How to Use Relative Strength Index (RSI) in Crypto Trading

Worry of lacking out (FOMO) and panic promoting smash many crypto trades. However there’s a greater strategy to make choices. Studying what RSI is in crypto provides you a easy, data-backed device to keep away from emotional trades. This text exhibits you precisely methods to use the Relative Power Index (RSI) in crypto buying and selling, so you possibly can spot momentum shifts, keep away from dangerous entries, and make smarter buying and selling strikes.

What Is the Relative Power Index (RSI)?

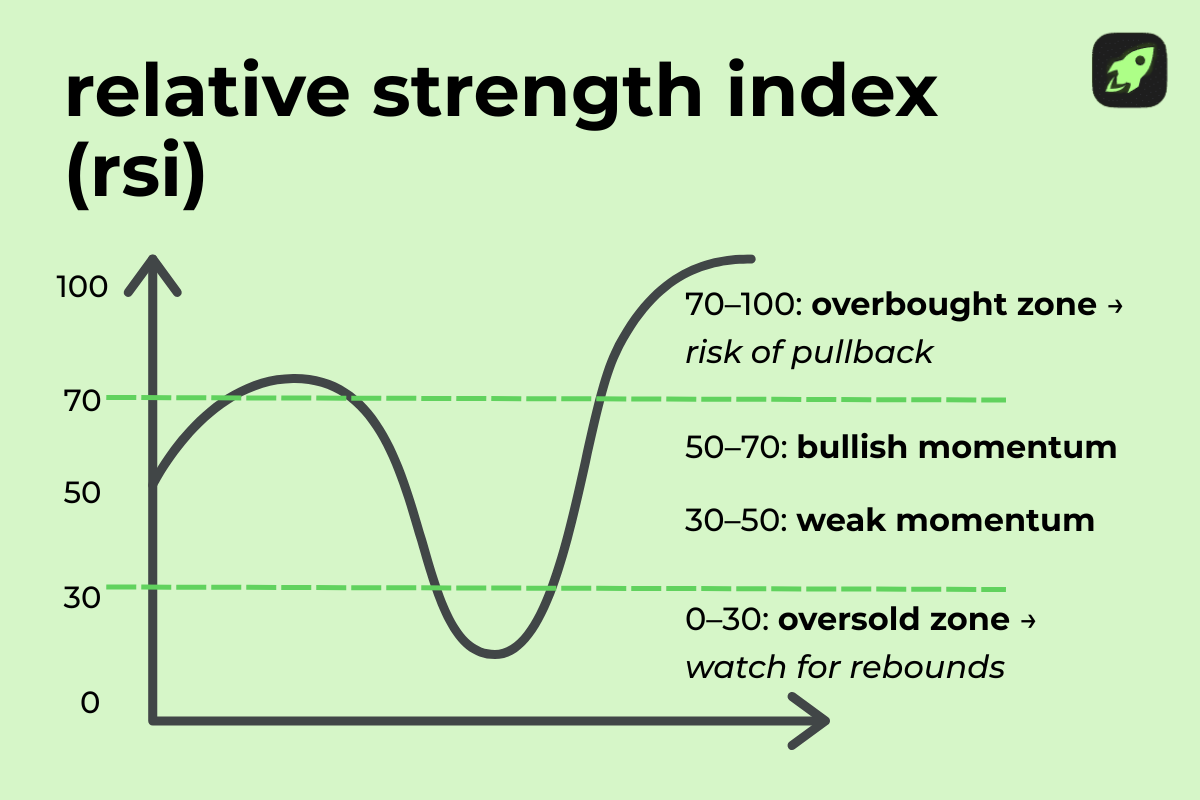

The Relative Power Index (RSI) is a momentum oscillator that compares current worth good points and losses to measure an asset’s relative power. It tracks how briskly and the way far costs transfer, displaying whether or not patrons or sellers are dominating the market at a given time. On a chart, the RSI stands as a single line that fluctuates between 0 and 100. When the road strikes increased, it means common good points outweigh losses; when it drops, promoting stress is in management.

The usual RSI interpretation is easy: readings above 70 counsel the asset could also be overbought and due for a pullback, whereas readings under 30 counsel it may very well be oversold and set for a bounce. Some merchants alter these thresholds relying in the marketplace pattern or volatility.

