Ethereum: What the top holders’ wallets tell you about ETH’s future

- The highest 10 ETH holders have a mixed steadiness of $51.6 billion.

- Lengthy-term holders are dedicated to not promoting.

5 years in the past, the highest 10 Ethereum [ETH] alternate and non-exchange addresses owned about 11.2% of the entire provide. However now, the highest holders have prolonged their attain within the distribution of the altcoin king, Santiment revealed.

Learn Ethereum’s [ETH] Worth Prediction 2023-2023

Getting ready the desk within the presence of doubts

In accordance with Santiment, the highest 10 addresses now account for 34.6% of the entire ETH provide. These cash are valued at $51.6 billion, representing 27.86 million ETH.

#Ethereum has been seeing its prime 10 addresses increase and accumulate increasingly of the entire out there coin provide. In 5 years, the highest 10 largest addresses have gone from proudly owning 11.2% to now 34.6% of $ETH. The 27.86M $ETH added is price $51.6B.

https://t.co/utI8W6DkRX pic.twitter.com/klgb7pus7K

— Santiment (@santimentfeed) August 9, 2023

As of March 2022, the on-chain analytic platform reported that the cohort holding elevated by 4.3% from 2021. This enhance ensured that the availability jumped to 23.7%.

So, the staggering bounce this 12 months implies that whales’ conviction that ETH could be largely worthwhile within the close to time period could have elevated. However was it the identical case with the retail brigade?

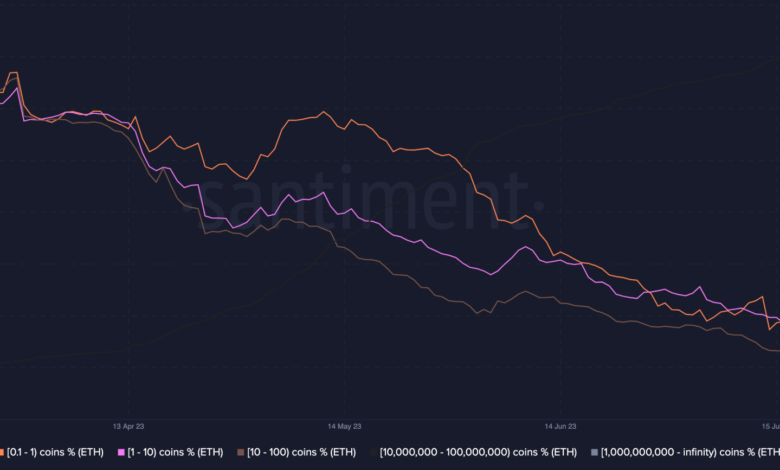

Nicely, Santiment’s information showed that the scenario was not the identical. Primarily based on the data accessed at press time, the steadiness of addresses holding between 0.1 and 100 cash has been reducing.

Though the entire provide grabbed by this cohort didn’t sum as much as 10%, the autumn in steadiness suggests that the majority retail holders have been promoting a notable a part of their holdings.

Supply: Santiment

The disparity in accumulation between whales and retail additionally implies that the sentiment towards the long-term worth diverged.

Nonetheless not eliminating ETH

Nonetheless, the holding dominance by whales doesn’t infer that ETH may not face a lower within the quick time period. This was as a result of the open curiosity in exchanges was at a significantly excessive stage.

Open curiosity retains monitor of each open place in a specific contract relatively than monitoring the entire quantity traded.

Excessive open curiosity often indicates a rise in liquidity for a contract. This typically means that there’s solely a slight discrepancy between the market value and the worth set on the contract. Therefore, open lengthy and quick positions might be substantial.

Moreover, the realized market cap HODL waves had been all the way down to 1.307. Much like the common HODL waves, the realized Cap HODL waves chart exhibits how an asset’s provide is distributed throughout varied coin age bands.

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

One may clarify the metric as a measure of the mixed USD values of all cash after they had been transferred to or bought by a brand new proprietor from a earlier one.

Supply: Santiment

Subsequently, the lower in ETH’s realized cap HODL waves implies that almost all of the coin house owners should not prone to promote. Thus, many could proceed holding for a very long time.