Story Protocol sheds 18% – THESE clusters warn of deeper IP pullback

Buyers’ subsequent transfer stays pivotal for the mental property token, Story Protocol [IP], as it can doubtless decide whether or not the value finds stability or slides additional into decline.

On-chain information and market indicators paint a transparent image of broad bearish sentiment. The longer-term worth construction continues to replicate decrease highs and decrease lows, reinforcing a downtrend that continues to be firmly intact.

Exercise throughout each spot and perpetual markets mirrors this outlook.

At this stage, the market’s solely reasonable probability at a rebound hinges on a important assist zone, which is able to largely dictate near-term worth route.

Capital flows reinforce the bearish bias

Perpetual market positioning has been dominated by sustained liquidity outflows and a gentle rise briefly publicity—two defining options of a bearish market setting.

Value motion has intently adopted this development. Over the previous 24 hours, IP posted considered one of its sharpest declines, shedding roughly 18% of its worth.

Throughout this era, roughly $17 million exited the IP perpetual market, dragging whole open liquidity all the way down to $68.93 million.

Outflows of this scale sometimes replicate a mixture of entrenched bearish conviction and investor capitulation, as merchants rush to exit positions amid accelerating draw back stress.

Supply: CoinGlass

This dynamic culminated in a liquidation cascade that pushed whole liquidations on Story Protocol to about $1.19 million, with lengthy positions absorbing the vast majority of the losses.

The Funding Charge provides additional affirmation to this bearish setup. Regardless of thinning liquidity, the merchants that stay are more and more skewed quick, with quick contracts dominance now outweighing lengthy positions on the time of this report.

A destructive Funding Charge underscores this imbalance.

When funding turns destructive, it signifies that quick merchants are paying a premium to keep up positions, typically signaling expectations of continued draw back momentum.

The spot market gives little aid. Over the previous 9 days, shopping for exercise has fallen to its weakest stage, with simply $542,000 deployed by IP traders.

This muted demand highlights the shortage of conviction amongst Spot patrons.

With restricted spot inflows to soak up promoting stress and bearish positioning dominating derivatives markets, draw back dangers stay elevated.

Help ranges beneath stress

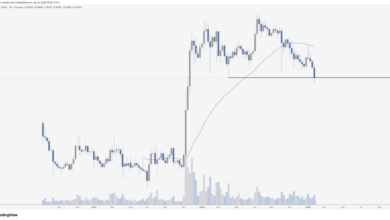

IP traded at a technically fragile stage, hovering near its all-time low of $1, first set in February 2025.

As of press time, worth was confined inside a broader assist vary between $1.7 and $1.0—a zone that has traditionally acted as a reversion space.

Inside this band, IP has already slipped to the mid-range assist close to $1.4, putting the asset in an more and more weak place.

A failure to carry this mid-range stage would doubtless verify a broader bearish continuation, signaling inadequate buy-side demand to stabilize the value.

Supply: TradingView

In a extra constructive state of affairs, worth might set up a short-term vary, oscillating between the mid-range assist and the higher boundary of the zone, earlier than making a extra decisive transfer.

For now, nonetheless, weak spot participation and protracted bearish dominance counsel the chance of a sustained rally stays restricted. As a substitute, IP dangers slipping under the mid-range stage, retesting its all-time low, and probably setting a brand new one.

Is a rebound nonetheless potential?

Liquidity evaluation provided additional perception into potential worth paths.

At current, merchants focus liquidity between the mid-range assist and the higher boundary close to $1.7.

This distribution suggests {that a} rebound stays technically potential, with worth probably rotating inside this vary.

Supply: CoinGlass

Nonetheless, if shopping for momentum fails to carry up as worth strikes towards the higher liquidity zone, draw back dangers improve.

Merchants have additionally stacked liquidity under the mid-range assist, creating room for a deeper pullback if sellers regain management.

Ultimate Ideas

- IP is recording regular capital erosion within the spot market, whereas perpetual merchants stay firmly bearish.

- Story (IP) is now only one key assist stage away from retesting its all-time low of $1, with rising odds of setting a brand new decrease low.