Whales Abandon Ship? Ethereum Value In Jeopardy As Major Holders Liquidate

Ethereum (ETH), a major participant within the crypto house, has just lately come beneath scrutiny attributable to some regarding on-chain actions.

Notably, the variety of addresses holding vital quantities of Ethereum has declined, and a few long-term holders seem like liquidating their positions, doubtlessly posing threats to Ethereum’s worth.

Whale Watch: A Steep Decline In Ethereum Holdings

On-chain analytics have been instrumental in providing real-time insights into crypto market traits. Current revelations have highlighted a downturn in Ethereum’s holding patterns which may have deeper implications for the digital asset’s worth and the market.

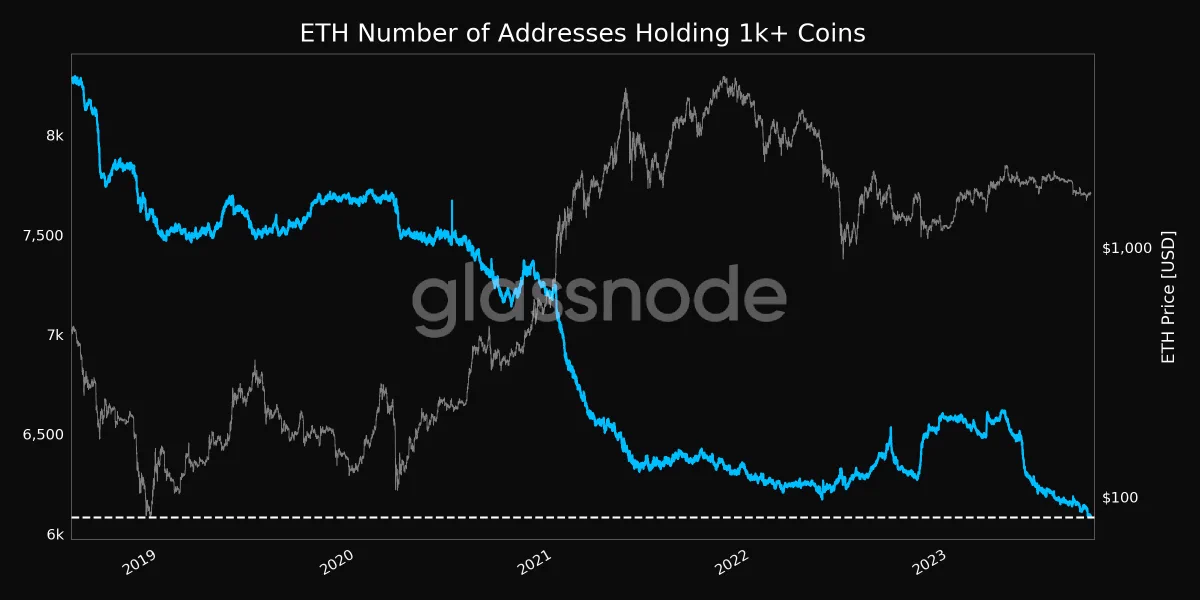

Based on Glassnode, a number one on-chain analytic platform, the variety of addresses holding 1,000 Ethereum (ETH) cash or extra has plummeted to a 5-year low.

Exactly, these addresses, usually termed ‘whale addresses’ within the crypto world, have decreased to six,082. Such a pointy decline might be attributed to the liquidation actions of a few of Ethereum’s long-term holders.

It’s value noting that this contraction in whale holdings might doubtlessly enhance the susceptibility of Ethereum to market bears, doubtlessly initiating a downward value trajectory.

The influence of such gross sales available on the market is clear. When giant portions of a cryptocurrency, akin to Ethereum, are offloaded, it usually results in a substantial inflow of promoting strain. This will trigger panic amongst smaller traders, prompting additional gross sales and probably resulting in a value drop.

Further Pressures From Dormant Wallets

Curiously, one other layer provides to Ethereum’s promoting strain alongside the lower in large-scale holdings. Based on data from Lookonchain, a famend on-chain knowledge evaluation agency, a dormant Ethereum pockets, untouched for round 4 years, has instantly sprung into motion.

The pockets in query liquidated its total ETH holding, shortly pushing roughly $4.81 million value of the altcoin into the market.

A pockets that had been dormant for 4 years bought all 2,591 $ETH for $4.18M stablecoins 6 hours in the past.https://t.co/et78rXHG5u pic.twitter.com/pJanMLxwA3

— Lookonchain (@lookonchain) September 20, 2023

Such sudden gross sales from long-inactive wallets might increase alarms out there. Whereas the precise causes behind such liquidations usually stay hid, they invariably amplify the promoting pressures on the affected cryptocurrency, which, on this case, is Ethereum.

In the meantime, Ethereum’s value has seen a slight bullish trajectory over the previous week, up 1.4%. The asset has moved from a low of $1,596 seen final Wednesday to commerce above $1,650 on Monday earlier than retracing to $1,626, on the time of writing down by 1.8% up to now 24 hours.

Featured picture from Unpslah, Chart from TradingView