Bitcoin woes continue amid waning transactions, slumping fees

- Resulting from a gradual lower in each day transactions on the Bitcoin community, community charges dropped by over 15% within the final seven days.

- With robust resistance confronted at $26,000, BTC accumulation has decreased.

The common transaction price on the Bitcoin [BTC] community dropped by greater than 15% up to now week to round $0.85 by 26 August. This represented its lowest stage since 30 July, information from IntoTheBlock revealed.

Bitcoin charges have dropped by greater than 15% this week because the variety of transactions has slowed down. pic.twitter.com/8WSdgvYRiu

— IntoTheBlock (@intotheblock) August 26, 2023

How a lot are 1,10,100 BTCs value at the moment?

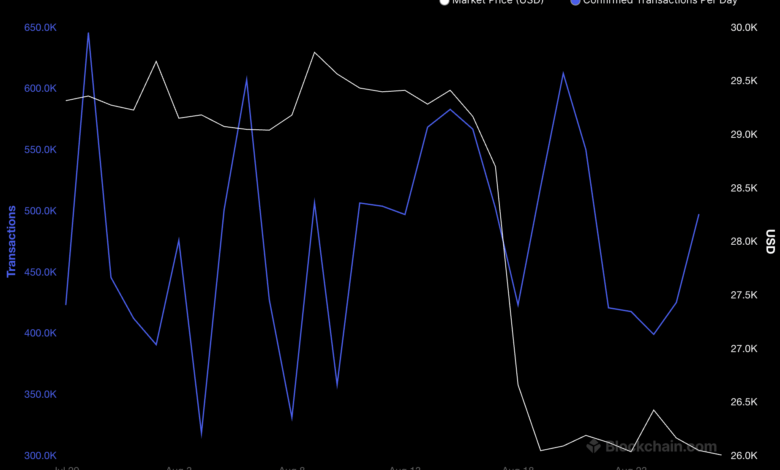

The drop in charges had been attributable to a slowdown within the variety of transactions on the community. In line with information from Blockchain.com, the depend of each day transactions on the Bitcoin community plummeted severely following the deleveraging occasion of 17 August. Throughout the 24 hours of the capital exodus, the each day transaction depend on the community had dropped by over 15%.

As of 26 August, the variety of each day confirmed transactions on the Bitcoin community totaled 497,513.

Supply: Blockchain.com

The coin’s worth continues to stagnate at $26,000

At press time, the value per BTC was $26,026, in line with information from CoinMarketCap. After exchanging arms briefly above $26,500 on 23 August, the main coin’s worth corrected and has since traded below $26,100.

The emergence of a brand new bear cycle on 16 August, a day earlier than the deleveraging within the coin’s futures markets, has brought on BTC to face additional resistance on the $26,000 worth stage. As optimistic sentiment stays overwhelmed down, accumulation momentum amongst each day merchants has fallen.

With the bear cycle nonetheless underway at press time, BTC’s MACD line remained positioned beneath its development line.

Highlighting the energy of BTC sellers within the present cycle, the coin’s Directional Motion Index (DMI) confirmed that BTC bears had management of the market on a each day chart. As of this writing, the optimistic directional index (inexperienced) at 13.16 rested under the unfavourable directional index (inexperienced) at 29.27.

Furthermore, the Common Directional Index (ADX) was 31.64. An ADX studying above 25 signifies that the development is powerful. This typically alerts that the value is transferring in a transparent path and is more likely to proceed to maneuver in that path.

Practical or not, right here’s BTC’s market cap in ETH phrases

On this case, the BTC sellers have overpowered these taken with shopping for the coin, and its worth may proceed to linger under $26,500 till sentiment improves.

Because the market mulls over the coin’s subsequent worth path, accumulation has dwindled considerably. Key momentum indicators confirmed that BTC was oversold, as many take to “dumping” their baggage to stop publicity to any additional worth drops. The coin’s Relative Power Index (RSI) was 24.68, whereas its Cash Circulation Index (MFI) was 14.73.

Supply: BTC/USDT, TradingView