Crypto ATM Scams: What They Are and How They Work

Crypto ATMs appear to be easy and handy to make use of, which is strictly why they’ve develop into a strong instrument for scammers. For many individuals, these machines really feel acquainted—like a traditional money ATM—however they function very in a different way from banks, exchanges, or cost apps.

Understanding how crypto ATM scams work is vital as a result of the hurt typically occurs quick, quietly, and with out apparent warning indicators. This information breaks down what these scams are, why they’re so efficient, how victims are guided step-by-step via the rip-off, and what can realistically be finished to scale back the danger.

What Are Crypto ATM Scams?

A crypto ATM rip-off is a kind of fraud the place scammers trick individuals into sending cryptocurrency via a bodily machine that appears just like an everyday money ATM. These machines are formally known as Convertible Digital Forex (CVC) kiosks, and the most typical model is a Bitcoin ATM. Not like crypto exchanges or cellular wallets, these kiosks are designed primarily for cash-to-crypto conversions, the place you place in money and the machine sends cryptocurrency on to a pockets tackle.

That simplicity is what creates the issue: You haven’t any account, no assist agent, and no built-in security checks such as you’d discover on an alternate. As soon as the transaction is shipped, it goes straight to the blockchain. Scammers exploit this by convincing victims to make use of the kiosk for pressing “funds,” figuring out the funds transfer quick and are extraordinarily laborious to recuperate.

Why Scammers Love Crypto ATMs

Scammers are drawn to crypto ATMs as a result of they mix pace and ease, and have only a few safeguards. The largest attraction is transaction irreversibility—as soon as a crypto transaction is shipped, it can’t be canceled or reversed like a financial institution switch or card cost.

Crypto ATMs additionally function on a permissionless blockchain, which suggests anybody can obtain funds with out approval from a financial institution or central authority. Victims are normally instructed to ship cash to a crypto pockets, which is just a digital tackle used to retailer and obtain cryptocurrency. In scams, that is typically a third-party pockets switch, which means the pockets belongs totally to the scammer, to not any firm or establishment.

As a result of there isn’t a identification examine of the recipient and no buyer assist that may cease the transaction halfway, crypto ATMs create a quick, one-way cost path that scammers know could be very laborious for victims to undo.

Keep Protected within the Crypto World

Learn to spot scams and defend your crypto with our free guidelines.

The Scale of the Drawback: Losses, Victims, and Tendencies

Reviews from shopper safety and regulation enforcement companies present that crypto ATM scams aren’t uncommon or remoted—they’re a rising drawback. The Federal Commerce Fee tracks fraud complaints nationwide and has warned that crypto ATMs have develop into a serious cost instrument for scammers. In its evaluation, FTC Knowledge Highlight “Bitcoin ATMs: A payment portal for scammers,” highlights how losses linked to those machines have risen lately.

Legislation enforcement is seeing the identical development. The Federal Bureau of Investigation collects sufferer reviews via the Web Crime Criticism Middle, and its IC3 Cryptocurrency Fraud Report in 2023 shows that crypto-related scams value victims billions total, with crypto ATM instances standing out for his or her pace and severity.

Older adults are particularly affected by these scams, which is why the Nationwide Elder Fraud Hotline commonly reviews instances the place retirees and seniors lose their life financial savings after being despatched to a crypto ATM. Collectively, these reviews paint a transparent image: losses are rising, victims are sometimes weak, and scammers are more and more centered on crypto ATMs as an efficient instrument.

How a Crypto ATM Rip-off Works (Step by Step)

