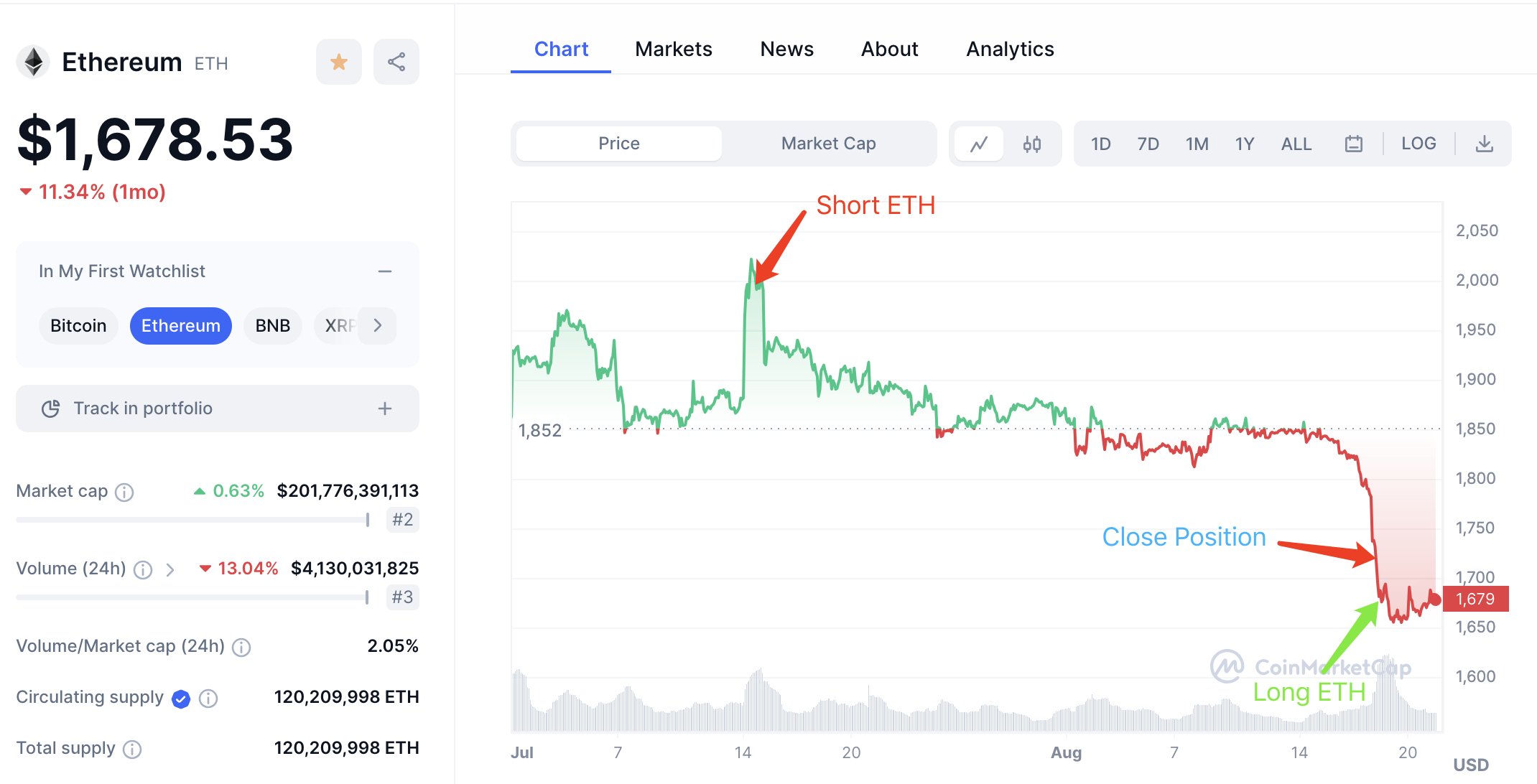

GMX Trader Makes Over $1 Million Shorting and Then Longing Ethereum During Crypto Market Crash: On-Chain Data

Blockchain tracker Lookonchain finds {that a} dealer utilizing the decentralized trade (DEX) GMX made greater than $1 million by precisely predicting Ethereum’s (ETH) value motion over the previous a number of weeks.

Lookonchain notes the dealer shorted ETH on July 14th, when it was buying and selling close to a latest excessive at round $2,000, after which the dealer closed the place after the market crashed final Thursday, making almost $1 million.

The dealer subsequently went lengthy on Ethereum with an entry value of $1,624 and is making a $145,721 revenue on that place at time of writing.

ETH is buying and selling at $1,667 at time of writing. The second-ranked crypto asset by market cap is down 0.75% previously 24 hours and greater than 9.6% previously seven days.

GMX focuses on perpetual futures and goals to offer low swap charges and low-price influence trades, in accordance with the undertaking’s website.

The DEX is at present stay on the Ethereum scaling resolution Arbitrum (ARB) and the sensible contract platform Avalanche (AVAX).

Not all GMX merchants had been as profitable because the one talked about above, in accordance with Lookonchain. A special dealer went long on Bitcoin (BTC) earlier than the market crashed final week and had lost round $1.07 million at time of writing. Information from GMX reveals that the dealer remains to be holding the underwater place.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney