This Indicator Sparks Confidence In Bitcoin Rise To $27,000

For Bitcoin (BTC), the most important cryptocurrency available in the market, the month of September has seen an absence of definitive energy from each bulls and bears, leading to a interval of sideways chop and speedy bouts of volatility.

Materials Indicators, a distinguished crypto evaluation agency, sheds gentle on the prevailing market circumstances and highlights the intricacies of short-term value motion (PA) towards the backdrop of the macro sentiment.

Unpredictable Market Situations Prevail As BTC Seeks Path

Regardless of a bearish macro sentiment, the place a broader downtrend is anticipated, short-term value motion usually deviates from the macro development. This phenomenon explains the occasional short-term pumps and rallies noticed even inside a prevailing downtrend.

Materials Indicators emphasizes the significance of understanding these dynamics and the potential implications they maintain for Bitcoin.

Yesterday’s efficiency of the main cryptocurrency might have come to a detailed, however Materials Indicators level to indications that one other rally may very well be on the horizon.

The agency highlights the Development Precognition A1- indicator developed and used to identify micro, and macro developments by the firm- continues to exhibit a slight uptick in bullish momentum throughout the every day (D), weekly (W), and month-to-month (M) charts, as seen above.

This development suggests the opportunity of a resurgence in Bitcoin’s worth, albeit with the necessity for warning and additional evaluation.

As of the time of writing, Bitcoin is presently buying and selling at $25,800, persevering with its extended interval of sideways value motion because the begin of the month. Nevertheless, it’s price noting that Bitcoin has been unable to regain the crucial $26,000 degree, which holds important significance for the cryptocurrency.

Reclaiming this degree is essential with the intention to invalidate any potential bearish strain and mitigate the opportunity of Bitcoin experiencing an additional decline in its value.

Surge In New Bitcoin Addresses Alerts Rising Curiosity

Amidst ongoing uncertainty and sideways value motion, an intriguing development has emerged that sheds gentle on the increasing curiosity in Bitcoin.

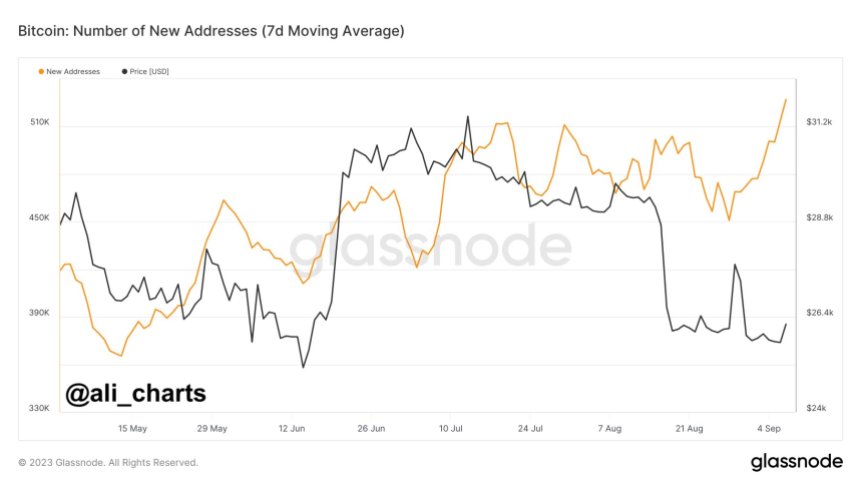

Notably, roughly 527,000 contemporary Bitcoin addresses are being created each day, reaching a brand new yearly excessive. Famend crypto analyst Ali Martinez delves into the importance of this surge and its implications for the cryptocurrency market.

The surge in new Bitcoin addresses suggests a rising curiosity and engagement with the digital forex, even throughout a interval when its value has witnessed occasional drops.

This surge in tackle creation signifies that an growing variety of people are exhibiting curiosity in Bitcoin, doubtlessly attracted by its underlying know-how, decentralized nature, and potential for monetary independence.

For long-term buyers and advocates of Bitcoin, this surge in tackle creation serves as a constructive signal, reflecting sustained curiosity and belief within the cryptocurrency’s community. It demonstrates that people should not deterred by short-term value volatility and are dedicated to collaborating within the Bitcoin ecosystem for the lengthy haul.

By actively creating new Bitcoin addresses, people are primarily establishing a connection to the community and positioning themselves to interact in varied Bitcoin-related actions, together with sending and receiving funds, collaborating in decentralized purposes (DApps), and exploring the broader cryptocurrency ecosystem.

Ali Martinez emphasizes that this upward development in tackle creation is important because it suggests an increasing person base and a possible inflow of latest individuals into the Bitcoin market.

As extra people be part of the community, it strengthens the general resilience and legitimacy of Bitcoin, additional solidifying its place as a distinguished participant within the international monetary panorama.

Featured picture from iStock, chart from TradingView.com