GameFi Narrative Is Finally Showing Signs of Life — These 3 Tokens Lead The Way

GameFi tokens have been left for lifeless after a brutal 2025. The sector ended the 12 months down roughly 75%, wiping out most investor curiosity. However early 2026 is beginning to present one thing completely different.

Utilization knowledge and costs are quietly turning up throughout just a few gaming-focused chains. It’s nonetheless early, however for the primary time in months, the numbers counsel GameFi could also be stabilizing — with a handful of tokens transferring first.

GameFi Is Exhibiting Early Indicators of Life Once more — What Offers

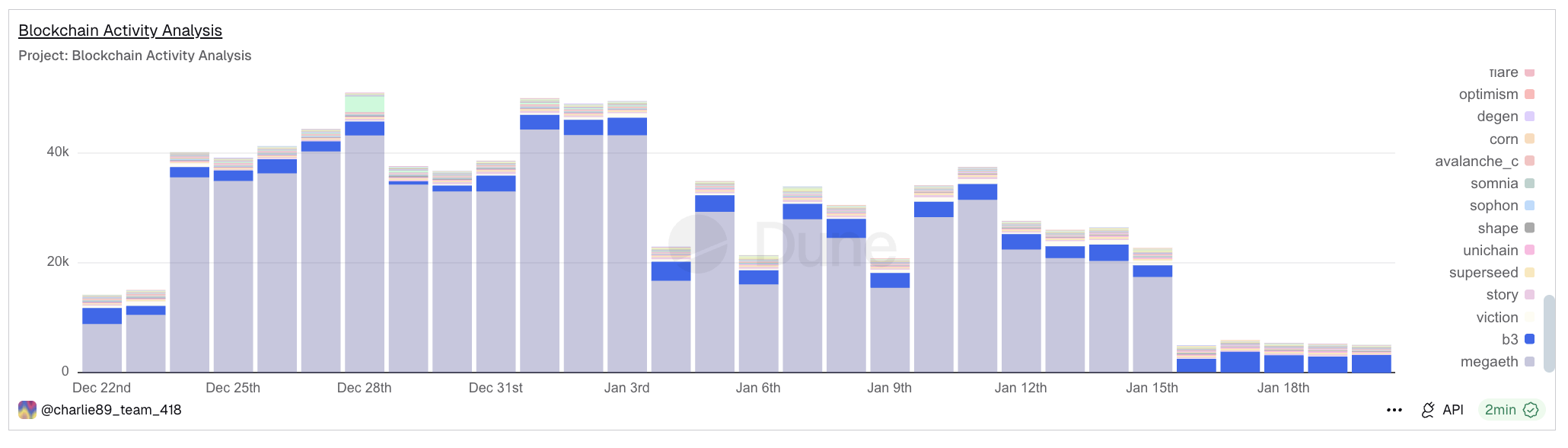

The primary sign comes from on-chain utilization.

Whereas scanning early-2026 Dune analytics dashboard knowledge throughout EVM chains, one metric stood out: common transactions per lively pockets. This measures the depth of exercise, not simply the pockets rely. Over the previous 4 consecutive days, B3, the gaming layer constructed on Base, has led all main chains on this metric, beating Optimism, Mantle, Circulate, and others.

B3 Is Exploding: Dune

That issues as a result of actual gaming habits reveals up as repeated actions by the identical customers.

