Why Is The Bitcoin Price Down Again? Analyst Calls Out Trading Desk For Triggering Crashes

Crypto analyst Bull Principle has defined why the Bitcoin price has been crashing lately. The analyst identified that Wall Road merchants had been chargeable for the value declines, indicating that these buying and selling desks had been manipulating the marketplace for their very own profit.

Analyst Explains Why The Bitcoin Worth Is Crashing

In an X post, Bull Principle blamed Jane Road for the Bitcoin worth’s fixed crash at 10 a.m. ET when the U.S. market opens. The analyst identified that BTC erased 16 hours of good points in simply 20 minutes after the U.S. market opened. This has notably been taking place since early November, when the flagship crypto fell below $100,000. In the meantime, the same worth motion additionally performed out within the second and third quarters of this yr.

Associated Studying

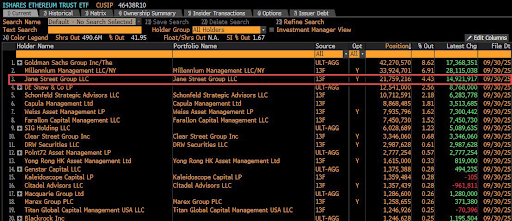

Bull Principle famous that one other analyst, Zerohedge, has claimed that Jane Road is more than likely the entity chargeable for this Bitcoin price crash. The analyst acknowledged that the chart reveals a sample that’s too constant to disregard, with a clear wipeout inside an hour of the market opening, adopted by a gradual restoration. He added that that is traditional high-frequency execution and that it matches Jane Road’s profile.

Bull Principle acknowledged that Jane Street is without doubt one of the largest high-frequency buying and selling companies on the planet and that they’ve the velocity and liquidity to maneuver markets for a couple of minutes. The analyst claimed that their conduct is easy: dump BTC on the market open, push the Bitcoin worth into liquidity pockets, after which re-enter at a lower cost.

By doing this, the analyst claimed that Jane Road has accrued billions in BTC. The buying and selling agency is claimed to carry $2.5 billion price of BlackRock’s Bitcoin ETF, which is its Fifth-largest place. Bull Principle added that this implies a lot of the dump within the Bitcoin worth isn’t as a consequence of macro weak spot however manipulation by this entity. He expects that BTC will proceed its upward momentum as soon as these massive gamers are completed shopping for.

Bitcoin At Threat Of A Decline Submit-FOMC

Crypto analyst Ali Martinez indicated that the Bitcoin worth was liable to a big decline following today’s FOMC meeting. He identified that BTC has constantly reacted negatively to FOMC conferences, with six out of seven conferences this yr resulting in corrections for the flagship crypto.

Associated Studying

The Bitcoin worth had rallied to as excessive as $94,500 yesterday in anticipation of a 3rd charge minimize this yr from the Fed. In line with CME FedWatch, there’s at present a 90% likelihood that the Fed will decrease charges by 25 foundation factors (bps). A CryptoQuant report famous how these charge cuts have turned out to be a ‘promote the information’ occasion on the 2 events the Fed lowered charges this yr, with the likelihood of this worth motion enjoying out once more.

On the time of writing, the Bitcoin worth is buying and selling at round $92,600, down within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com