Accumulation Surge Paves The Way For Imminent Price Blast

After a extremely anticipated partial victory for Ripple Labs and XRP traders, the fifth-largest cryptocurrency has succumbed to the general market downward pattern, dampening the thrill following its July 13 triumph in opposition to the US Securities and Change Fee. Over the previous 30 days, XRP has retraced by greater than 26%.

Regardless of experiencing important value fluctuations since its 16% drop on August 16, the token has recovered 4% of these losses inside the previous seven days. Because the market approaches the month-to-month shut and witnesses liquidity re-entering, there’s a rising chance that XRP will proceed its upward pattern.

Potential Value Explosion For XRP Following Prolonged Accumulation Section

In cryptocurrency, few phenomena captivate traders and merchants greater than anticipating a value explosion fueled by a chronic accumulation part.

Such is the case for XRP, which reveals a setup that mirrors earlier patterns that led to important value surges.

Crypto analyst and dealer, identified by the pseudonym “Crypto Bull,” has caught the eye of market individuals with its daring prediction that XRP might be getting ready to a serious upward rally.

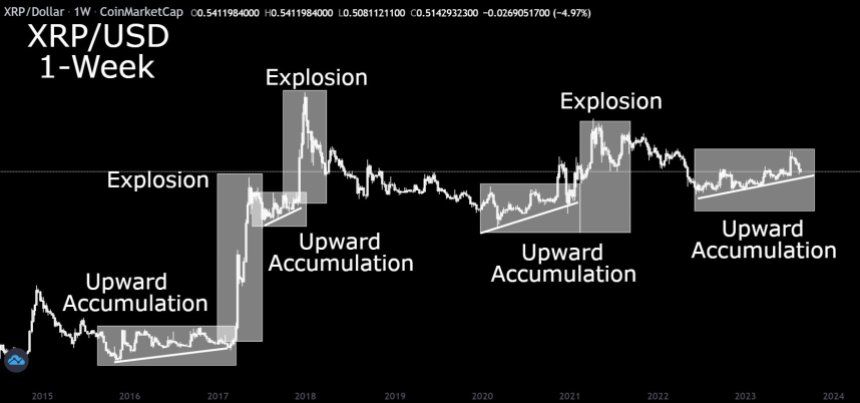

In response to Crypto Bull, historic information reveals a recurring sample for XRP, the place explosive value actions have persistently adopted prolonged intervals of upward accumulation.

Crypto Bull’s evaluation means that XRP is at present in its longest accumulation part in historical past, additional strengthening the potential for a major value surge.

Analyzing the weekly chart offered by Crypto Bull, it turns into evident that XRP has beforehand undergone notable value explosions in 2020 and 2021, making this its third accumulation part.

XRP’s Bullish Momentum

Throughout the first uptrend in 2020, XRP surged by a formidable 220%, beginning beneath the $0.250 stage and reaching a excessive of $0.774 in November. Following a typical value correction, XRP launched into one other upward pattern merely months later, in February 2021, aiming to surpass its earlier all-time excessive.

In April 2021, XRP skilled a exceptional bull run, aligning with the general market pattern, and skyrocketed from $0.540 to its present all-time excessive of $1.946. Subsequently, the token tried to retest this pinnacle however fell wanting reclaiming it.

These historic patterns in XRP’s value motion following important surges are noteworthy; nevertheless, whether or not the cryptocurrency will comply with its established trajectory or surpass its all-time excessive stays unsure.

What is for certain is that the continuing accumulation part, coupled with potential constructive developments within the US courts and rising investor pleasure, positions XRP for a potential main breakout.

Regardless of briefly surpassing its macro vary between $0.548 and $0.295 on July 13, XRP is at present inside this vary once more, presumably establishing a brand new base or awaiting the perfect situations for its subsequent uptrend.

Because the cryptocurrency ecosystem eagerly awaits additional developments, XRP’s future trajectory holds appreciable intrigue.

Whether or not it should reiterate its historic patterns or embark on an unprecedented journey stays to be seen. Nonetheless, the present accumulation part and the optimistic sentiment surrounding XRP set the stage for potential development and renewed pleasure amongst traders.

On the time of writing, XRP is traded at $0.5231, reflecting a 1.3% improve over the previous 24 hours.

Featured picture from iStock, chart from TradingView.com