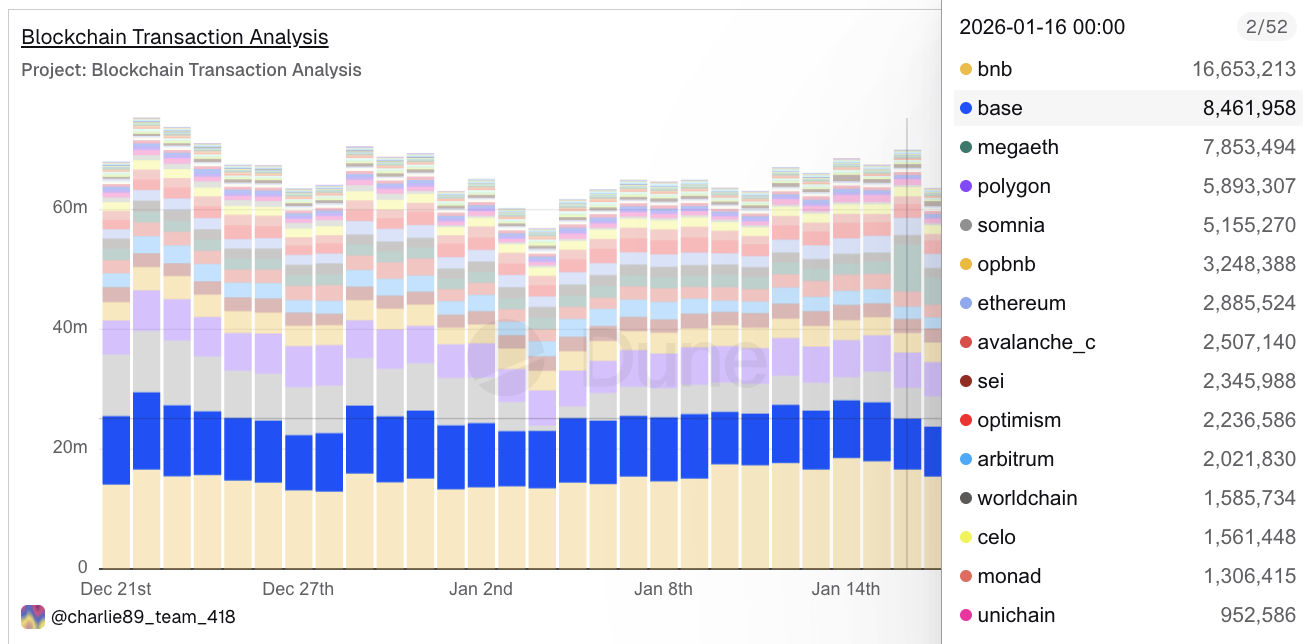

Base itself is reinforcing this sign. Past B3’s dominance in per-wallet exercise, Base has additionally ranked close to the highest in complete day by day transactions over the identical interval, indicating that gaming exercise is feeding into broader community utilization.