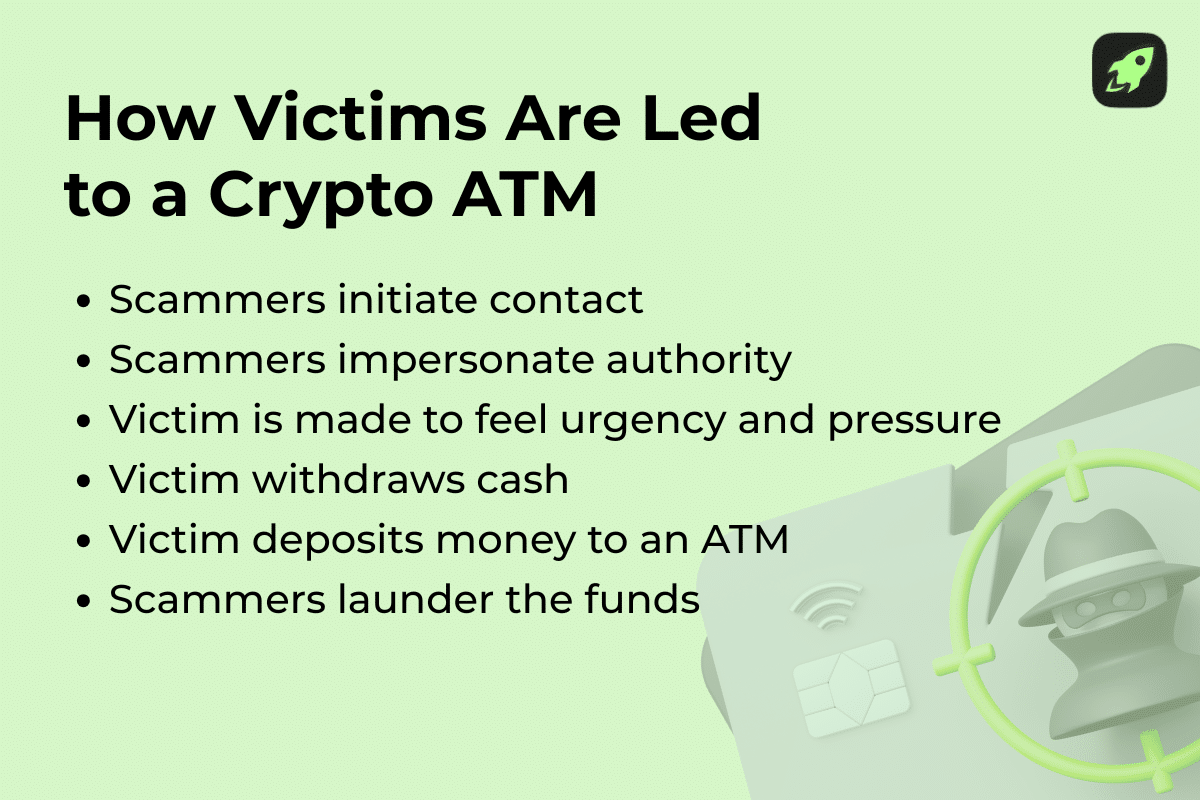

Like most scams, ATM scams comply with a particular construction geared toward reducing the sufferer’s guard and disorienting them sufficient to half with their cash.

- Step 1: The hook (textual content, name, pop-up, e mail)

Most crypto ATM scams start with social engineering. Somebody manipulates feelings to affect selections. The purpose is to achieve consideration and belief earlier than introducing urgency. - Step 2: Impersonation + urgency (financial institution, authorities, or tech assist)

As soon as contact is established, the scammer escalates strain by posing as an authority determine. Scammers might impersonate authorities representatives (faux cops or tax brokers), a financial institution worker, or tech assist warning about malware. Urgency is essential right here: threats, deadlines, or warnings are used to cease the sufferer from pondering clearly or looking for others’ recommendation. - Step 3: Money withdrawal and isolation ways

Subsequent, the sufferer is instructed to withdraw money and put together for a rip-off cost. Scammers typically insist the sufferer has to remain on the telephone and never converse to financial institution workers or household. They direct the sufferer to a close-by CVC alternate, framing it as a secure or crucial cost channel. This isolation prevents last-minute warnings that might cease the rip-off. - Step 4: The kiosk (QR code or pockets tackle)

On the machine, the scammer offers precise directions. Most frequently they ask to scan a QR code or enter a pockets tackle. Victims are instructed this tackle belongs to an organization or authority, however in actuality, it’s managed by the scammer. - Step 5: Funds disappear (laundering and why restoration is uncommon)

As soon as the transaction is full, the cash is shortly moved. Scammers would possibly launder the cash by breaking it into smaller transfers or routing funds via a cash mule—somebody paid to maneuver the cash onward. In bigger instances, these scams could be carried out by a transnational legal group (TCO) working throughout borders. As a result of crypto transactions are quick and ultimate, restoration is extraordinarily uncommon as soon as this stage is reached.

The Most Frequent Crypto ATM Rip-off Scripts

There are a number of widespread rip-off situations that comply with a predictable sample. Whereas the tales differ, the construction and strain ways are largely the identical.

