Apecoin breaks below crucial price level – time for a free fall?

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- Apecoin hit new lows as promoting strain intensified.

- Patrons may spring a shock primarily based on short-term accumulation development.

Apecoin [APE] hit a brand new low of $1.49 because the gaming token’s value continued its swift descent. Regardless of the most effective efforts of bulls to prop up the value from the $1.72 help stage in early August, APE in the end caved to the general bearish sentiment available in the market.

Life like or not, right here’s APE’s market cap in BTC’s phrases

A 33% value decline between 15 August and 17 August noticed bears smash the $1.72 help, leaving APE uncovered to a value free-fall which may lead it again to the depths of $1—a far cry from its mega heights of $23 in April 2022.

Bulls don’t have any combat left in them

Supply: APE/USDT on Buying and selling View

The sustained promoting strain on APE has curtailed bullish efforts at a value reversal. With patrons shedding one help stage after one other, bears have reigned supreme since April 2023.

Whereas the decrease timeframe (4H) value motion confirmed a number of sideways value motion, the upper timeframe (day by day) value motion confirmed that Apecoin’s continued implosion may see it hit $1 within the coming days/weeks.

The collection of decrease highs and decrease lows on the downtrend signaled that Apecoin is more likely to retest the brand new resistance at $1.72 earlier than persevering with its free fall.

Any hopes of a value reversal will likely be extremely dependent available on the market sentiment shifting bullish, particularly if Bitcoin [BTC] can reclaim the $28 – $30k value zone in the long run.

In any other case, Apecoin holders can anticipate a continuation of this free fall with no backside in sight. The Relative Energy Index’s (RSI) latest try at a reversal was met with a swift return to the oversold zone, highlighting the promoting strain.

Equally, the drop in curiosity for APE noticed the On Stability Quantity (OBV) register a 70 million decline in buying and selling quantity over the previous week.

May long-term holders be as much as a shock transfer?

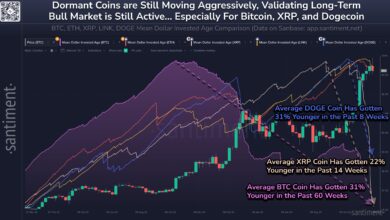

Supply: Santiment

Information from Santiment highlighted a stunning metric. The Market Worth to Realized Worth (MVRV) ratio for month-to-month (30d) and quarterly (90d) holders of Apecoin confirmed extreme losses of -15.90 and -25.49% respectively.

How a lot are 1,10,100 APEs value as we speak?

Nevertheless, the 90d imply coin age has been on the rise since 17 August, hinting at an accumulation of APE at cheaper costs by long-term holders in anticipation of a sustained value rebound.

This glimmer of hope advised a possible change in value dynamics if total market circumstances enhance.