Base Finds A Spot: Dune

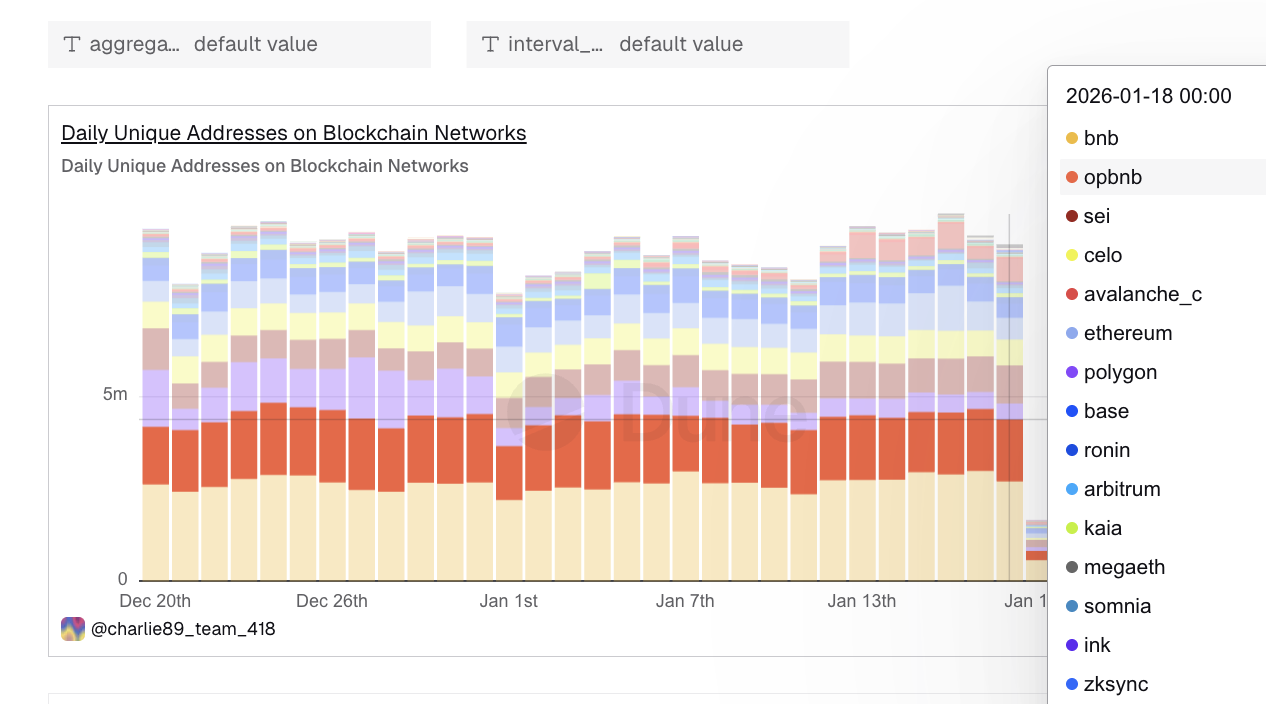

An analogous sample is showing on Sei, one other gaming-heavy chain. Over the previous a number of days, Sei has persistently stood out in day by day distinctive addresses.