- Financial institution “fraud division” / account compromise

Scammers pose as financial institution safety groups and declare there may be suspicious exercise on the sufferer’s account. The sufferer is instructed funds are in danger and have to be “secured” instantly, typically by sending cash via a crypto ATM. - Tech assist pop-ups and distant entry permissions

Pretend alerts warn of malware or hacking. As soon as contact is made, the scammer pressures the sufferer to grant distant entry and calls for cost to “repair” the difficulty. - Authorities / police / “warrant” threats

The scammer impersonates a authorities company or regulation enforcement officer, claiming unpaid fines, taxes, or an energetic warrant. Pressing cost is demanded to keep away from arrest or authorized bother. - Household emergency / “bail” scams

Victims are instructed a relative has been arrested, injured, or is in rapid hazard. Emotional stress is used to push for quick funds with out verification. - Funding “account verification” or “tax” calls for

Pretend funding platforms declare withdrawals are blocked till further charges or taxes are paid. Victims are instructed to make use of a crypto ATM to finish these funds shortly.

Easy methods to Spot a Crypto ATM Rip-off Immediately

You’ll be able to spot a potential ATM rip-off if you already know the most typical warning indicators. For those who discover any of the factors under, it’s a powerful sign that one thing is fallacious.

- “Pay with crypto to repair or defend your account”

Authentic banks, firms, and authorities companies by no means ask for funds via crypto ATMs. Crypto transactions are irreversible and scammers depend on this finality to shortly lock in your losses—and their positive factors. - “Don’t inform anybody” and “keep on the road”

Scammers attempt to isolate victims so nobody can interrupt the method. If you’re instructed to not converse to household, financial institution workers, or retailer workers, it’s a serious pink flag. - Being directed to a particular machine or location

If somebody tells you precisely which crypto ATM to make use of and urges you to go there instantly, that’s an indication of a scripted rip-off. Actual organizations don’t management the place or the way you make funds. - QR codes despatched by a stranger

Scammers typically ship a QR code to hurry issues up. Once you scan the code, it mechanically fills in a cost vacation spot, leaving little time to overview or query the place the cash goes. - Calls for for repeated transactions or a number of kiosks

Being instructed to make a number of funds, break up quantities, or go to a couple of machine normally means funds are being despatched to a third-party pockets managed by the scammer. This habits isn’t regular for reputable funds.

If even one in every of these indicators seems, it’s most secure to cease, stroll away from the machine, and search recommendation earlier than taking any motion.

The place These ATMs Are and How Scammers Route Victims to Them

Crypto ATMs are positioned in on a regular basis areas, which makes them straightforward to search out and simple for scammers to use.

- Typical placement (retail shops, fuel stations)

Most Bitcoin ATMs and CVC kiosks are positioned in high-traffic locations like shops, malls, and fuel stations. These areas really feel acquainted and secure, which lowers suspicion and makes the transaction really feel routine. - “Nearest machine” ways and maps

Scammers typically information victims to the closest machine utilizing on-line maps or instructions. They might even stroll the sufferer via the route step-by-step. Public instruments like Coin ATM Radar, which legitimately listing close by crypto ATMs, are generally misused to shortly determine machines which might be straightforward to achieve. - Why a handy location will increase rip-off success

Comfort performs a serious position in rip-off success. When a machine is close by, victims are much less prone to pause, rethink, or search recommendation. The quicker somebody reaches the kiosk, the extra possible they’re to finish the cost earlier than doubts set in. Scammers perceive this and design their directions to reduce distance, time, and alternatives for interruption.

Actual-World Case Patterns (What Victims Say Occurred)

Actual victims’ tales present how shortly a seemingly regular interplay can flip right into a loss at a crypto ATM.

In a single broadly reported case, 85-year-old Fran Bates from Texas was satisfied over the telephone that her checking account was in danger, and over the subsequent two days she was guided to a fuel station Bitcoin ATM kiosk the place she fed greater than $23,000 in money into the machine—cash that was by no means recovered. In her interview in regards to the incident, Bates remembers her personal emotions: “You suppose should you needed to hearken to it, you’ll marvel, ‘What’s occurring with that girl? Doesn’t she understand what they’re doing to her?’ No, you don’t.”

Equally, in New Jersey, 80-year-old Marlene Betesh obtained a faux alert about “suspicious exercise,” was instructed to withdraw money and deposit it at a close-by crypto kiosk, and misplaced $9,500 nearly immediately. In her interview on The Good Rip-off podcast, she remembers: “They stated that I accepted a sale from Russia the morning earlier than. He goes, ‘Marlene, it’s important to go to the financial institution and take out your cash earlier than Russia empties your checking account.’ ”

In communities throughout the US, seniors have repeatedly been focused—native reviews describe repeated telephone calls telling individuals their accounts have been compromised and urging rapid funds by way of crypto machines earlier than authorities or household may intervene. What these instances have in widespread is a persuasive “hook,” strain to behave quick, and funds disappearing into untraceable digital wallets as soon as the money is transformed on the ATM.

