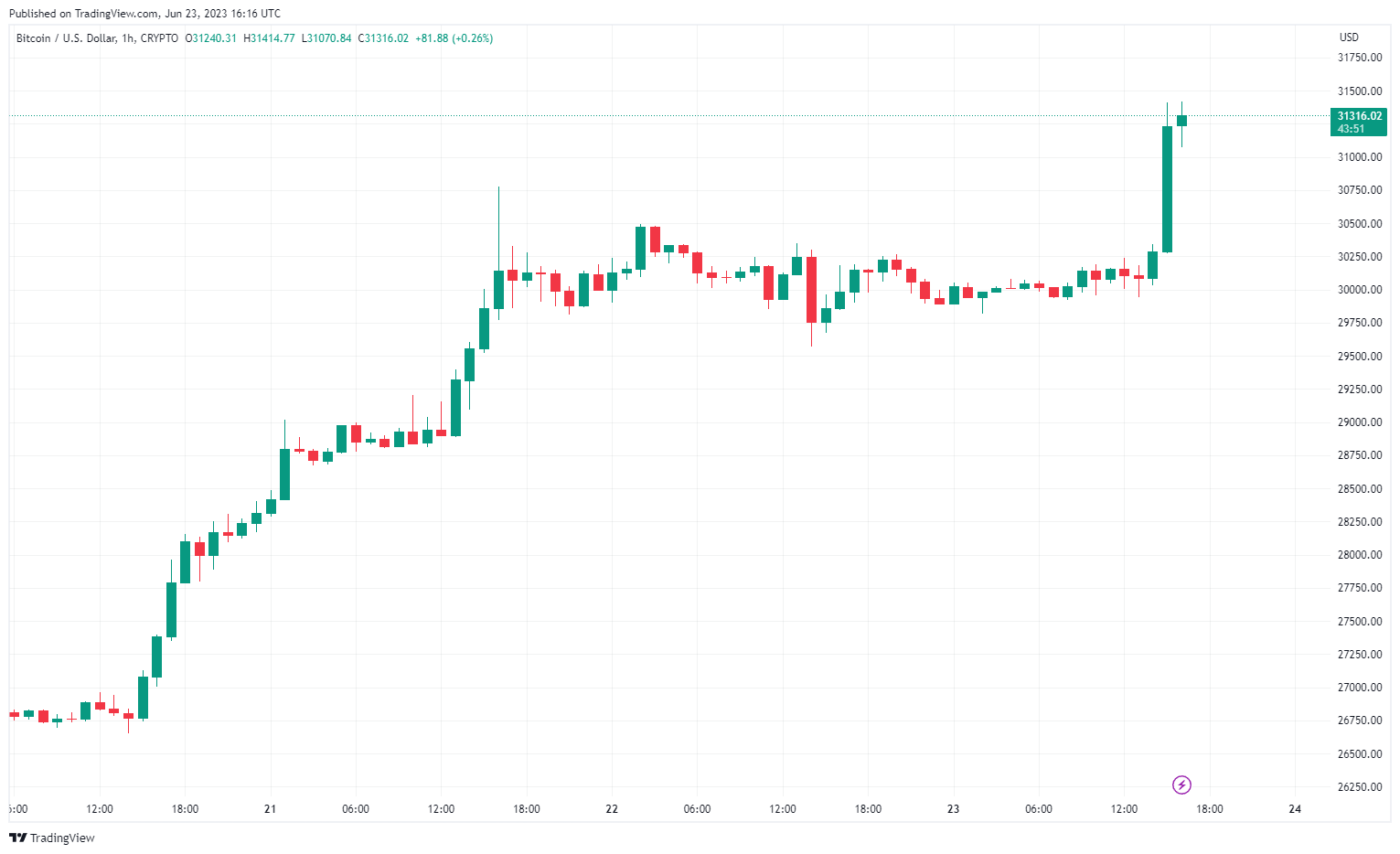

Bitcoin breaks $31k as it continues to shake off recent slumps

As ongoing regulatory pressures ramp up in the direction of a number of cryptocurrencies, Bitcoin (BTC)has proven spectacular resilience, breaking the $31,000 barrier at the moment and marking its highest shut of the 12 months.

This bounce comes after a protracted interval of stagnant buying and selling, with Bitcoin wavering between $25,000 and $30,000 since March 16.

The liquidation volumes for every cryptocurrency over the previous 4 hours had been $30.01 million in Bitcoin, $17.27 million in Ethereum (ETH), and $3.15 million in Bitcoin Money (BCH), in accordance with Coinglass information. These values contribute to the entire 4-hour liquidation quantity of $72.20 million, comprised of $13.01 million of lengthy positions and $59.18 million of brief positions.

Bitcoin was buying and selling at $31,234 as of press time.

BTC surge after institutional curiosity

This Bitcoin surge follows a wave of institutional curiosity. World funding big BlackRock submitted an utility final week to the U.S. Securities and Alternate Fee for a spot Bitcoin ETF. The regulator has but to grant approval for a spot Bitcoin ETF.

Including to the optimistic sentiment round Bitcoin, the launch of EDX Markets on June 20, which coincided with Bitcoin reclaiming the $28,000 mark, has been well-received by the market. Backed by heavyweights Constancy, Charles Schwab, and Citadel Securities, EDX Markets is a promising institutional crypto alternate.

Bitcoin’s rise is a stark distinction to the remainder of the cryptocurrency market, which has been struggling within the aftermath of the SEC’s unprecedented lawsuits in opposition to Binance and Coinbase. The SEC has alleged that a number of in style cryptocurrency tokens are, of their view, unregistered securities.

SEC Chair Gary Gensler has been express about his plan to take motion in opposition to crypto corporations that, in his view, function exterior U.S. legislation. Gensler has said that every one cryptocurrencies, with the only exception of Bitcoin, qualify as securities below U.S. legislation. Nonetheless, Gensler’s stance on Ethereum, the second-largest cryptocurrency by market cap, stays unclear.

The put up Bitcoin breaks $31k because it continues to shake off current slumps appeared first on CryptoSlate.