How Bitcoin [BTC] holders are proving to be in for the long haul

- The Bitcoin stability held on alternate addresses hit the bottom in additional than 5 years.

- The relative quiet available in the market means that many buyers have determined to carry for the long run.

Virtually 2000 days after the final lowest alternate stability, Bitcoin [BTC] alternate addresses have recorded a brand new low within the metric. In response to Glassnode, the Bitcoin stability held by alternate addresses reached 2.26 million.

The #Bitcoin Stability held on Alternate addresses continues to hemorrhage, falling to a price of two.26M BTC, the bottom stability held since Mar-14-2018 (1939 days in the past). pic.twitter.com/pZp6G3t8N0

— glassnode (@glassnode) July 5, 2023

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

An incidence like this implies that many holders weren’t prepared to promote BTC but regardless of the optimistic yields registered not too long ago. For sure, during the last 30 days, the king coin’s worth has elevated by 19.90%.

Whereas gentle profit-taking has led to a fall beneath $31,000, most holders didn’t see the rationale to ship into exchanges in a bid to promote.

Out to see it to the top

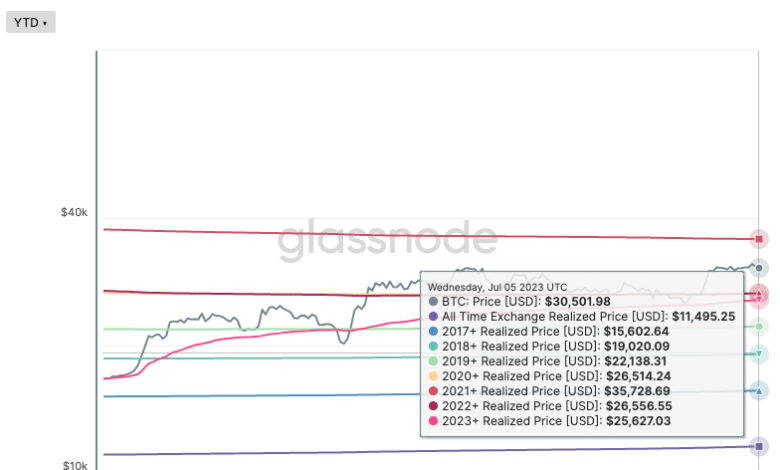

On trying on the alternate withdrawal price per 12 months, the on-chain analytic platform confirmed that BTC’s realized worth was $25,627. This implied that holders have been making strikes to carry Bitcoin in self-custody for the reason that aforementioned worth on a Yr-To-Date (YTD) foundation.

Supply: Glassnode

In the meantime, Bitcoin’s social dominance elevated considerably from the autumn on 5 July. This metric usually measures discussions round an asset in comparison with others within the prime 100.

The social dominance shine implied that Bitcoin may overcome upcoming influences from the macroeconomic sector. And this might flip right into a rebound season particularly because the broader crypto neighborhood considers it worthy to converse about.

Likewise, Bitcoin’s weighted sentiment moved a bit higher. In response to Santiment, the weighted sentiment was -0.928. The metric takes into consideration distinctive social commentary about an asset.

No plan to leap ship?

When it will increase or jumps into the optimistic area, it means that the common notion is optimistic. However when it falls, it signifies that market contributors should not elated by an asset’s efficiency.

Thus, BTC’s weighted sentiment means there was an enchancment from the pessimistic nature of the earlier month.

Supply: Santiment

Maybe, additionally it is essential to assess holders’ habits utilizing the Spent Coins Age Bands. The Spent Cash Age Bands classify spent cash primarily based on the heatmap available in the market. That is visually represented by uptrends and downtrends relative to the full quantity of cash moved.

Sensible or not right here’s BTC’s market cap in ETH phrases

At press time, Santiment confirmed Bitcoin’s Spent Cash Age Bands have been oscillating at increased highs and decrease lows. When the metric is at a excessive level, it means that there’s a lot of buying and selling exercise happening available in the market.

Supply: Santiment

Nonetheless, on the time of writing, the Spent Cash Age Bands have been right down to 17,300. This signified a drop in shopping for and promoting and buyers could also be holding on to their cash for the long run.