All social program benefits can be distributed onchain: Compliance exec

Blockchain expertise is an efficient medium for administering social profit applications, however key compliance challenges stay, based on Julie Myers Wooden, CEO of compliance and monitoring consulting agency Guidepost Options.

Guidepost Options suggested the Republic of the Marshall Islands’ authorities on a regulatory compliance and sanctions framework for its USDM1 bond, a tokenized debt instrument issued by the federal government, backed 1:1 by short-term US Treasuries.

The Marshall Islands authorities launched a Common Fundamental Earnings (UBI) program in November 2025 that distributes quarterly advantages to residents straight by means of a cellular pockets. Wooden advised Cointelegraph:

“Any profit that’s presently being distributed by means of analog means ought to be explored for a digital supply choice for a number of causes. Digital supply quickens the method and may present an auditable path for provisioning and expenditures.”

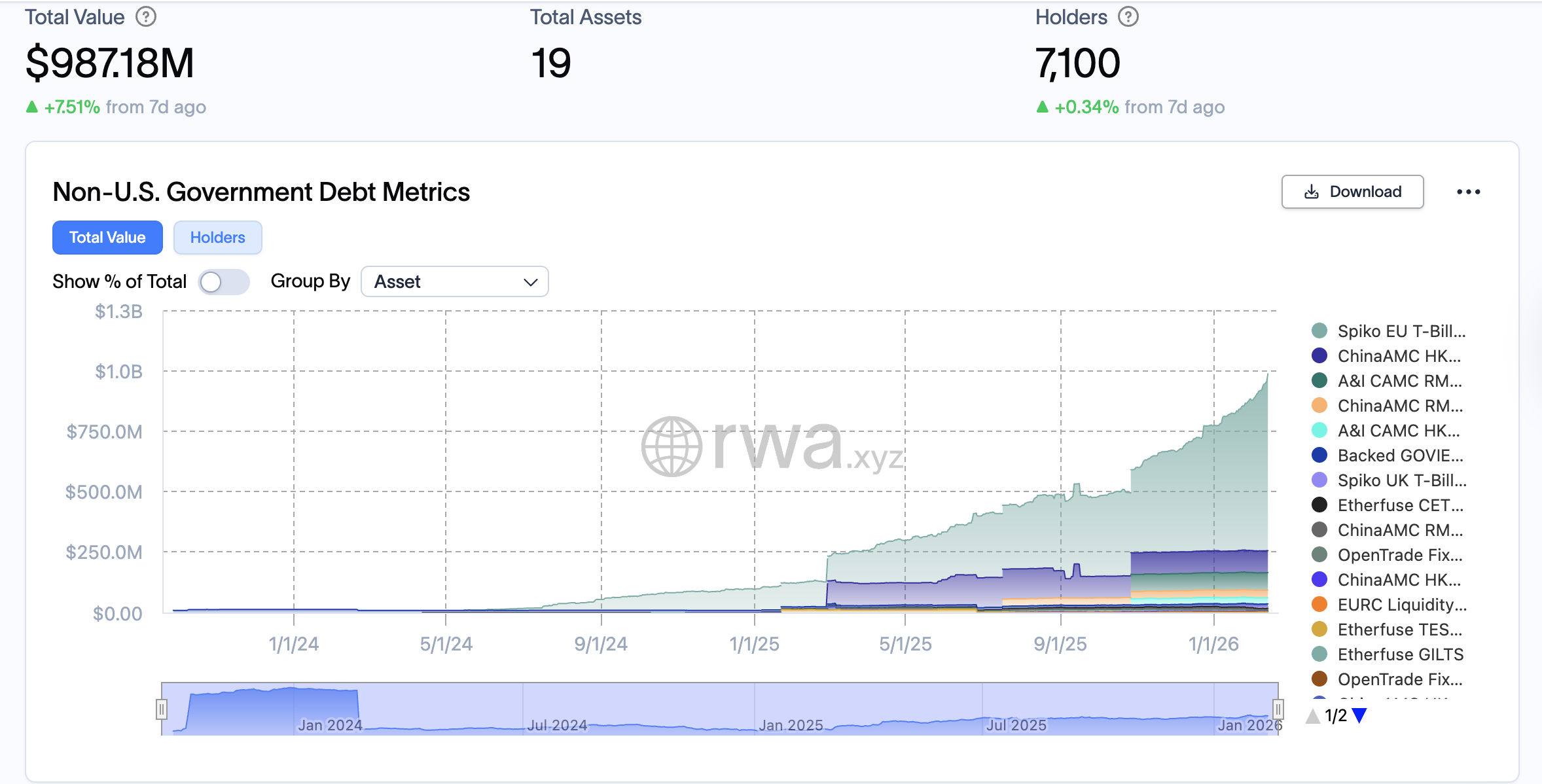

The marketplace for non-US tokenized authorities debt devices continues to develop. Supply: RWA.XYZ

A number of governments are exploring tokenized debt devices and administering social profit applications onchain to remove settlement delays and dear transaction charges inherent in conventional finance by disintermediating the issuing and clearing course of.

Associated: UK authorities appoints HSBC for tokenized bond pilot

Regulatory compliance and sanctions challenges stay because the tokenized bond market grows

The price discount and near-instant settlement instances for tokenized bonds and different onchain devices democratize entry to the monetary system for people who lack entry to conventional banking infrastructure.

Nevertheless, anti-money laundering (AML) necessities and sanctions compliance are two of the largest regulatory dangers for governments issuing onchain bonds to the general public, Wooden advised Cointelegraph.

Governments issuing tokenized bonds should additionally gather know-your-customer (KYC) data to make sure that funds are directed to the correct recipients, she added.

The tokenized US Treasury market grew by over 50x since 2024, based on knowledge from crypto evaluation platform Token Terminal.

The tokenized US Treasury market has grown by over 50x since 2024. Supply: Token Terminal

The tokenized bond market might surge to $300 billion, based on a forecast from Lamine Brahimi, co-founder of Taurus SA, an enterprise-focused digital asset companies firm.

Diminished settlement instances, transaction prices and asset fractionalization, which permits people to buy fractions of a monetary asset, all increase investor entry to the worldwide monetary system, Brahimi advised Cointelegraph.

Journal: Will Robinhood’s tokenized shares REALLY take over the world? Execs and cons