Ethereum’s Shapella unlocks new opportunities for…

- Liquid staking protocols prolonged their dominance after Shapella and outperformed different staking choices.

- LSD beat ETH to grow to be the most important collateral asset on Aave lending protocol.

Customers within the crypto area have proven vital curiosity in Ethereum [ETH] staking during the last ten months, pushed by two crucial upgrades – The Merge and Shapella.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Staking, which was as soon as thought of a dangerous proposition attributable to ambiguity over withdrawals, bought a lift after the Shapella Improve enabled customers to unstake their ETH. This confidence led them to restake their ETH after an preliminary burst of withdrawals.

Consequently, Could recorded the very best month-to-month web influx of ETH, as per blockchain analysis agency Messari.

1/ #Ethereum underwent transformative upgrades (The Merge, Shapella) previously yr.

This led to outstanding financial developments and a skyrocketing development of recent liquid staking protocols and liquid staking tokens (LSTs).@kunalgoel dives in. 🧵 pic.twitter.com/9pqdEEtqpU

— Messari (@MessariCrypto) June 15, 2023

Rise of liquid staking derivatives

Messari’s evaluation revealed an intriguing development occurring due to Shapella: the expansion of liquid staking derivatives/tokens (LSD).

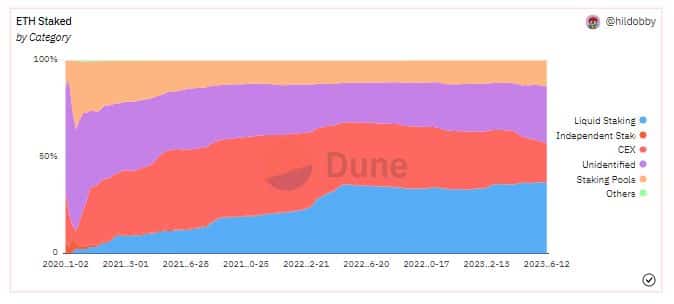

As a class, Liquid staking protocols like Lido Finance [LDO] prolonged their dominance after Shapella and outperformed different staking choices like centralized exchanges (CEX) and staking swimming pools.

Knowledge from Dune lent credence to this remark. Notably, the contribution of CEXs to ETH staking declined from 27% to twenty% since Shapella.

Supply: Dune

This development has unlocked new doorways of alternatives for LSDs. As broadly identified, these receipt tokens enable customers to immediately take part in staking whereas additionally sustaining the flexibility to make use of them elsewhere in decentralized finance (DeFi) for greater yield alternatives.

The preferred LSD in use is Lido Staked Ether [stETH].

Ethereum in bother?

Messari highlighted that LSDs have changed ETH because the prime collateral in a number of DeFi protocols. The truth is, these by-product tokens beat ETH to grow to be the most important collateral asset on main protocol Aave [AAVE].

Supply: Messari

Furthermore, the most important lending protocol, MakerDAO [MKR], which allows customers to borrow the DAI stablecoin, recorded a substantial enhance in its LSD deposits for the reason that Shapella Improve went dwell.

Supply: Messari

Moreover, rate of interest protocols, which contain changing ETH’s floating staking charge to a hard and fast charge, have gained reputation as a result of surge in LSDs. Though nonetheless at a really nascent stage, the prospects for these initiatives look encouraging.

Learn Ethereum’s [ETH] Value Prediction 2023-24

On the time of publication, the aggregated market capitalization of all liquid staking tokens was $14 billion, with stETH accounting for an enormous 86% share, as per CoinGecko.

Buying and selling quantity price greater than $70 million was recorded as a result of sale and buy of those tokens within the final 24 hours.