The RSI Indicator Throughout Markets

J. Welles Wilder developed the Relative Power Index (RSI) in 1978, publishing it in his e book New Ideas in Technical Buying and selling Programs. Since then, it has grow to be probably the most standard indicators in each conventional and crypto markets. Wilder additionally utilized smoothing to each common worth good points and losses, so RSI not often reaches 100 or 0.

In crypto buying and selling, RSI is used precisely as in shares or foreign exchange: to gauge momentum and ensure traits. When RSI rises sharply, it indicators robust shopping for exercise; when it falls, momentum is weakening. Many merchants add RSI to their charts to examine if a rally is gaining actual power or dropping steam. It’s a visible, easy-to-read device that performs a key position in technical buying and selling methods, serving to crypto merchants time entries, exits, and pattern confirmations.

Calculating RSI: The Relative Power Index Method Defined

The RSI components compares common good points to common losses over a set variety of durations, often 14. This calculation helps you measure current worth modifications and decide momentum. The components is:

RSI = 100 – [100 ÷ (1 + RS)]

Right here, RS is the ratio of common achieve to common loss in the course of the chosen interval. If costs largely go up, RS will increase, pushing RSI increased. If costs largely fall, RS drops, and RSI strikes decrease.

Let’s break it down with an instance.

Say Bitcoin rises on 10 of the final 14 days, averaging a 1% day by day achieve, and falls on 4 days, averaging a 0.5% day by day loss. RS = 1 / 0.5 = 2. Plug that into the components:

RSI = 100 – (100 / (1 + 2)) = 66.7

This end result exhibits reasonable bullish momentum.

Most merchants use a 14-period RSI, however you possibly can alter it nevertheless you want. A shorter look-back interval (like 7 or 9) makes RSI extra aware of current strikes, which is helpful for quick crypto markets. An extended interval (like 21) smooths out noise, higher for long-term traits.

Many fashionable buying and selling platforms calculate RSI routinely, however understanding the RSI calculation provides you extra management.

RSI Worth Scale: 0–100

RSI values vary from 0 to 100, serving to you measure momentum extremes. The usual overbought and oversold ranges are 70 and 30. Readings above 70 sign an asset is overbought, that means it could be overheated and due for a correction. Readings under 30 counsel it’s in oversold territory, the place promoting stress might fade and patrons step in.

These RSI ranges are tips, not strict guidelines. In crypto bull markets, merchants generally shift overbought or oversold territory to 80/40 to keep away from false indicators. In bear markets, they may alter it to 60/10.

For meme cash or small-cap tokens, RSI spikes occur typically, so be cautious. Robust traits can preserve RSI in excessive zones for lengthy durations with out reversing.

Use oversold ranges and overbought warnings as alerts, not commerce instructions. They can assist you notice potential exhaustion factors, however all the time affirm with worth motion or different instruments earlier than appearing.

How Do You Learn the RSI?

The RSI indicator exhibits you ways momentum shifts over time. When it rises, patrons are in management. When it falls, sellers dominate. Studying RSI is about understanding RSI habits in relation to market momentum, it’s not simply meaningless numbers. Most crypto merchants use RSI along with the worth chart to verify indicators or spot warning indicators.

4.1 Overbought and Oversold: When to Be Cautious

Essentially the most fundamental RSI studying is the overbought or oversold sign. When RSI strikes above 70, the market is taken into account overbought. This means the asset might need risen too quick and will face a pullback. When RSI drops under 30, it indicators oversold circumstances, that means heavy promoting could have pushed the asset too low, too shortly.

However watch out—these are alerts, not automated commerce indicators. In robust traits, RSI can keep overbought or oversold for weeks. For instance, Bitcoin’s RSI stayed above 70 for many of its 2021 bull run. Realizing what occurs when RSI is simply too excessive is vital: worth would possibly right, or it would preserve rallying if the pattern is powerful.

4.2 RSI and Worth Tendencies: Affirmation vs. Contradiction

Use RSI to verify or problem the pattern you see on the chart. In a bullish pattern, RSI often stays within the higher half of the dimensions, with increased lows and constant power. In a bearish pattern, RSI tends to remain within the decrease half, reflecting vendor dominance.

When worth makes an upward pattern however RSI makes decrease highs, that’s a bearish pattern divergence—an indication the rally is dropping momentum. The alternative is true in a downward pattern: if worth makes decrease lows however RSI makes increased lows, it’s a bullish sign that momentum is shifting.

