Bitcoin above $26,000 – Here’s what the odds are

- A number of datasets revealed that buyers have been accumulating BTC whereas its value dipped

- BTC’s miners income remained excessive, as did its hashrate

Altcoins have been having a tough time of late whereas Bitcoin’s [BTC] value has remained comparatively secure. Glassnode and Santiment’s knowledge revealed that buyers have been extremely assured in BTC, which was evident from their accumulation pattern. Within the coming week, ought to we anticipate BTC’s value to comply with that of altcoins’, or will BTC change the market pattern?

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Bitcoin holders are being affected person

Glassnode’s tweet revealed that the proportion of BTC long-term holder provide despatched to exchanges stays extraordinarily low at 0.004%. As per the identical, this highlights the inactivity of the cohort amidst elevated market misery, remaining detached to the Binance and Coinbase regulatory modifications.

The share of #Bitcoin Lengthy-Time period Holder Provide despatched to Exchanges stays extraordinarily quiet at 0.004%.

This highlights the profound inactivity of the cohort amidst elevated market misery, remaining detached to the #Binance and #Coinbase regulatory costs. pic.twitter.com/yWfdQHu4Ca

— glassnode (@glassnode) June 11, 2023

Along with that, BTC whales have additionally been exhibiting immense confidence within the king of cryptos. Santiment’s chart identified a bullish divergence in BTC’s accumulation chart. Buyers continued to extend their holdings whereas BTC’s value suffered blows.

Whale exercise has risen every day too. To be exact, whales are collectively including greater than 1,000 BTCs again to their wallets day by day.

🐳 As #altcoin insanity has ensued, there quietly is a #bullish divergence between #Bitcoin‘s accumulating whales and falling value. With whale holdings shifting up by ~1K $BTC per day whereas costs fall, there’s purpose to consider a powerful rebound can happen. https://t.co/Ol0cK5VhPE pic.twitter.com/FeHPqqJx7o

— Santiment (@santimentfeed) June 11, 2023

Is that this improve in accumulation an aftermath of the altcoin market crash, or is it hinting that BTC is organising its subsequent bull rally?

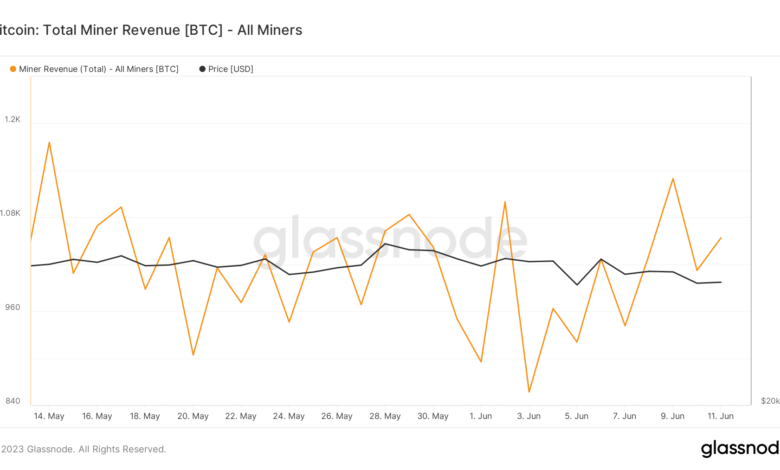

A flourishing mining business

Amidst this chaos, BTC’s mining business has continued to develop.

For example, as per YChart’s data, BTC’s hashrate was hovering close to its all-time excessive, which it reached on 1 Might 2023. At press time, the determine for a similar stood at 415.14M TH/s. One other good piece of reports for BTC’s mining business is that its miners’ income has remained comparatively excessive.

Supply: Glassnode

BTC to cross $26,000 quickly?

On the time of writing, the king coin was down by greater than 3% within the final seven days and was buying and selling at $25,805.83. A number of of the metrics lent credence to the potential of BTC’s value bouncing again.

For example, the coin’s change reserve has been decreasing, suggesting that it’s not below promoting stress. Bitcoin’s aSORP was inexperienced too, which generally alerts a market backside. Nevertheless, Bitcoin’s taker purchase/promote ratio was crimson, revealing the dominance of promoting sentiment within the derivatives market.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

A better have a look at Bitcoin’s derivatives market

As per Coinglass, BTC’s open curiosity declined barely over the previous couple of days, suggesting that the present value pattern would possibly change. Nevertheless, if BTC’s lengthy/brief ratio is to be thought-about, issues haven’t been wanting good.

In actual fact, the metric recorded a decline, which typically signifies that bearish sentiment is dominant.

Supply: Coinglass