What Crypto ATM Operators, Banks, and Retail Hosts Can Do

Stopping crypto ATM scams is feasible when operators and on-site companions add good friction and keep alert to warning indicators.

- Friction that works (cool-downs, prompts, clearer receipts)

Small pauses can cease huge losses. Time delays, on-screen warnings, and plain-language prompts that designate dangers give individuals a second to rethink. Clear receipts that present charges and locations additionally assist. Repeated reminders of transaction charges and fee prices can immediate customers to decelerate, so making prices apparent reduces rushed selections. - Monitoring pink flags (structuring, repeat pockets addresses)

Operators can look ahead to structuring—should you’re breaking a big quantity into a number of smaller deposits or sending funds repeatedly to the identical pockets. These behaviors are unusual for regular use and will point out a rip-off in progress. - Coaching frontline workers (cashier interventions)

Retailer workers are sometimes the final line of protection. Primary coaching helps cashiers acknowledge panic, scripted telephone calls, or repeated money withdrawals. When kiosks are run by a noncompliant kiosk operator, or one which lacks safeguards, workers consciousness is much more vital. A easy query or suggestion to pause can interrupt a rip-off earlier than cash is misplaced.

Regulation and Coverage: What’s Altering (and What’s Not)

Crypto ATMs aren’t unregulated, however the guidelines round them are sometimes misunderstood.

- In the USA, operators are topic to the Bank Secrecy Act (BSA), a federal regulation that requires monetary providers to assist stop crime.

- To conform, reputable operators should run an AML/CFT Program, which is a set of controls designed to detect cash laundering and terrorist financing.

- Most crypto ATM firms are labeled as a cash providers enterprise (MSB), which means they have to full MSB Registration (FinCEN) and comply with reporting guidelines. These embrace primary Buyer Identification Verification (KYC), particularly for bigger transaction quantities.

- When suspicious habits seems, operators are anticipated to file a Suspicious Exercise Report (SAR), generally utilizing particular identifiers just like the SAR Key Time period “FIN-2025-CVCKIOSK” to flag crypto kiosk exercise.

- Massive money transactions can also set off a Forex Transaction Report (CTR). What’s altering is enforcement and steering—akin to FinCEN Discover FIN-2025-NTC1, which clarifies expectations for kiosk operators.

The fundamental actuality, nonetheless, shouldn’t be altering: guidelines exist, however they don’t cease scams for the time being of cost, which is why prevention and consciousness nonetheless matter most.

Last Phrases

Crypto ATM scams succeed not as a result of persons are careless, however as a result of the system is designed for pace and ease relatively than safety. Scammers benefit from urgency, confusion, and the ultimate nature of crypto transactions to push victims into selections they’d by no means make below regular situations. Regulation and monitoring are bettering, however they can’t change consciousness for the time being of cost. Figuring out the patterns, recognizing the warning indicators, and understanding how these machines differ from banks or exchanges stay essentially the most dependable defenses.

Relating to crypto ATMs, slowing down and asking questions could make the distinction between a routine transaction and an irreversible loss.

FAQ

Are you able to reverse a Bitcoin ATM transaction?

No. As soon as a Bitcoin ATM transaction is shipped, it can’t be reversed or canceled. Crypto transactions are ultimate by design, not like financial institution or card funds.

How do I get my a refund from a crypto ATM rip-off?

Typically, you may’t. Restoration could be very uncommon as a result of the funds transfer shortly and can’t be returned. It is best to report the rip-off instantly to regulation enforcement and shopper safety companies.

Are Bitcoin ATMs regulated?

Sure, however oversight is proscribed. Within the US, operators should comply with anti-money laundering guidelines and register as cash providers companies, however these guidelines don’t cease scams for the time being of cost.

What would a legit firm/authorities company by no means ask you to do?

They’ll by no means ask you to pay fines, taxes, charges, or account safety prices utilizing a crypto ATM, QR code, or cryptocurrency.

How can shops stop scams at ATMs on-site?

Shops can practice workers to acknowledge misery, submit clear rip-off warnings close to machines, and encourage clients to pause or ask questions earlier than finishing transactions.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.