Ethereum: Fees and Open Interest hit record lows

- The whole charges on Ethereum fell to a six-month low on Sunday.

- ETH’s Open Curiosity additionally plummeted to its year-to-date low on 23 August.

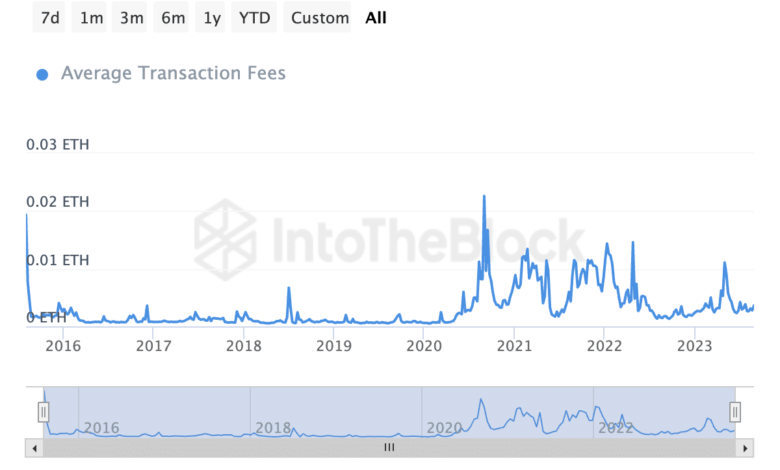

The whole each day charges paid by customers to finish transactions on Layer 1 (L1) blockchain Ethereum [ETH] fell to a six-month low of 1,719 ETH ($2.8 million) on 27 August, in accordance with information from on-chain analytics platform IntoTheBlock.

Complete each day charges on Ethereum reached a 6-month low on Sunday, registering at 1.72k $ETH. Might this be an indication of investor warning in right this moment’s market panorama?

Dive deeper into the infohttps://t.co/af9A4ahkBq pic.twitter.com/XiMapAQvx2

— IntoTheBlock (@intotheblock) August 28, 2023

Sensible or not, right here’s ETH’s market cap in BTC phrases

This represented a 97% decline from this 12 months’s whole price all-time excessive of 84,000 ETH, recorded on 1 Might. Throughout the similar interval, the common each day price paid per transaction plummeted by 70%, information from IntoTheBlock confirmed.

Supply: IntoTheBlock

The decline in community charges on the main L1 is because of a drop in community utilization and the expansion within the adoption of Layer 2 (L2) scaling options previously few months.

After climbing to a year-to-date excessive of $13.42 billion on 14 March, the each day transaction quantity on Ethereum has since fallen by 78%.

Supply: IntoTheBlock

As anticipated, the regular decline in community charges resulted in a lower in community income. In accordance with information obtained from Token Terminal, Ethereum’s community income declined by 22% previously 30 days.

ETH futures contracts at their lowest degree this 12 months

On 17 August, main coin Bitcoin [BTC], suffered its largest single-day sell-off of the 12 months, which despatched it to commerce briefly under the $25,000 worth mark. Attributable to its statistically vital optimistic correlation to the coin, ETH has since skilled a liquidity exodus from its futures market.

In accordance with information from Coinglass, ETH’s Open Curiosity has since trailed downward. As of this writing, it was pegged at $4.69 billion, having fallen by 29% for the reason that deleveraging occasion.

On 23 August, the liquidity flush-out precipitated the alt’s Open Curiosity to succeed in its year-to-date low of $4.67 billion.

Supply: Coinglass

This sort of vital decline in an asset’s Open Curiosity is mostly interpreted as a adverse signal for the underlying asset. It implies that buyers are closing out their positions of their numbers as market sentiment continues to be overwhelmingly bearish.

Whereas ETH’s worth maintained assist at $1600, it continued to commerce inside a slim vary at press time, leaving many buyers unsure about its subsequent worth path. Whereas a catalyst is being awaited, many have determined to hedge in opposition to any additional dangers by exiting their positions.

How a lot are 1,10,100 ETHs value right this moment?

Traders who haven’t closed their ETH positions for the reason that deleveraging occasion are betting in opposition to ETH’s worth. That is evident from the adverse funding charges throughout crypto exchanges since 17 August, in accordance with Coinglass.

This indicated that there was a big quantity of short-selling stress on ETH, which may contribute to additional worth declines.

Supply: Coinglass