Why Maker might witness another price correction

- MKR failed to carry on to the $1,270-$1,300 help zone and went underneath $1,230.

- On-chain metrics and market indicators seemed bearish.

Maker [MKR] loved a cushty bull rally over the previous couple of weeks, which pushed its worth up. In actual fact, it even managed to cross $1,300 through the starting of August. Nonetheless, the momentum declined because the token as soon as once more settled underneath the $1,3000 degree.

Real looking or not, right here’s MKR market cap in BTC phrases

Just a few purple flags for Maker

Maker, which is a market chief by way of real-world belongings, shocked traders with a promising bull rally in mid-July 2023. Nonetheless, the expansion trajectory got here down over the past week as its worth moved marginally.

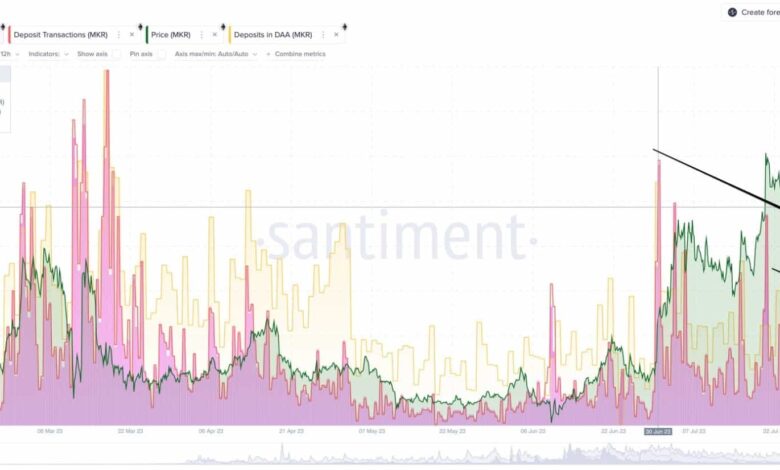

Santiment’s newest report identified fairly a couple of components that may have performed their roles in slowing down MKR’s progress.

Social dominance towards #Maker has soared as costs surged previous $1,200, and quickly, $1,300, this previous week. Our newest perception covers the newest on handle exercise, deposit transactions, and circulation to investigate if $MKR‘s breakout will proceed. https://t.co/VxTMkaun6n pic.twitter.com/nhhl7JU0Px

— Santiment (@santimentfeed) August 7, 2023

As an example, MKR’s social dominance registered a decline whereas its worth continued to rise. This confirmed that the value cycle’s peak curiosity could have been reached.

Moreover, the token’s lively addresses peaked round 21 July earlier than starting to say no. As per the report, altcoins’ 30-day MVRV Ratio often peaks at round 30–30%. In MKR’s case, the metric reached 36%, suggesting a attainable market peak.

Not solely that, however when MKR’s worth was rising in June, its deposits on CEXs and DEXs dropped. Comparable patterns on the chart could emerge because of a worth improve blended with a lower within the urge to promote. This additionally meant that MKR would possibly witness a worth correction.

Supply: Santiment

Maker is struggling to go above $1,300

MKR failed to carry on to the $1,270-$1,300 help zone, which confirmed bearish intent. CoinMarketCap’s data revealed that Maker’s worth motion turned sluggish, because it solely moved marginally over the past week.

At press time, it was buying and selling at $1,222.54 with a market capitalization of over $1.1 billion. A take a look at MKR’s on-chain metrics instructed that the token might witness one other worth correction.

Its internet deposits on exchanges had been high in comparison with the 7-day common, suggesting that it was underneath promoting stress. MKR’s provide on exchanges rose sharply final week, which was a bearish sign.

Moreover, Maker’s open curiosity plummeted, suggesting that derivatives traders weren’t shopping for the token.

Supply: Santiment

How a lot are 1,10,100 MKRs value right now

Maker’s MACD displayed a bearish higher hand out there. On high of that, the Chaikin Cash Stream registered a downward pattern and went under the impartial mark, growing the possibilities of a worth decline.

Nonetheless, MKR’s Exponential Transferring Common (EMA) Ribbon continued to be within the bulls’ favor.

Supply: TradingView