4.3 Understanding RSI Reversals vs. Continuations

Many merchants search for potential reversals when RSI hits extremes. However more often than not, RSI confirms the present pattern. Performing on each RSI excessive can result in false alarms from false indicators, particularly in fast-moving crypto markets. Give attention to reversals that align with help/resistance or patterns, not RSI alone.

4.4 RSI Crosses: Above or Beneath the 50 Midline

The RSI crosses of the 50-line are one other key sign. When RSI strikes above 50, it’s typically a bullish crossover, displaying optimistic momentum. When it drops under 50, it’s a bearish crossover, signaling sellers are gaining management.

The right way to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

The right way to Use RSI When Buying and selling Crypto

The RSI is among the hottest instruments in crypto buying and selling. It really works throughout totally different buying and selling methods, whether or not you’re swing buying and selling, day buying and selling, or long-term investing. Since crypto is thought for sharp strikes and excessive volatility, the relative power index helps you time your trades higher.

RSI is constructed into most buying and selling crypto platforms, together with Binance, Coinbase Professional, and TradingView. Utilizing it successfully means studying not simply when to purchase or promote, however methods to learn its indicators in context. The next RSI methods cowl the most typical functions for crypto merchants. These approaches are easy to start out, however highly effective when mixed with technical evaluation and different momentum indicators or technical indicators.

1. Entry and Exit for Your Commerce

Merchants typically use RSI for entry indicators and promote indicators. When RSI dips into oversold (under 30), that may be a shopping for alternative. When RSI rises into overbought (above 70), it may very well be time to promote or scale back publicity. For instance, if Ethereum’s RSI drops to 25 after a correction, some merchants purchase, anticipating a rebound. If RSI then rises to 75, they may exit.

Take into accout: RSI just isn’t good. In robust traits, bullish indicators could occur even when RSI is excessive. All the time use RSI along with worth motion to verify your entry and exit factors.

2. Swing Buying and selling

For swing buying and selling, RSI is a go-to device. Swing merchants attempt to seize short- to medium-term strikes inside a bigger pattern. RSI helps establish these swings by highlighting momentum modifications. A typical buying and selling fashion would possibly contain shopping for when RSI crosses again above 30 after being oversold, and promoting when it crosses again under 70.

This method works properly in range-bound markets, the place crypto costs transfer between help and resistance ranges.

3. Determine Help and Resistance Ranges

RSI may also enable you to establish traits in market circumstances. Typically RSI kinds its personal help or resistance, separate from the market worth or asset’s worth. For instance, if RSI bounces off the 40 degree a number of instances throughout a rally, that 40 degree turns into a momentum help zone. If RSI retains failing to interrupt above 60 in a downtrend, it could act as resistance.

4. Bullish and Bearish Divergence

One of the vital helpful RSI functions is discovering bullish and bearish divergence. Recognizing divergences early can assist you catch pattern modifications earlier than they occur.

RSI divergence happens when worth and RSI disagree. If worth makes new highs however RSI makes decrease highs, that’s a bearish divergence—a warning that momentum is fading.

If worth makes new lows however RSI kinds increased lows, that’s a bullish divergence, signaling a attainable reversal.

When Can We Belief the RSI Indicator?

In crypto, RSI works greatest in market circumstances the place costs transfer sideways or inside a spread. It’s particularly helpful for large-cap cash like Bitcoin and Ethereum, the place traits are extra secure. In small-cap altcoins or meme cash, RSI can set off false indicators due to sudden volatility.

To enhance accuracy, mix RSI with different indicators. For instance, examine shifting averages to verify the pattern. Some merchants additionally add shifting common convergence divergence (MACD) for higher indicators. RSI is a superb device for recognizing momentum shifts, however all the time confirm it with broader market context.

Errors Merchants Make with RSI

Many merchants misuse RSI by making use of it blindly or with out understanding the broader market context. The relative power index is among the hottest instruments in technical evaluation, besides, it isn’t foolproof.

Blindly Trusting RSI Overbought/Oversold Labels

One of the vital widespread errors is figuring out overbought or oversold RSI readings and assuming the worth will immediately reverse. In principle, when RSI enters overbought or oversold circumstances, it means the market could also be due for a pullback or rebound. However crypto typically ignores these indicators, particularly throughout robust traits.

As we talked about, Bitcoin’s RSI stayed above 70 throughout its 2021 bull run for months and not using a main correction. In actuality, overbought and oversold circumstances are simply warnings, not commerce triggers. It’s best to by no means rely solely on RSI extremes to enter or exit trades. All the time search for affirmation from worth motion or different indicators.

