June Sees Third Largest Influx in History

Be part of Our Telegram channel to remain updated on breaking information protection

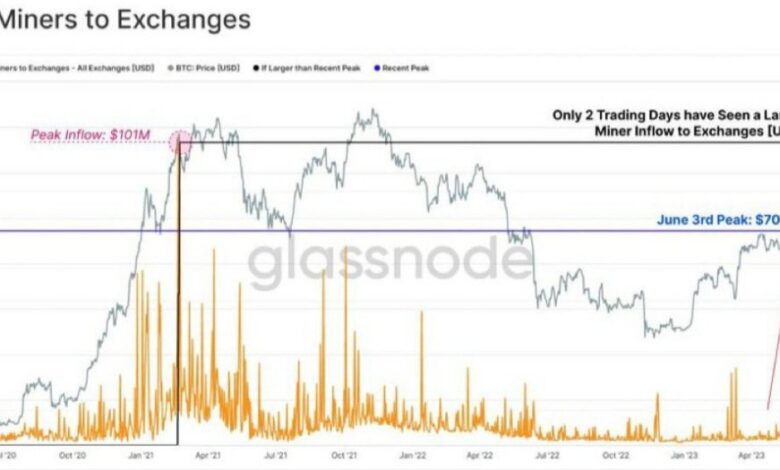

Over the previous week, on-chain knowledge means that Bitcoin miners are transferring a substantial quantity of cash to exchanges, reaching a notable influx of $70.9 million. That is the third largest influx on file, $30.2 million lower than the height influx of $101 million recorded throughout the major bull market in 2021.

#Bitcoin Miners are depositing #BTC on exchanges. In June, the third largest inflow #BTC to exchanges from #miners in historical past was recorded

This often signifies that there can be promoting strain pic.twitter.com/QcmkUMHThk— Crypto Economic system (@cryptooeconomy) June 12, 2023

On crypto exchanges like Binance and Coinbase, notable outflows have occurred prior to now week. In keeping with data recorded by Nansen, there was a major outflow of multi-chain property prior to now week, excluding Bitcoin from Binance, which quantities to $2.376 billion. On the similar time, Binance.US recorded an outflow of $124 million, whereas Coinbase skilled $1.787 billion.

Whales Proceed to Accumulate at Each Dip Whereas Bitcoin Miners are Promoting Cash

The worth of Bitcoin has been on the rise since December 2022. Nevertheless, the promoting of cash by miners has been on the rise in latest months, with worth declines and rising mining prices as obvious causes. Nevertheless, it’s price noting that not all miners promote their cash instantly. Some select to carry onto them (HODL), whereas others promote solely a portion of their earnings

Bitcoin continues to commerce beneath $26,000 because it nears a part of sturdy consolidation. On-chain knowledge, nonetheless, signifies some accumulation from whales at each dip.

Based mostly on a report from Santiment, Bitcoin whales have collected near 60,000 BTC amidst a latest worth correction of 10% in the previous few weeks.

🐳 As #altcoin insanity has ensued, there quietly is a #bullish divergence between #Bitcoin‘s accumulating whales and falling worth. With whale holdings transferring up by ~1K $BTC per day whereas costs fall, there may be motive to consider a robust rebound can happen. https://t.co/Ol0cK5VhPE pic.twitter.com/FeHPqqJx7o

— Santiment (@santimentfeed) June 11, 2023

Moreover, Bitcoin’s market dominance has additionally moved nearer to 50%. This comes amid the latest market crash in altcoin costs because of high-handed SEC motion. It’s the first time since April 2021 that Bitcoin’s (BTC) dominance has reached 50%.

When Bitcoin’s dominance rises above 50%, it often suggests a bear market state of affairs. Such a state of affairs could come up as a result of buyers transfer cash into safer havens. This was seen in 2018, when BTC dominance reached above 50%.

There may be the probability that Bitcoin might probably proceed to commerce with a help of $25,000 and an upside resistance of round 26,100. Amidst the latest SEC motion, BTC long-term holders proceed to carry their property.

Miner Exercise Ignites Curiosity

The surge of Bitcoin miners transferring substantial quantities of Bitcoin from their wallets to exchanges has ignited curiosity and raised questions concerning the potential influence on Bitcoin’s worth and general market sentiment. Miners play an important function within the ecosystem, securing the community and sustaining its integrity. Nevertheless, latest actions have steered a shift of their habits.

One chance of such actions could also be that miners are making the most of the latest worth improve in Bitcoin. Miners could capitalize on the chance to money of their holdings and safe earnings. Others consider that miners could also be positioning themselves for future market developments.

Within the quick time period, there’s a perception that miners’ traits might exert downward strain on Bitcoin’s worth. A transfer in the direction of exchanges means there’s a probability of promote strain outweighing purchase strain, probably leading to a worth correction.

There may be additionally the assumption that the long-term implications might not be as easy. Miners could use exchanges as intermediaries to hold out over-the-counter trades and even participate in different methods.

The explanations for these actions stay speculative, with Bitcoin’s worth unsure. As such, it underscores the significance of monitoring miner exercise and its potential implications for the general market.

Extra Information

Wall Avenue Memes – Subsequent Huge Crypto

- Early Entry Presale Stay Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Finest Crypto to Purchase Now In Meme Coin Sector

- Group Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection