Bitcoin whales in a predicament as prices hover near $30k: To buy or to sell?

- BTC whales have traded divergently as value oscillates inside $28,000 to $32,000 ranges.

- With a surge in BTC earnings prior to now few months, whales have more and more despatched their holdings to exchanges.

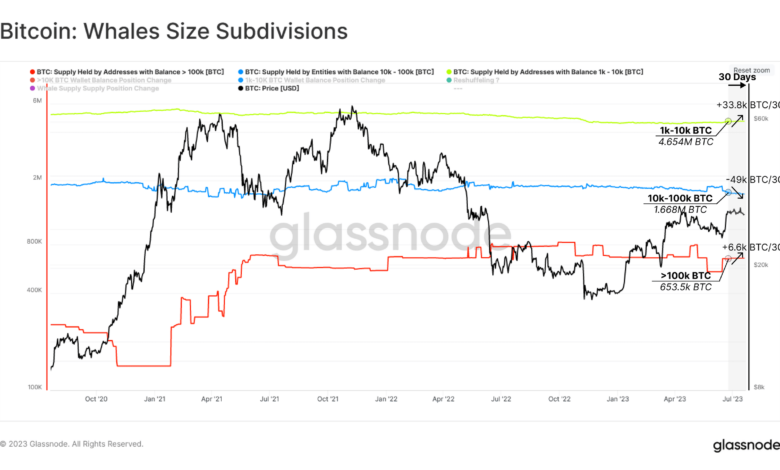

For the previous 4 months, Bitcoin [BTC] has been persistently buying and selling inside the vary of $28,000 to $32,000. Because the king coin lingers inside a slender value vary, varied cohorts of BTC whales have been making distinct buying and selling strikes, Glassnode present in its new report.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Some sowed whereas others slept

Glassnode discovered that within the final month, the totally different sub-groups of BTC whales exhibited assorted behaviors because the coin’s value confronted resistance on the $30,000 psychological value mark.

Whales that held between 1,000 to 10,000 BTC adopted a bullish method as they elevated their stability by about 33,800 BTC. Likewise, whales with over 100,000 BTC elevated their holdings by 6,600 BTC.

Nonetheless, holders of 10,000 to 100,000 BTC adopted a bearish method, decreasing their stability by 49,000 BTC. As a result of this, the interval below evaluation was marked by a “web discount of simply -8.7k BTC,” Glassnode discovered.

Supply: Glassnode

Nonetheless, whereas mixture stability change remained comparatively flat, the report famous that whale entities could be shifting funds amongst themselves on crypto exchanges as “there are vital modifications going down each internally and through change flows.”

To check its principle, Glassnode thought-about BTC’s Whale Reshuffling metric on a 30-day shifting common for 2 whale subdivisions: these with over 10,000 BTC and people with 1,000 to 10,000 BTC.

It discovered intervals of sturdy inverse correlations of -0.55 or much less, indicating cases of stability shifts between the 2 teams. These intervals coincided with the instances when BTC’s value approached the $30,000 vary.

This led Glassnode to conclude:

“This implies that whales have certainly exhibited a comparatively impartial stability change of late, with a lot of their latest exercise being reshuffling through exchanges.”

Supply: Glassnode

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

With BTC’s MVRV ratio nonetheless within the worthwhile area, all cohorts of BTC whales have despatched various quantities of their holdings to crypto exchanges for onward gross sales. Glassnode discovered that the coin’s latest rally induced whale influx volumes to surge “fairly considerably” to over 16,300 BTC day by day.

“It is a whale dominance of 41% of all change inflows, which is similar to each the LUNA crash (39%) and the failure of FTX (33%).”

Supply: Glassnode

Over the previous 5 years, whale-to-exchange web flows have typically remained round ±5,000 BTC day by day. Nonetheless, in June and July of this yr, there was a sustained enhance in whale inflows to exchanges, with a bias in the direction of inflows starting from 4,000 to six,500 BTC per day.