Bitcoin: Hodlers defy market trends as BTC accumulation persists

- BTC accumulation has continued with over 27,000 per thirty days.

- BTC value was on an uptrend, however MACD confirmed a bearish divergence.

Current information revealed that regardless of Bitcoin [BTC] reaching its present value, the passion for accumulating it has remained sturdy. Furthermore, because the variety of cash being amassed continued to develop, there was a noticeable lower in distributions. This indicated a big surge in hodling habits.

Learn Bitcoin (BTC) Value Prediction 2023-24

Bitcoin accumulation persists

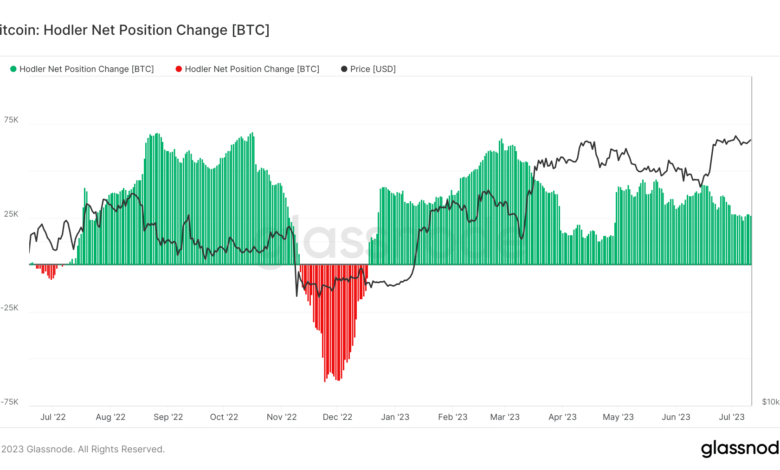

Glassnode’s analysis of the Bitcoin Hodler Web Place Change clearly confirmed holders partaking in a vigorous accumulation spree. Analyzing the chart, it grew to become evident that by the tip of December, the distribution of BTC got here to a halt, and accumulation took priority.

This accumulation development grew stronger round February, albeit with a subsequent decline. Nevertheless, even within the face of this decline, one factor remained simple: accumulation continued.

Supply: Glassnode

As of this writing, holders are firmly entrenched in an accumulation regime, steadfastly absorbing a powerful month-to-month charge of over 27,000 BTC. The chart additionally revealed that holders have amassed throughout varied value ranges, defying market developments. This habits has continued, whilst Bitcoin experiences an upward trajectory, additional highlighting the unwavering dedication of holders to build up this digital asset.

2-year final energetic BTC ramps up

Glassnode’s evaluation revealed {that a} rising portion of Bitcoin provide is inactive, indicating a notable lack of on-chain motion. The provision final energetic chart, which displays BTC that have been final energetic between one 12 months and 5 years in the past, demonstrated an growing variety of cash becoming a member of this class.

Supply: Glassnode

Notably, the over-two-year final energetic chart exhibited a extra substantial addition of cash. As of this writing, this particular chart accounted for over 55.6% of the availability, highlighting a transparent and chronic development. The one age band surpassing this share was the one-year-plus chart. It sat at over 69%, indicating the next focus of long-inactive cash.

Provide in revenue overshadows provide in loss

The continued value development appeared to be favoring nearly all of holders, as indicated by the availability in revenue chart. As of this, out of the roughly 19 million BTC in circulation, with a complete provide cap of 20 million, over 15 million have been at the moment yielding income, whereas round 4 million remained in a state of loss. Notably, the chart highlighted that the upward trajectory in revenue started in January.

Supply: Glassnode

It’s price noting that the availability in revenue and loss are inversely correlated, as every Bitcoin should fall into certainly one of these classes.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

These provide areas are topic to alter as spot costs fluctuate, surpassing or dropping beneath the worth stamp related to every Unspent Transaction Output (UTXO) within the UTXO set.

As of this writing, Bitcoin (BTC) was buying and selling at roughly $30,800, exhibiting a marginal each day enhance of lower than 1%. Whereas the worth chart displayed an total upward development, the Shifting Common Convergence Divergence (MACD) indicated a bearish divergence on the time of commentary.