is 2 exponential shifting averages and a 9-period EMA for the sign line.

For sooner trades, strive (6,13,5).

For long-term tendencies, use (24,52,18).

Combining MACD with Different Indicators

MACD works higher alongside different technical indicators. Pair it with the Relative Energy Index (RSI) to substantiate trades. For instance, a purchase sign is stronger if RSI is rising from oversold ranges. It’s also possible to test quantity, pattern strains, and help zones to cut back false indicators.

MACD reveals clear entry and exit factors, however it works greatest as a part of a broader buying and selling plan.

Learn how to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero price

Danger Administration with Shifting Common Convergence Divergence

You’ll be able to see that Shifting Common Convergence Divergence is a strong device. However it will probably’t predict each market transfer. That’s why you want strict threat administration:

- All the time management place sizing, most merchants threat simply 1–2% per commerce.

- Use stop-loss orders to restrict harm if the commerce goes towards you.

- For profit-taking, set clear targets or use a trailing cease.

- If Shifting Common Convergence Divergence hints at momentum fading, be prepared to regulate.

This method protects you from sudden volatility, particularly in crypto’s 24/7 markets. Danger administration turns good setups into long-term buying and selling success.

Limitations of MACD Use for Crypto

The MACD crypto technique is helpful, however it has limits, particularly in unstable or sideways markets. Since MACD is a lagging indicator, indicators usually affirm tendencies after they’ve began, not earlier than.

One other problem is that sign line crosses can produce false indicators in uneven markets. Throughout low-volume intervals or value consolidations, you would possibly get a number of crossovers that result in whipsaws. That’s why many merchants mix MACD with different indicators like RSI or quantity. It’s additionally good to take a look at longer timeframes for clearer indicators. Bear in mind: no indicator works completely in each situation. Use MACD as a part of a broader buying and selling system, not as your solely device.

Errors New Merchants Usually Make with MACD

New merchants usually misuse MACD as a result of they deal with it as a “magic sign”. One frequent mistake is counting on oversold situations with out context. MACD doesn’t let you know if a coin is actually oversold. It reveals momentum, not valuation.

One other problem is utilizing Shifting Common Convergence Divergence indicators alone, with out checking market construction. For instance, getting into a commerce simply because MACD crosses with out help and resistance can result in dangerous entries.

Many merchants additionally overlook to think about the timeframe. A sign on the 5-minute chart would possibly contradict the every day chart, however except you’re a day dealer, it’s higher to concentrate on longer timeframes for extra dependable indicators. Inconsistent timeframes result in confusion and losses.

Lastly, some merchants ignore technical evaluation fundamentals. MACD is only one device, and it really works greatest when mixed with quantity, pattern strains, and candlestick patterns. In case you use MACD with out a greater technique, you’ll seemingly fall into frequent traps and overtrade.

Remaining Phrases

The Shifting Common Convergence Divergence indicator is without doubt one of the most trusted instruments in crypto buying and selling. It simplifies momentum monitoring and helps you see pattern adjustments sooner. However like every indicator, it’s not good. Use MACD as a part of a whole buying and selling technique that features threat administration, different indicators, and clear targets. Sensible buying and selling comes from combining instruments, not counting on a single one.

FAQ

Is MACD bullish or bearish?

MACD may be each. A bullish MACD divergence suggests upward momentum might observe, particularly if the value kinds decrease lows whereas MACD makes larger lows. A bearish sign occurs when the MACD line crosses beneath the sign line, indicating downward stress. Since MACD is a momentum oscillator, it tracks the power of tendencies, not simply route. When divergence happens, it usually warns of a potential reversal.

Learn additionally: Reversal Candlestick Chart Patterns

What’s the greatest timeframe for utilizing MACD in crypto buying and selling?

You need to use MACD alongside totally different timeframes, however the perfect one will depend on your technique. For swing trades, many cryptocurrency merchants favor every day or 4-hour charts. Day merchants usually use the 15-minute or 1-hour charts for faster indicators. A rule of thumb is to align MACD along with your buying and selling fashion. Use longer timeframes to observe tendencies and shorter ones for fine-tuning entries or exits.

Can MACD be used successfully for altcoins, or is it higher for Bitcoin and Ethereum?

You need to use MACD on each. For Bitcoin and Ethereum, MACD works effectively due to their excessive liquidity and clear tendencies. For altcoins, it’s nonetheless efficient—however it is advisable to determine divergence fastidiously. Low-cap or thinly traded cash can produce extra false indicators as a result of erratic value motion. All the time mix MACD with quantity evaluation and broader market context when buying and selling altcoins.

What’s the greatest MACD for BTC?

For Bitcoin, the default MACD (12,26,9) works effectively on every day charts. Some merchants tweak it to (24,52,18) for long-term tendencies or (6,13,5) for sooner indicators on short-term charts. The perfect setting will depend on your fashion—whether or not you’re swing buying and selling or day buying and selling BTC. All the time backtest your MACD setup earlier than utilizing it reside.

Ought to I modify the default MACD settings (12-26-9) for crypto buying and selling?

Sure, you possibly can regulate MACD based mostly in your technique. The default (12,26,9) works for many circumstances, however sooner purchase and promote indicators come from utilizing (6,13,5). That is useful for day merchants or scalpers. For long-term investing, slower settings like (24,52,18) scale back noise. There’s no common “greatest” setting, take a look at totally different configurations in your favourite crypto belongings to see what matches your targets.

Disclaimer: Please notice that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.