Utilizing RSI Alone With out Confluence

One other mistake is utilizing the relative power indicator by itself, with out checking different instruments. RSI measures momentum however says nothing about pattern path or market construction.

For higher outcomes, mix RSI with shifting averages, help and resistance ranges, or quantity indicators. For instance, a bullish RSI sign is extra dependable if the worth can be above the 200-day shifting common. Confluence provides your trades a stronger basis.

Ignoring Market Situations (Information, Occasions, Sentiment)

Many merchants neglect that RSI reacts to cost actions, not fundamentals. If breaking information hits the market—a regulatory crackdown, change hack, or main partnership—worth could transfer dramatically no matter what RSI says. In crypto, market sentiment can shift quick, making momentum indicators briefly ineffective. Earlier than appearing on RSI, take into account information, on-chain knowledge, and broader market occasions that may clarify why worth is shifting the best way it’s.

Misjudging RSI Timeframes for Fast Trades

This indicator is delicate, so the RSI interval and RSI settings you select play an enormous position. Utilizing the default 14-period RSI on a 1-minute chart will give very totally different outcomes from utilizing it on a day by day chart.

When RSI falls shortly on brief timeframes, it typically triggers false alarms due to small worth fluctuations. Alter your settings to match your buying and selling fashion: brief durations for scalping, longer durations for swing or pattern buying and selling. This helps filter out noise and keep away from dangerous entries.

Ultimate Phrases

The relative power indicator is a robust device for crypto merchants, however it works greatest as a part of a broader buying and selling technique. RSI helps you notice momentum shifts, affirm traits, and time entries or exits with extra confidence. Bear in mind, no indicator is ideal—use RSI with confluence, alter your settings to your buying and selling fashion, and keep conscious of market circumstances. With follow, RSI turns into a key ally for navigating crypto’s fast-moving worth cycles.

FAQ

What is an effective RSI to purchase?

A “good” RSI to purchase sometimes occurs when the indicator strikes from oversold again towards impartial. Many merchants begin waiting for entries when RSI is between 30 and 40, signaling the market is recovering from a dip. Nevertheless, in some circumstances, merchants await RSI to interrupt particular ranges relying on the asset’s pattern. All the time affirm with worth motion or help ranges earlier than shopping for.

What does RSI inform you?

RSI is a relative power indicator that exhibits whether or not patrons or sellers are dominating the market. It tracks the stability between current good points and losses, providing you with a view of market momentum. When RSI rises, shopping for stress is powerful. When it falls, promoting stress dominates. RSI helps you establish if an asset is trending, ranging, or reaching an excessive that might result in a reversal or pullback.

What occurs when RSI is simply too excessive?

When RSI rises too excessive—often above 70—the asset enters overbought and oversold zones. This warns that purchasing momentum could be unsustainable, and a pullback might comply with. Nevertheless, in robust uptrends, RSI can keep elevated for weeks and not using a reversal. All the time mix RSI with pattern evaluation or help/resistance ranges to keep away from exiting too early or falling for false reversal indicators.

Can RSI be used successfully in extremely risky crypto markets like meme cash or low-cap altcoins?

Sure, however with warning. In extremely risky markets, RSI typically provides whipsaw indicators due to fast worth swings. Meme cash and low-cap altcoins could hit excessive RSI readings regularly with out significant reversals. To make use of RSI successfully right here, widen your thresholds—for instance, deal with 80/20 as overbought/oversold as an alternative of 70/30—and ensure with different indicators like quantity or pattern strains earlier than buying and selling.

What’s the very best RSI timeframe for crypto buying and selling?

The very best RSI timeframe depends upon your technique. Day merchants typically use shorter RSI durations, like 7 or 9, for faster indicators. Swing merchants keep on with the traditional 14-period RSI on 4-hour or day by day charts. For long-term traits, some use 21-period RSI to easy out market noise. All the time alter your RSI settings to match your buying and selling fashion and the asset’s volatility.

How dependable is RSI throughout robust traits (bull runs or crashes)?

In robust bull runs or crashes, RSI is much less dependable for recognizing reversals. It typically stays in overbought territory throughout rallies or stays oversold in crashes. This occurs as a result of momentum stays one-sided. As an alternative of utilizing RSI to foretell tops or bottoms in traits, deal with the 50-line crosses or use RSI to verify the pattern’s power. This reduces the chance of buying and selling in opposition to market momentum.

Disclaimer: Please observe that the contents of this text are usually not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.