Debate erupts over crypto’s network effects as investors question L1 value

Santiago Roel Santos, founder and CEO of crypto funding firm Inversion Capital, stated cryptocurrencies will not be topic to optimistic community results, however different consultants disagree.

In a latest Substack put up, Santos wrote that “crypto is priced for community results it doesn’t have.” He additionally pointed to the community impact valuation system, Metcalfe’s Regulation, saying that it “doesn’t justify crypto’s valuation” and as a substitute “exposes it.”

Santos claimed that a lot of crypto’s community results are adversarial, attributable to congestion, resembling increased charges, a worse person expertise, and slower transactions. “Fb didn’t worsen when it added 10 million customers,“ he stated.

Different consultants push again

Some analysts agree that crypto could also be overvalued, however others say Santos is making use of the improper framework.

Santos admitted that new blockchains improved transaction throughput, however he claimed that this results in decrease friction, not compounding worth. Nonetheless, he stated that liquidity, builders and customers can transfer whereas code might be forked, and worth seize is weak.

Associated: DeFi is already 30% of the best way to mass adoption: Chainlink founder

Jasper De Maere, desk strategist at main crypto market maker Wintermute, informed Cointelegraph that deeming layer 1 blockchains overvalued attributable to adverse community results is “making use of consumer-app logic to infrastructure,” increasing on the Fb instance.

“Fb’s back-end additionally had congestion and outages early on; these adverse results had been merely internalized and abstracted.“

De Maere stated that “customers will not be presupposed to work together with L1s immediately,” making month-to-month energetic customers and person stickiness irrelevant. In accordance with him, “the actual community results for an L1 exist on the validator, safety and liquidity layer, not the end-user layer, and that’s the place compounding truly occurs.”

Tomas Fanta, principal on the crypto funding agency Heartcore, stated he disagrees with Santiago that charges worsen as utilization grows. He stated that on high-performance blockchains, “the charges change from meaningless to meaningless,” and that liquidity improves and yields improve as adoption will increase.

Ben Harvey, digital asset researcher at crypto buying and selling firm Keyrock, informed Cointelegraph that he largely agrees with Santos’ declare that L1 blockchains are overvalued. Nonetheless, he doesn’t assume this is applicable to all L1s equally, with protocol scalability and synthetic intelligence integration being key elements.

Associated: Blockchain is struggling to carry on to its authentic goal: Aztec co-founder

Analysts debate crypto valuation logic

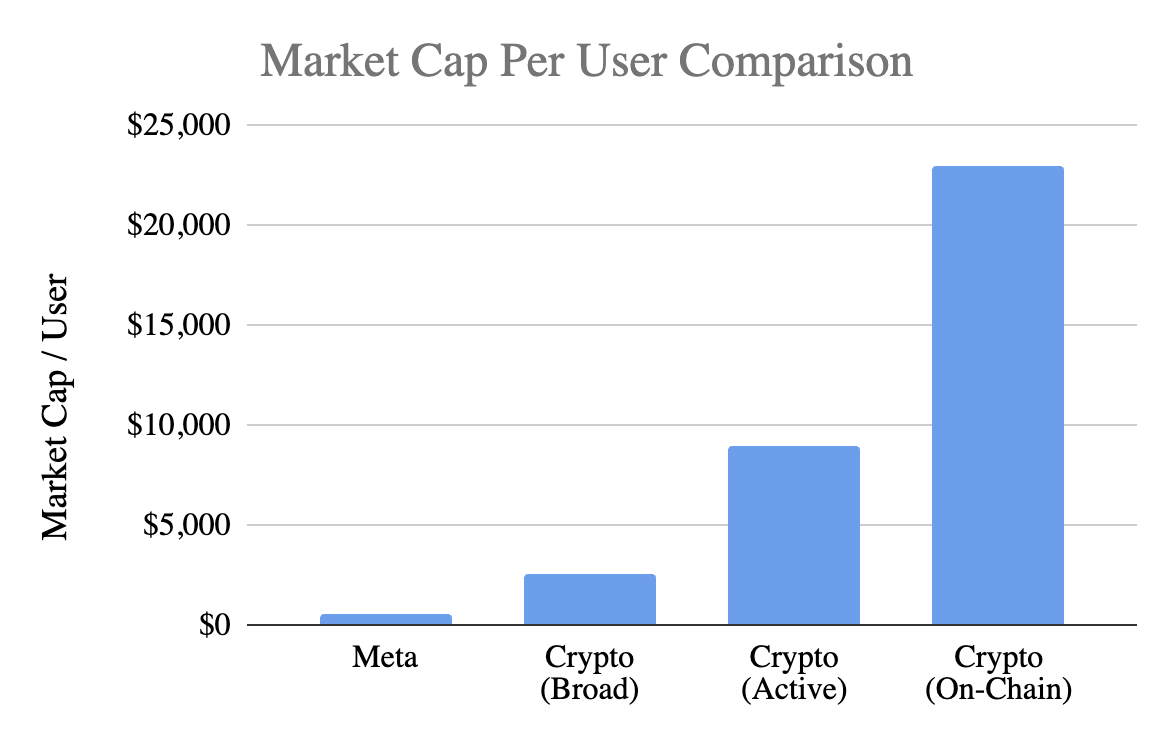

Santos pointed to some tough mathematical estimates of the worth an onchain person holds for a blockchain. Contemplating the present complete crypto market cap excluding Bitcoin (BTC), of $1.26 trillion, this could value the 40–70 million month-to-month energetic customers estimated by enterprise capital firm Andreessen Horowitz final month at $18,000 to $31,500 every.

The identical report estimates that 716 million individuals personal crypto. This is able to lead to a per-user worth estimate of practically $1,760, however it’s an overcount as a result of Bitcoin isn’t excluded. With Santos’ estimated 400 million customers, the worth could be $3,150 per person.

With Fb’s 3.1 billion month-to-month energetic customers and Meta’s market cap of $1.6 trillion, we get a per-user valuation of $516. Moreover, Meta additionally runs different platforms and companies along with Fb which might be priced in.

Market cap per person comparability. Supply: Santiago Roel Santos

Martin Kupka, a former investor at Web3 funding agency RockawayX, informed Cointelegraph that crypto “community results at the moment are in stablecoins, centralized exchanges and perpetual future decentralized exchanges.” He defined that “the extra helpful it’s as a medium of change and collateral, the extra merchants a CEX or perpetual venue has, the deeper the liquidity and higher the execution.”

Wintermute’s De Maere stated that “Web3 is modular and that makes the underlying community results far simpler to see” in comparison with Web2. He defined that these results typically emerge throughout L1 as safety and validator focus, in stablecoins as liquidity, and in decentralized and centralized exchanges, in addition to within the utility layer the place customers mixture.

“As a result of these layers are separable slightly than bundled, you may clearly observe the place compounding occurs,” De Maere stated. “That’s why, based mostly on conventional metrics like ARPU […] they will look overvalued,” he added. The present state of crypto valuation resembles when “we had been struggling to worth Web2 platforms […] and created particular fashions to take action,” he stated.

Journal: Bitcoin whale Metaplanet ‘underwater’ however eyeing extra BTC: Asia Categorical