Signal With Perfect Track Record Predicts Bitcoin Bull Market Parabola: Analyst

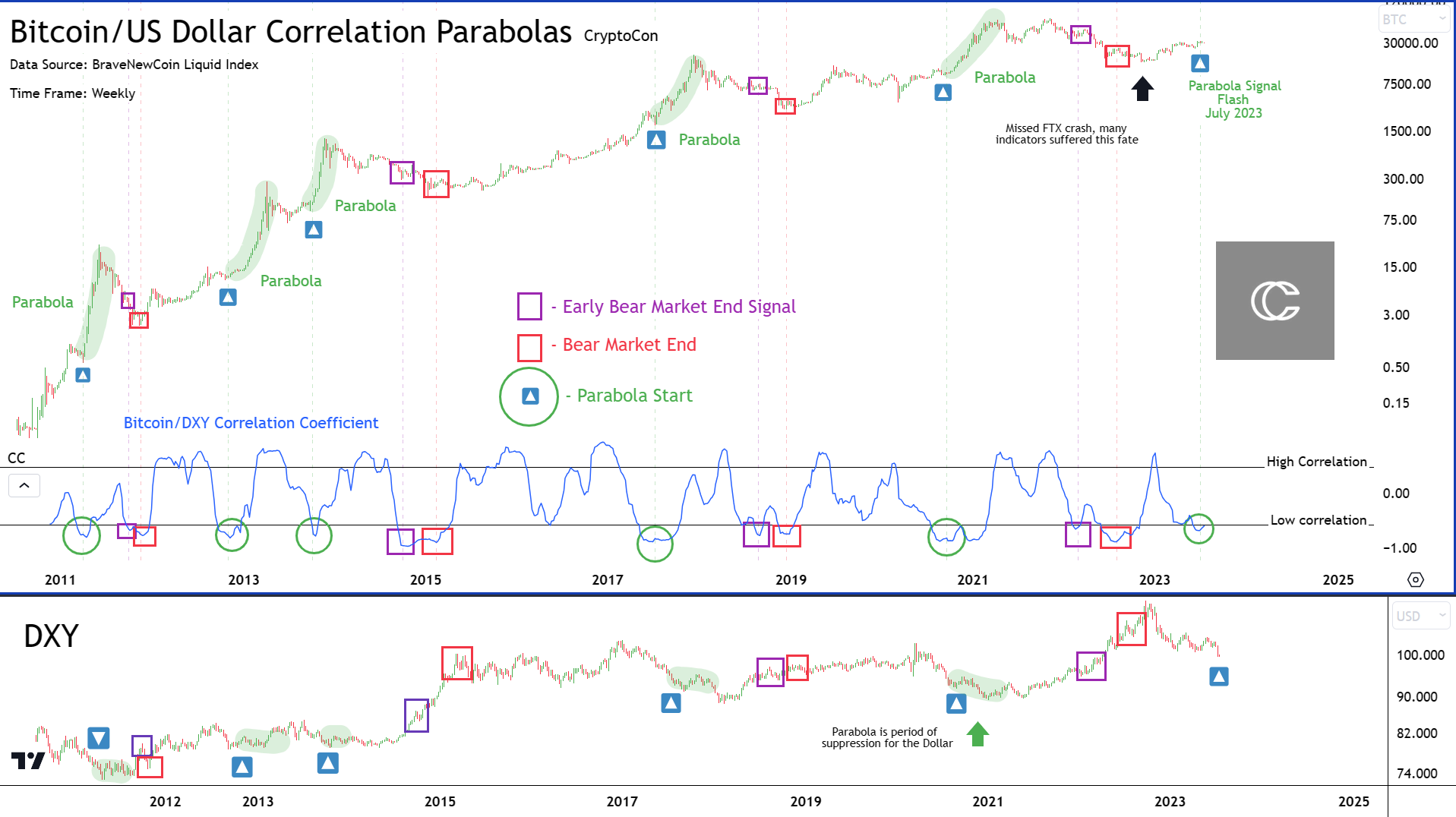

In a latest newsletter by famend analyst CryptoCon, a groundbreaking indicator referred to as the “Bitcoin DXY correlation coefficient” has captured the eye of the group. This indicator, which measures the correlation between Bitcoin and the U.S. Greenback Index (DXY), has proven exceptional accuracy in predicting Bitcoin’s value actions and signaling the start of bull market parabolas.

In accordance with CryptoCon, the Bitcoin DXY correlation coefficient is “one of the attention-grabbing finds” he has come throughout in fairly a while. In his e-newsletter, he explains the importance of this indicator and its implications for the way forward for Bitcoin’s value trajectory.

Bitcoin At Onset Of A Bull Market Parabola?

The analyst highlights the three distinct phases that the correlation coefficient enters throughout a market cycle. He states, “Throughout a given market cycle, the correlation coefficient enters this zone in 3 phases.” These phases are represented by totally different colours:

- PURPLE: The primary transfer into the low correlation zone, which happens barely earlier than the bear market backside.

- RED: The second transfer into the low correlation zone, marking the tip of the bear market or the underside of the cycle.

- GREEN: After a while, the metric returns to the low correlation zone, signaling the beginning of the true bull market parabola.

CryptoCon emphasizes the importance of those findings, stating, “And…there aren’t any false alerts when seen on this manner, extraordinarily attention-grabbing! I’ve reviewed another observations that allude to this, however to not this degree of preciseness and caliber.”

Moreover, the analyst brings consideration to the affect of the U.S. greenback on Bitcoin’s parabola. He explains, “And that is from an outdoor issue, the Greenback. That means that the power of the US greenback has nice affect on when Bitcoin parabola takes place.” This correlation provides a further layer of complexity and highlights the interaction between these two market forces.

Drawing comparisons to the 2013 cycle, the analyst speculates on the potential future trajectory of Bitcoin. He means that the upcoming market cycle might resemble a two-curve sample. CryptoCon states:

I consider this might look one thing like a 2013 cycle. If we’re certainly anticipating an early highly effective bull transfer, this might come within the type of two curves.

He additional elaborates on the timeframes for these curves, stating, “The primary comes early and would in all probability finish someday in 2024. The second comes later and ends late 2025 in response to my Nov twenty eighth Cycles Idea.”

The analyst additionally shared his value projections for the upcoming bull market parabola. He states, “As for the worth goal of this parabola, I’ll communicate to the primary one. Personally, I might count on it to return simply over or wanting ATHs. The secondary later prime at 90-130k which is my private vary and projection for the cycle.”

Concluding the e-newsletter, he emphasizes the potential alternative that lies forward for Bitcoin buyers. He states, “So whatever the brief time period, huge issues are on the horizon for Bitcoin in response to information. And perhaps… simply perhaps… you may not must be as affected person as you count on for it.”

At press time, Bitcoin traded at $30,016.