SEI Main Larger Chains: Dune

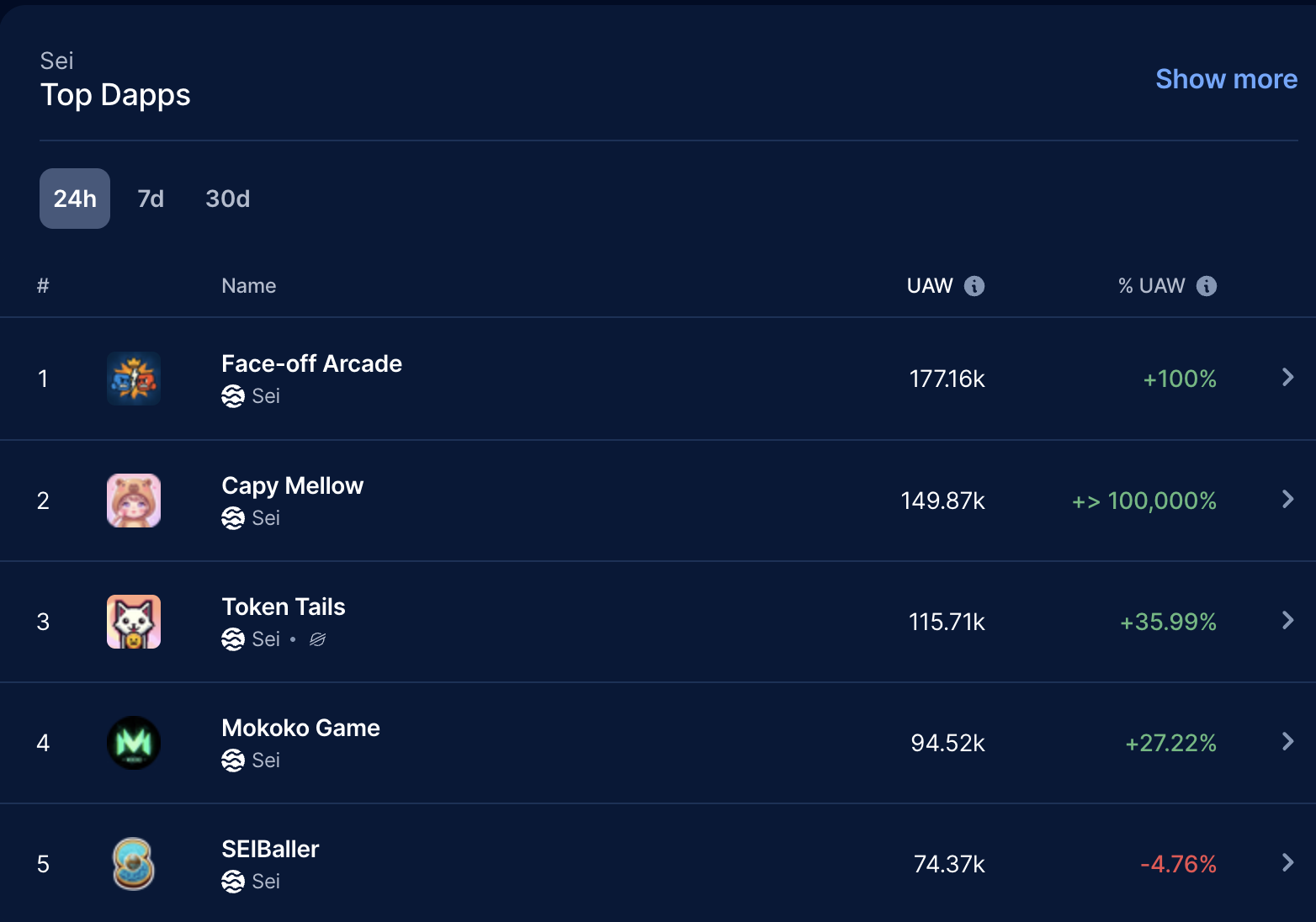

When damaged down additional, DappRadar knowledge reveals a number of Sei-based video games posting sharp 24-hour progress in lively wallets.

SEI Video games Doing Properly: DApp Radar

Context issues right here. GameFi fell almost 75% in 2025.

Based on CoinGecko’s Crypto Narratives Ranked by Returns 2025, RWA led the market with +185.76%, adopted by Layer 1 (+80.31%) and Made in USA (+30.62%), whereas most different sectors posted losses—led by Gaming (−75.16%) and DePIN (−76.74%). https://t.co/BGdrxjLiSU pic.twitter.com/RtFW77ZVVu

— Wu Blockchain (@WuBlockchain) December 26, 2025

As the primary month of 2026 begins, these alerts are beginning to line up, as highlighted by specialists like Yat Siu, Chairman of Animoca Manufacturers.

1/ Particular web3 gaming tokens within the @animocabrands fam are sharply up with quantity for $AXS and $SAND over $1 billion and $380m respectively. During the last 30 days $CHECK is up 300% $AXS 143% $SAND 35% throughout the identical interval. 2026 might be an thrilling 12 months for gaming a 🧵👇 pic.twitter.com/6TZ8yLZQzj

— Yat Siu (@ysiu) January 18, 2026

This doesn’t imply GameFi is again in full pressure. But it surely does counsel that the worst section of abandonment could also be passing.

When requested what actually issues for a GameFi restoration, and which indicators traders ought to give attention to past short-term worth strikes, Robby Yung, CEO of Animoca Manufacturers, stated in an unique commentary to BeInCrypto:

“For the GameFi class normally, I believe that there must be a strong, partaking product underlying the token (as all the time),” he stated.

That brings the main target to cost. A small group of established GameFi tokens is already responding.

Axie Infinity (AXS): Sentiment Surge and Construction Align

Axie Infinity is rising as one of many strongest leaders within the GameFi rebound. AXS is up roughly 117% over the previous seven days, clearly outperforming most large-cap gaming tokens as January progresses.

