Bitcoin: Institutional investors find new opportunity in BTC accumulation

- Bitcoin belief premiums begin to rise indicating institutional curiosity.

- Miner revenues proceed to fall, which might result in potential promoting stress.

On the time of writing, Bitcoin[BTC]’s value had been persistently hovering across the $30,000 mark. Nevertheless, the latest curiosity displayed by establishments in BTC could doubtlessly exert a optimistic affect on its value trajectory.

Establishments present curiosity in BTC

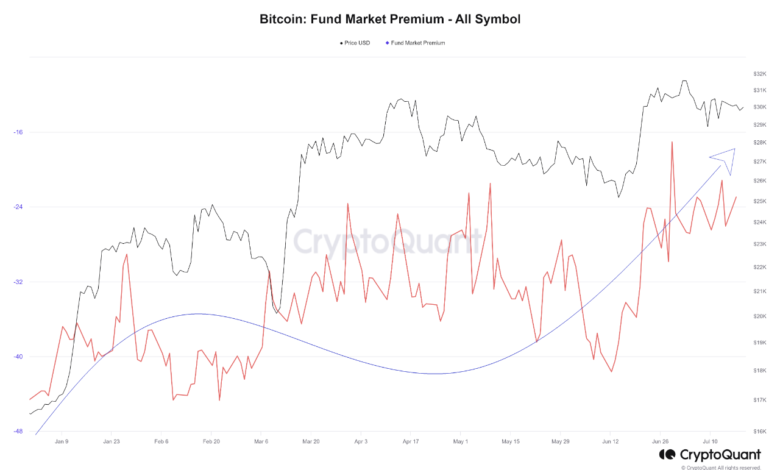

In line with latest information by Woominkyu from CryptoQuant, institutional buyers’ optimism was evident from the rising premium of Bitcoin trusts. The premium represents the distinction between the market value of the belief and its Web Asset Worth (NAV), indicating the demand for the fund.

For context, a Bitcoin belief is a monetary product or funding automobile that permits buyers to realize publicity to Bitcoin’s value actions with out straight proudly owning the cryptocurrency

From January 2023 till the time of writing, the premium of the Bitcoin belief persistently grew, signifying rising investor eagerness to buy the fund, which in flip displays a optimistic outlook on Bitcoin. Because the premium rose, the hole between the belief’s market value and the precise market value of Bitcoin narrowed down, additional indicating the rising positivity amongst buyers in direction of Bitcoin.

Supply: Crypto Quant

Rising religion in BTC was additionally evident via the rising variety of long-term holders of the king coin. In line with information from glassnode, a considerable 55% of Bitcoin’s whole provide has remained unmoved for a minimum of two years.

Supply: glassnode

Moreover, after observing the realized PnL of BTC holders, it was seen that Bitcoin was not underneath a interval of capitulation. This indicated that the market sentiment and habits in direction of Bitcoin had shifted from excessive concern and panic promoting to a extra steady and balanced state.

Capitulation is a time period used to explain a state of affairs the place buyers quit hope and promote their property in a panic, inflicting a pointy decline in costs. The absence of capitulation suggests a possible enchancment in investor confidence and a potential turnaround in Bitcoin’s value development.

Multi-year view:

Bitcoin is not in a interval of capitulation pic.twitter.com/G6drpcZ6BQ

— Will Clemente (@WClementeIII) July 19, 2023

Miners might want to see inexperienced

Nevertheless, there could also be some promoting stress from miners that would drive down BTC’s value sooner or later. Latest information indicated that the income generated by miners declined materially over the previous couple of days. If this development continues, miners could also be pressured to promote their holdings to stay worthwhile.

Supply: Blockchain.com

At press time, Bitcoin was buying and selling at $30,200. Over the past week, the variety of addresses holding BTC had grown. Nevertheless, the rate of BTC had declined. This implied that the frequency with which BTC was being traded had fallen.

Supply: Santiment