Greed or fear? Here’s where Bitcoin traders have pitched their tent

- The merchants’ dialogue about Bitcoin was at a wholesome degree.

- Liquidity flowing into the futures market has been comparatively modest.

For the previous few weeks, Bitcoin [BTC] has been buying and selling round $30,200 and slightly beneath $29,000. With its worth in a slim vary, it isn’t uncommon to seek out BTC merchants tangled between going bullish or succumbing to the bearish aspect.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

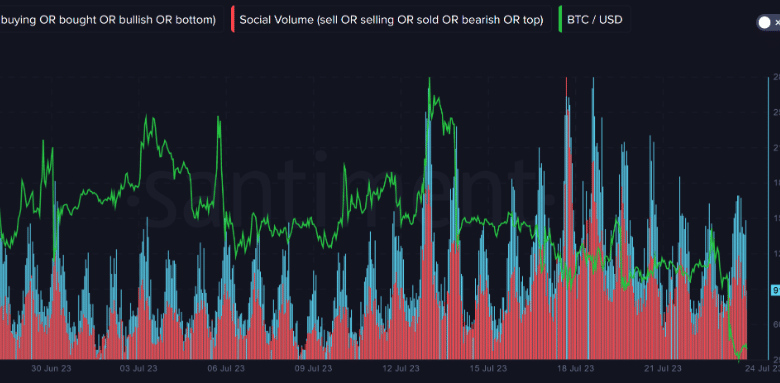

Curiously, Santiment’s 25 July analysis thought-about which flank merchants usually tend to camp. Within the on-chain evaluation put ahead by Brian Quinlivan, merchants don’t appear to be frightened about Bitcoin’s lack of the $30,000 psychological assist degree.

Bulls eyes over bears?

In line with Quinlivan, this conclusion was as a result of the social quantity was primarily based on the purchase and promote sentiment. From the evaluation, the variety of bullish calls exceeded these showing to name for the value high.

This implies the common dealer has aligned with the thought that BTC’s worth, if the tight buying and selling vary exits, would development upwards fairly than downwards.

Supply: Santiment

Moreover, Bitcoin’s social dominance was 20.58%. In line with Quinlivan, the metric implied that the speed of BTC discussions was at a wholesome degree contemplating that,

On a greater be aware, the share of dealer discussions associated to Bitcoin (in comparison with high 100 altcoins) remains to be hanging on in a area that we think about to be a “wholesome” space on our chart. Not by rather a lot, however you’ll be able to see that BTC social dominance remains to be 2.42% above the wholesome zone of debate price

Supply: Santiment

Delicate liquidity out there

When it comes to Open Interest (OI), Santiment confirmed that it has elevated. Open Curiosity is the variety of excellent futures or choices contracts on an alternate. When the Open Curiosity will increase, it implies that new cash is coming into the market.

However when it decreases, it’s a signal that the market is liquidating and extra merchants are closing their positions.

Supply: Coinglass

In Bitcoin’s case, the Open Curiosity hovered across the identical space for some time. This depicts that liquidity circulation into the market has been oscillating between a rise and a lower.

Regarding the funding price, Santiment confirmed that the metric was nonetheless optimistic. For context, funding charges are periodic funds between lengthy and short-perpetual contract positions.

Lifelike or not, right here’s BTC’s market cap in ETH phrases

A destructive funding rate implies that perpetual costs are beneath the spot worth. On this case, merchants are bearish. However when the funding price is optimistic, it implies that merchants have a bullish sentiment towards the value motion.

Supply: Santiment

In conclusion, the general sentiment towards Bitcoin tilts towards indecisiveness. For now, merchants are skeptical about going absolutely bullish or betting on a downturn.