Bitcoin ETFs have left XRP short of inflow – here’s how

- SEC’s ETF approval ensured that curiosity shifted to BTC at XRP’s expense.

- XRP’s quantity had its interval of improve however it wasn’t in a position to match BTC.

Final week, Bitcoin [BTC] made headlines after the U.S. SEC accredited the primary leveraged Alternate-Traded Funds (ETF). The growth captured the eye of buyers, which led to the king coin’s dominance in general digital asset influx.

Sensible or not, right here’s XRP’s market cap in BTC’s phrases

BTC will get the main focus; XRP stumbles

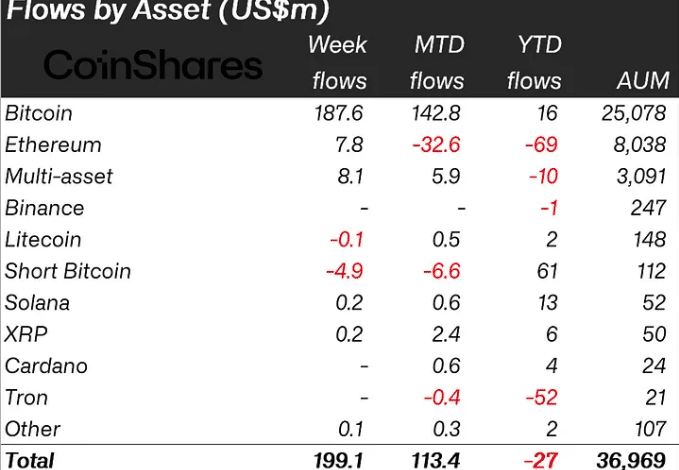

In keeping with CoinShares’ fund flow report, funding merchandise reached their highest since July 2022 over the earlier week. This amounted to $199 million, with Bitcoin accounting for $187 million of it.

For context, the weekly publication covers the funding inflows and outflows of mutual funds and Alternate Traded Merchandise (ETPs).

So, the surge in Bitcoin’s share implies that buyers’ confidence was excessive.

CoinShares acknowledged,

“We consider this renewed constructive sentiment is because of current bulletins from excessive profile ETP issuers which have filed for bodily backed ETFs with the US Securities & Alternate Fee.”

Not like BTC, Ripple [XRP] was one asset that was starved of liquid enter. Primarily based on the report, XRP’s influx accounted for $240,000, a lot lower than Ethereum [ETH] and Solana [SOL].

Supply: CoinShares

In some unspecified time in the future, XRP had a stronghold on inflows. However the current drop in enthusiasm, as per its case with the SEC, has affected the token’s momentum.

Though different altcoins didn’t fare too impressively, solely Tron [TRX] and Cardano [ADA] fell in need of XRP’s efficiency. In regards to the matter, CoinShares talked about,

“This flip in sentiment didn’t trickle right down to altcoins with solely very minor inflows into XRP and Solana totaling US$0.24m and US$0.17m respectively.”

Who wins the quantity and value race?

There was, nevertheless, a noteworthy prevalence with BTC and XRP throughout the identical week. On a number of events, the volume of BTC considerably elevated. The identical additionally occurred with XRP.

Nevertheless, the distinction between each metrics was not marginal. And at press time, XRP’s quantity was 815 million whereas BTC was 13.62 billion.

Supply: Santiment

Such a excessive buying and selling quantity for BTC meant there was robust shopping for stress. This demand pushed the value to trade arms above $30,000.

For XRP, the demand was not totally vital to push the worth above board. Consequently, it solely managed a slight improve within the final seven days, which has was a 1.44% fall.

Is your portfolio inexperienced? Examine the Ripple Revenue Calculator

To finish, the introduction of Bitcoin-leveraged ETFs has certainly had an impression on the influx of funds into XRP.

Subsequently, some buyers who might need beforehand allotted funds to XRP could now be directing their investments towards Bitcoin ETFs as an alternative. This would possibly stay the case until some notable growth adjustments with XRP.