ETH derivatives demand suggests this about its performance in Q3 and Q4

- Ethereum demand within the derivatives phase outweighed spot demand in June.

- ETH’s funding price additionally witnessed an increase, particularly within the final week of June.

Current knowledge analyzing the state of demand for crypto reveals that the derivatives phase grew considerably in June. Ethereum [ETH] was among the many cryptocurrencies which were tapping into that demand.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

June turned out to be fairly an attention-grabbing month not just for ETH however the crypto market on the whole. It is because there was a big surge in demand through the month.

In keeping with a recent CCData report, each spot and derivatives demand on centralized exchanges surged by 14.2% to $2.71 trillion. The derivatives phase contributed most of that demand at $2.13 trillion which is equal to a 13.7% upside.

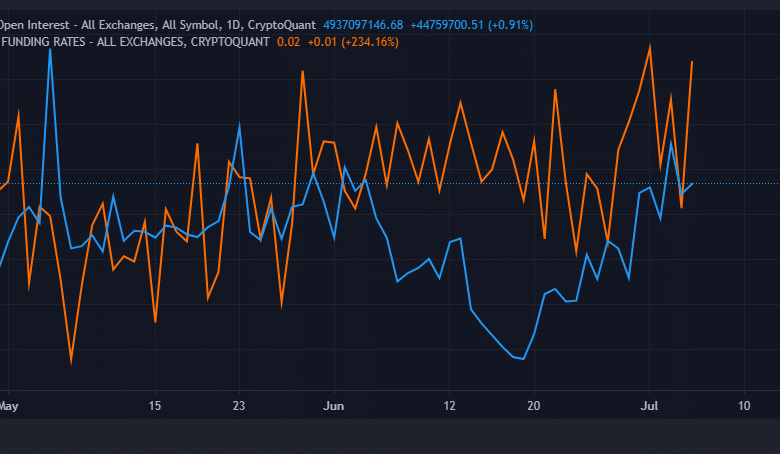

ETH was one of many cryptocurrencies that benefited from the surge in derivatives demand. For perspective, this was mirrored in its open curiosity metric which registered a big upside from its lowest level within the final 2 months (in Could). It lately peaked at a brand new excessive in the beginning of July, confirming sturdy exercise within the derivatives market.

Supply: CryptoQuant

Ethereum’s funding price has additionally been on the rise, particularly within the final week of June. This additional confirmed the inflow of liquidity into ETH derivatives. However why has derivatives demand been greater than spot demand? Maybe one of many causes was the benefit of investing within the derivatives phase. However one of many main causes is also that it gives leverage alternatives.

Is the prevailing leverage sufficient for a considerable impression?

The extent of confidence out there tends to impression the demand for leverage. As such, the final week of June attracted a surge within the demand for leverage as many merchants anticipated greater costs.

Supply: CryptoQuant

Increased leverage usually confirms some directional confidence out there. Nonetheless, it additionally lends the underlying asset to potential liquidations which can set off a pivot.

ETH’s newest upside didn’t rally again above the $2,000 value vary regardless of an try. It exchanged palms at $1,913 at press time. Moreover, the extent of liquidations surged barely within the final two days.

Supply: coinglass

What number of are 1,10,100 ETHs price at the moment

ETH lengthy liquidations peaked at $8.44 million within the final 24 hours in comparison with $522,000 quick liquidations. Nonetheless, these liquidations are too low to have an effect on the worth.

However, the noticed development in derivatives demand and urge for food for leverage is already a wholesome signal. It means that the market restoration that was seen within the first half of 2023 may proceed into the second half of the 12 months.