Alliance DAO Partner QwQiao Questions Long-term Value of L1 Tokens

Key Highlights

- QwQiao argues that main L1 networks and tokens lack lasting aggressive benefits, also referred to as a moat, which makes it susceptible

- He believes that the primary drawback is that it’s now too simple for customers and builders to change between completely different blockchains, which pulls down the long-term worth of their tokens

- He proposed an answer, saying that blockchains ought to construct apps and companies immediately on their networks

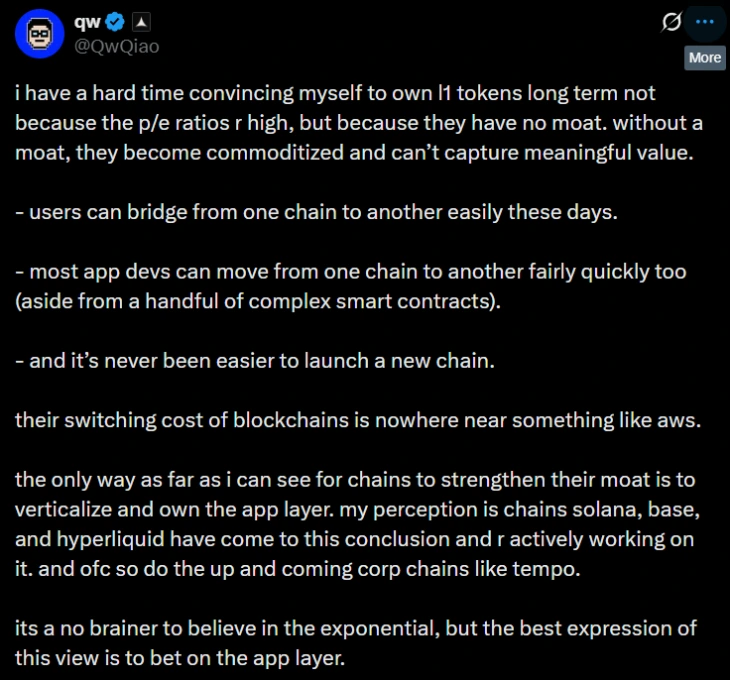

On November 27, QwQiao, a associate on the Alliance DAO, shared a tweet through which he raised questions concerning the long-term worth of L1 tokens.

(Supply: QwQiao on X)

Within the newest publish on X, he said that he has a “exhausting time convincing” to carry Layer 1 (L1) blockchain tokens for the long run. His concern was not about their present excessive costs. As a substitute, he questioned their very core construction by stating that L1 networks shouldn’t have a “moat.”

With out this much-needed safety, he believes that these infrastructure chains will develop into easy commodities, like electrical energy or water. Because of this, it will likely be unable to seize main worth over time.

L1 Tokens Have No Moat: QwQiao

The primary level of QwQiao’s argument could be very easy. He talked about that in right this moment’s crypto sector, there’s nearly no friction in stopping customers, builders, or capital locked on the blockchain from leaving one blockchain for one more.

In keeping with QwQiao, it solely takes a couple of minutes to maneuver digital belongings between completely different blockchains, due to superior bridge applied sciences like Wormhole and LayerZero. The whole quantity of those cross-chain transfers has already surpassed billions of {dollars} in 2025.

For builders, the method of transferring an software can be simple. Most can switch their code throughout suitable chains in a number of days. The rise of user-friendly growth instruments has even simplified the method of transferring to non-compatible networks.

Other than this, it simply takes weeks to launch a completely new blockchain or application-based rollup, not years, with the assistance of available kits.

This infrastructure makes the price of switching blockchains low compared to the issue of transferring an organization’s knowledge off a cloud service supplier like Amazon Internet Companies (AWS).

Qw said that “its a no brainer to consider within the exponential, however the perfect expression of this view is to guess on the app layer.”

QW is associate of Alliance DAO, which is a company often called one of the vital profitable DAOs within the cryptocurrency area. It’s also often called the DeFi Alliance. This group has helped launch main tasks like Pump.enjoyable and Fantasy Prime.

It has raised $50 million within the fundraising spherical by top-tier funding corporations like Sequoia and Paradigm.

Earlier than this, Qw has additionally raised earlier warnings in 2025 about dangers in retail ETFs, and AI tokens have confirmed appropriate. Now, his views on L1 tokens have develop into a subject of debate among the many crypto neighborhood.

QwQiao Thinks Vertical Integration is a Resolution

QwQiao has additionally shared his answer for the survival of L1 networks. He argues that they have to cease appearing as pure infrastructure and as a substitute absolutely transfer to personal the appliance layer constructed on high of them.

“the one approach so far as i can see for chains to strengthen their moat is to verticalize and personal the app layer. my notion is chains solana, base, and hyperliquid have come to this conclusion and r actively engaged on it. and ofc so do the up and coming corp chains like tempo,” he mentioned.

He talked about Base, an L2 community from Coinbase, for example. It’s shortly attracting a big consumer base of latest DeFi exercise. He additionally talked about Hyperliquid, which is a decentralised trade (DEX) constructed by itself high-performance Layer 1 blockchain.