Bitcoin ETFs: Institutions refuse to give up

- The CBOE had amended its ETF proposal as institutional curiosity in BTC remained on the rise.

- BTC costs remained stagnant, whilst the general variety of holders surged.

The SEC’s refusal to approve Bitcoin [BTC] ETFs hasn’t slowed down institutional curiosity within the slightest. Not too long ago, the Chicago Board Choices Trade (CBOE), one of many largest U.S. primarily based choices exchanges, made amendments to its Spot ETF proposal.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Received’t take no for a solution

On 11 July, the CBOE submitted amendments for all five of its Bitcoin ETF functions. One notable alteration concerned the language pertaining to CBOE’s Safety Sharing Settlement (SSA) with Coinbase. Particularly, the earlier assertion “anticipating to enter” has been revised to “reached an settlement on phrases.”

This indicated that many establishments other than BlackRock and Knowledge Tree have additionally been competing to get their proposals authorized. These establishments are concurrently making amendments to their proposals to fast-track approval and acquire a first-mover benefit.

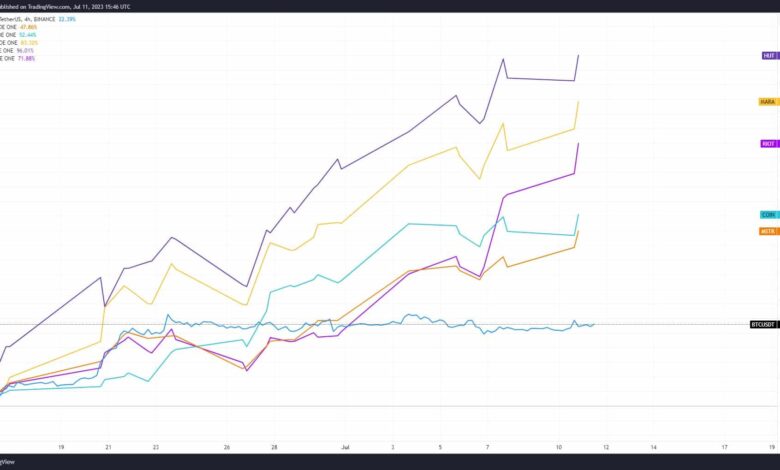

One other indicator of institutional curiosity in Bitcoin could be the Bitcoin-related fairness’s efficiency in opposition to BTC.

Bitcoin associated fairness outperformance vs BTC is a sign of huge fairness funds putting excessive expectations on $BTC ETF approval

These guys have seen dozens of ETFs authorized throughout their careers

Appears as if crypto natives are underpricing approval chance and timeline pic.twitter.com/JpXfpn2De9

— Andrew Kang (@Rewkang) July 11, 2023

Supply: Buying and selling View

If these establishments get approval from the SEC, it might trigger a surge in bullish sentiment in the direction of BTC and it might assist the king coin break previous the $30,000-$31,000 ranges.

What are HODLers as much as?

At press time, BTC was buying and selling at $30,704. The amount of BTC being traded had fallen in the previous few weeks together with BTC’s velocity, signifying that BTC wasn’t being traded as incessantly as earlier than.

Moreover, the MVRV ratio remained excessive, suggesting that almost all addresses have been worthwhile on the time of writing.

Supply: Santiment

Regardless of the excessive profitability, it appeared that almost all BTC holders have been right here to remain. In accordance with Glassnode’s information, at press time, roughly 30% of Bitcoin’s provide was being held for 5 years or longer.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Particularly, 14.8% of the provision has been held for over 10 years, 5.6% for a length between seven and 10 years, and eight.7% for 5 to seven years.

Supply: Glassnode

Solely time will inform how these components will affect Bitcoin sooner or later.