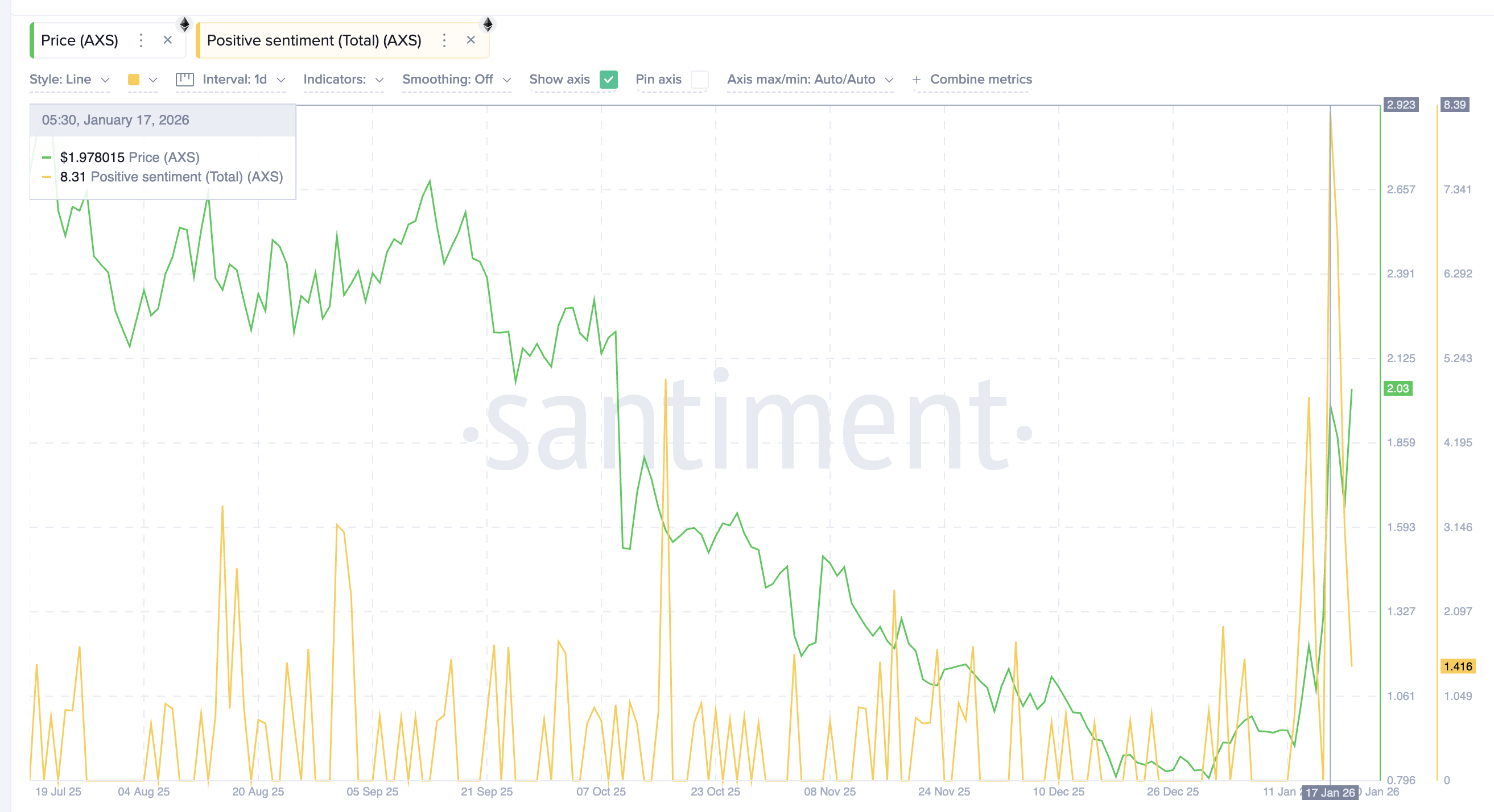

One purpose Axie is transferring forward of the pack is bettering sentiment, pushed by a shift in how the neighborhood views the undertaking. On January 17, optimistic sentiment for AXS spiked to eight.31, the best degree seen in over six months. Optimistic sentiment tracks how typically a token is mentioned favorably throughout social and on-chain channels, and spikes of this measurement often mirror renewed engagement somewhat than late-stage hypothesis.

AXS Sentiment”>

AXS Sentiment”>

AXS Sentiment: Santiment

That sentiment shift traces up with a basic catalyst highlighted straight by Robby Yung, who addressed Axie’s latest energy:

“The catalyst, on this case, was a change within the tokenomic mannequin for AXS, which was very well-received by the neighborhood, and led to an uptick in shopping for because the neighborhood was reinvigorated, so that is very a lot a grass roots-led motion,” he talked about.

Whereas that sentiment studying has cooled barely, it stays elevated in comparison with latest weeks, retaining consideration centered on AXS.

From a worth perspective, AXS started its rally in early January and is now consolidating after a pointy vertical transfer. This pause resembles a bull-flag construction, the place worth digests features with out breaking the pattern. So long as larger lows proceed to carry, the sample stays constructive somewhat than exhausted.

Pattern help is tightening. The 20-day exponential transferring common (EMA) is rising towards the 100-day exponential transferring common, which regularly acts as a medium-term pattern filter. A confirmed bullish crossover would reinforce the continuation case. A clear day by day shut above $2.20 would sign a breakout from consolidation and open upside towards $3.11 and even larger.

