Bitcoin crosses $30k yet again – short sellers feel the burn

- Bitcoin’s latest surge above $30,000, challenged brief positions.

- Open Curiosity rose together with MVRV ratio.

The cryptocurrency enviornment has been a battleground of sentiment, with Bitcoin [BTC] experiencing a dip beneath the essential $30,000 benchmark over the past month. This shift in market dynamics prompted skepticism and triggered a wave of brief positions in opposition to the king coin.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

In a latest flip of occasions, Bitcoin’s value rallied, surpassing the $30,000 threshold inside the previous 24 hours, subsequently present process a correction. Merchants who had positioned themselves for upward motion capitalized on the surge, resulting in profit-taking.

The influential function of whales within the crypto panorama got here to the forefront as important lengthy positions have been initiated on the $29,000 degree. The strategic transfer underscored the whales’ anticipation of potential value positive factors and demonstrated their influence on market sentiment.

#Bitcoin whales opened giga lengthy positions at $29k.https://t.co/WulPUE47ab https://t.co/GNmIiRJ7EJ pic.twitter.com/CbJsn06plF

— Ki Younger Ju (@ki_young_ju) August 8, 2023

Quick sellers really feel the warmth

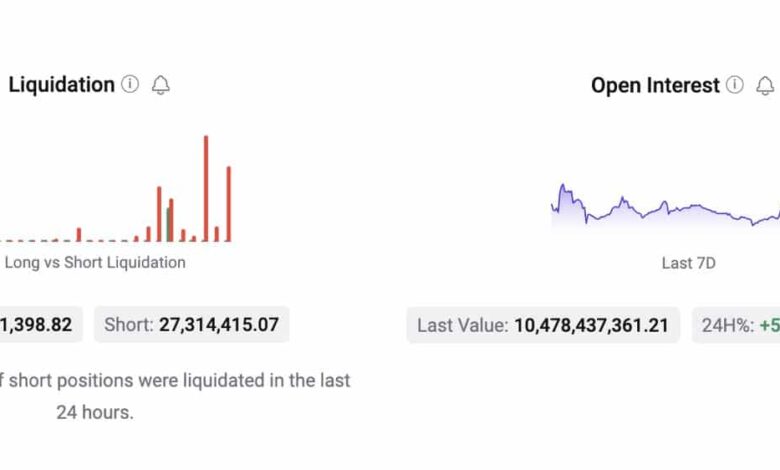

As Bitcoin exhibited an sudden resurgence, brief sellers discovered themselves in a difficult predicament. Over the previous 24 hours, the crypto market has witnessed a staggering $27 million price of brief positions being liquidated.

The substantial liquidations might set the stage for a compelling narrative of a brief squeeze, the place the unwinding of brief positions might gas a fast surge in Bitcoin’s value.

Supply: Crypto Quant

Revenue taking over the rise

Moreover, a big surge in open curiosity, amounting to $616 million, unfolded inside the identical 24-hour window. This surge in open curiosity can amplify market volatility as properly. Together with the surge in Open Curiosity, there was a surge within the MVRV ratio as properly.

The rising MVRV ratio prompt that almost all Bitcoin addresses have been turning worthwhile. This might incentivize holders to promote their holdings and interact in profit-taking, which might influence BTC’s value.

Supply: Santiment

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

A nuanced shift within the put-to-call ratio added one other layer of complexity. With a drop from 0.45 to 0.43 previously week, this ratio illuminated optimistic evolving investor sentiment in direction of BTC and potential hedging methods that might affect Bitcoin’s near-term path.

Supply: TheBlock

Moreover, the declining Implied Volatility signified diminishing anticipation of great value fluctuations. Whereas this might create a way of stability, it additionally hinted at a possible discount in revenue alternatives for merchants who thrive in risky situations.

Supply: TheBlock