How Ethereum HODLers pegged Bitcoin to second place

- The variety of ETH long-term holders surpassed BTC by greater than 40 million.

- Bitcoin’s incapacity to supply a plethora of use instances contributed to the swap.

As the highest two Most worthy cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH] haven’t needed to take care of any robust competitors to yank them off the standings. Nevertheless, there was a change in the way in which market contributors view each belongings.

Real looking or not, right here’s ETH’s market cap in BTC phrases

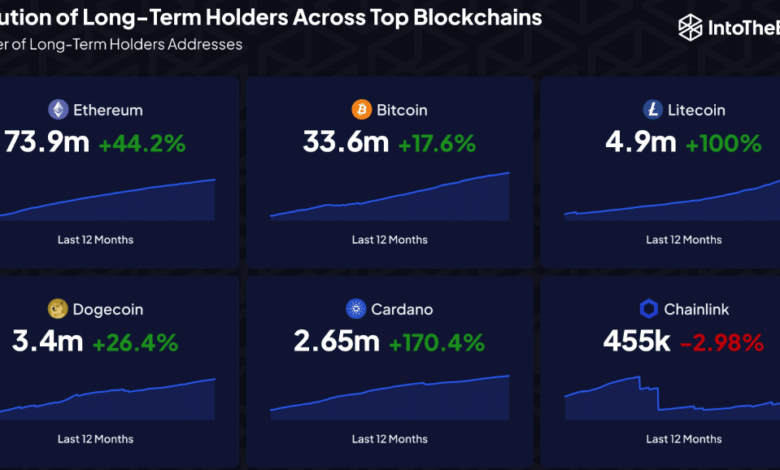

Bitcoin, being the foremost cryptocurrency, was the asset with essentially the most long-term holders at one level. Nevertheless, based on a current infographic by IntoTheBlock, Ethereum has flipped the king coin with an over 40 million distinction.

IntoTheBlock famous that Ethereum has 73.9 million long-term holders. Bitcoin, however, has 33.6 million HODLers. Though each cryptocurrencies registered will increase within the metric on a 12 months-on-12 months (YoY) foundation, Ethereum led once more with a 44.2% improve.

Supply: IntoTheBlock

However how has this occurred? Effectively, there are a selection of causes for the change. And the highest of the listing must be the basics, use instances, and developmental trajectories of each initiatives.

BTC stays true to the core, ETH evolves

For Bitcoin, it has maintained its place as a peer-to-peer cost community and retailer of worth for its holders. Nevertheless, Ethereum has continued to evolve since Vitalik Buterin’s 2013 whitepaper. At the moment, the Ethereum c0-founder solely defined the blockchain as a mannequin of constructing decentralized Functions (dApps).

Whereas the dApp growth was largely finished on the Ethereum mainnet, the arrival of making different layers on the blockchain led to a rise in interplay with ETH.

As an illustration, Ethereum has additionally solidified its place because the constructing block of Decentralized Finance (DeFi), sport growth, and Non-Fungible Tokens (NFTs).

Though the second-largest blockchain has not but been in a position to scale as a lot as Bitcoin by way of transaction prices, the event of scalable options beneath it has been in a position to entice extra holders of ETH.

In relation to value motion, BTC has clearly been the higher asset because it existed lengthy earlier than the arrival of ETH. In accordance with CoinMarketCap, ETH’s all-time efficiency was a 61,363.72% hike. BTC, nonetheless, may boast of a 44.22 million all-time improve.

Supply: CoinMarketCap

Attracting holders with their needs

Nevertheless, in current occasions, the adoption of cryptocurrency has not been restricted to cost motion alone, particularly in seasons the place the market situation isn’t precisely favorable.

On the identical time, developments that go well with the needs of market contributors have performed a component, and Ethereum appears to have gained on this regard. Notable examples are the Merge and the Shapella improve which supplied validators entry to stake and unstake at any given interval.

Relating to NFTs, the Ethereum blockchain proved to be the star of the season through the 2021 bull cycle. One should admit that these collectibles affect the adoption ETH has seen up to now.

This 12 months, some builders on the Bitcoin community tried making NFTs mainstream on the blockchain. However after a interval of spectacular adoption by way of Bitcoin Ordinals, the hype dwindled.

How a lot are 1,10,100 ETHs price immediately?

And at press time, Ethereum NFT gross sales have completely outclassed its Bitcoin counterpart, primarily based on CryptoSlam’s knowledge.

Supply: CryptoSlam

Because it stands, it might be difficult for the variety of Bitcoin holders to flip Ethereum. Nevertheless, the chance could not but be gone. However it may rely on numerous components together with retail and institutional adoption, regulatory insurance policies, and undoubtedly, value motion.