AXS Worth Evaluation”>

AXS Worth Evaluation”>

AXS Worth Evaluation: TradingView

Invalidation ranges are nicely outlined. A sustained drop under $1.98 would weaken the bullish construction. A deeper transfer under $1.63 and ultimately the 100-day transferring common line would invalidate the setup.

The Sandbox (SAND): Axie’s Bellwether Impact Spills Into Bigger GameFi Tokens

The Sandbox is starting to observe Axie Infinity’s lead, reinforcing the concept that the GameFi rebound is spreading past a single token. SAND is up roughly 27% over the previous seven days and almost 9% within the final 24 hours, a notable transfer for one of many largest gaming tokens by market worth.

That sequencing issues. Axie moved first, and Sandbox is reacting after, regardless of SAND being the chief by way of market cap. This traces up with how Robby Yung framed the sector dynamic, noting that Axie typically units the tone for broader GameFi strikes. As he put it,

“AXS could be very a lot a bellwether on this class, so once we see motion there, it’s more likely to be excellent news for the remainder of the sector,” he stated.

On-chain knowledge helps the optimistic outlook. Since January 16, SAND’s trade circulation stability has flipped sharply. Earlier within the month, trade balances confirmed internet inflows of about 4.36 million SAND, signaling lively promoting. That has now reversed into internet outflows of roughly 2.33 million SAND, that means tokens are being pulled off exchanges somewhat than ready on the market.

SAND Inflows Flip Outflows”>

SAND Inflows Flip Outflows”>

SAND Inflows Flip Outflows: Santiment

Shopping for strain rising alongside worth energy is a constructive sign, particularly for a large-cap token.

From a worth construction standpoint, SAND is forming a cup-and-handle sample, one other breakout formation. The rounded base developed by way of December, adopted by a powerful restoration leg in early January. Worth is now consolidating within the deal with zone. A clear day by day shut above $0.168 would break the neckline and open upside towards $0.190, with extension potential towards the $0.227 zone.

SAND Worth Evaluation”>

SAND Worth Evaluation”>

SAND Worth Evaluation: TradingView

Invalidation stays clear. Dropping $0.145 weakens the construction, whereas a drop under $0.106 would invalidate the bullish setup solely.

Decentraland (MANA): Whale Accumulation Alerts Early Positioning

Decentraland is the weakest short-term performer amongst main GameFi tokens, however that could be precisely why it’s attracting large cash. MANA is up about 7% over the previous 24 hours and roughly 15% over the previous seven days, lagging Axie Infinity and The Sandbox in proportion phrases.

What stands out is how whales are positioned throughout that relative underperformance.

Since January 17, wallets holding massive MANA balances have elevated their mixed holdings from roughly 1.00 billion tokens to 1.02 billion, an addition of about 20 million MANA, nearly $3.2 million, in only a few days. At one level, whale balances briefly reached 1.03 billion earlier than some mild trimming. That pullback was shallow and adopted by renewed accumulation, suggesting positioning somewhat than distribution.

MANA Whales”>

MANA Whales”>

MANA Whales: Santiment

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

From a worth construction perspective, MANA seems to be breaking out of an inverse head-and-shoulders sample on the day by day chart. This sample typically marks a transition from downtrend to restoration when it holds. The breakout zone sits close to $0.159, with energy bettering on larger closes.

For affirmation, MANA wants a day by day shut above $0.161. If that holds, upside targets open close to $0.177, $0.20, and doubtlessly $0.221, with prolonged resistance close to $0.24 if GameFi momentum broadens.

MANA Worth Evaluation”>

MANA Worth Evaluation”>

MANA Worth Evaluation: TradingView

A drop again under $0.152 would weaken the breakout, whereas a transfer underneath $0.137 would invalidate all the construction.

MANA could also be transferring final, however whale habits suggests it might not keep that manner if the GameFi narrative continues to rebuild.

The publish GameFi Narrative Is Lastly Exhibiting Indicators of Life — These 3 Tokens Lead The Manner appeared first on BeInCrypto.