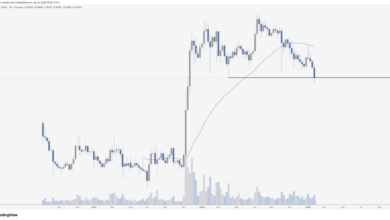

Bitcoin: Leverage unwinds as BTC slips 10% monthly -Stabilization ahead?

Bitcoin’s month-to-month returns reveal a recurring cycle of sharp advances adopted by corrective phases.

Durations of consecutive month-to-month losses, notably in 2014 and once more in 2018, marked the unwind of overheated rallies moderately than structural failure. Latest weak point follows the identical sample.

As Bitcoin [BTC] reached a brand new all-time excessive in October 2025, the ends in the month-to-month returns contradicted the efficiency.

This was a results of tighter international liquidity, shifting ETF flows, and restrictive financial circumstances lowering marginal demand, thereby translating to damaging returns in the identical month.

Supply: CoinGlass

On the identical time, profit-taking has weighed on short-term efficiency.

Traditionally, Bitcoin delivered its strongest returns in 2013, 2017, and 2020–2021, whereas the weakest years adopted speculative extra.

Recoveries usually emerged by means of consolidation, decrease leverage, and renewed spot accumulation.

That restoration path stays viable below present circumstances. It is because leverage is resetting.

Extended damaging month-to-month returns usually coincide with compelled deleveraging. As soon as that course of matures, draw back strain weakens as marginal sellers exit.

Market deleveraging accelerates amid Bitcoin’s risky decline

In keeping with CoinGlass, liquidation data signifies a interval of intense market stress.

As of press time, greater than $5 billion in crypto positions had been liquidated over the past 4 days.

This marked the biggest liquidation occasion because the tenth of October 2025, with lengthy liquidations exceeding $2.5 billion on peak days.

Supply: CoinGlass

As liquidations elevated, Bitcoin’s worth declined alongside them, displaying a robust relationship between compelled promoting and worth weak point.

Related patterns appeared in mid-November and early December, each adopted by sharp worth drops.

Supply: CoinGlass

Bitcoin not too long ago fell beneath $80,000 to about $77,700, triggering $1.6 billion in weekly liquidations.

A rebound towards $80,000 might liquidate $1 billion in brief positions, doubtlessly driving a brief squeeze, though elevated leverage retains market dangers balanced.

Deleveraging resets market construction

Bitcoin’s worth decline now strikes alongside a transparent drop in Open Curiosity.

As the worth slipped towards $77,500, Open Curiosity dropped from about $47.5 billion to just about $24.4 billion, indicating a discount in leveraged positions.

This sample signifies a cautious response from merchants, who choose to scale back publicity as an alternative of accelerating aggressive bets.

Supply: CryptoQuant

In earlier cycles, related declines in each worth and Open Curiosity appeared throughout late levels of deleveraging and infrequently led to durations of consolidation.

Market construction stays weak as sentiment cools. Promoting strain persists, but decrease leverage factors to rising fatigue.

All in all, the market now sits between additional draw back threat and the potential for stabilization as soon as positioning resets.

Last Ideas

- Bitcoin’s drawdown mirrors previous post-rally corrections, the place tightening liquidity and profit-taking triggered deleveraging moderately than structural breakdown.

- Heavy liquidations and collapsing Open Curiosity present leverage is resetting, leaving the market balanced between additional draw back and stabilization.