NEAR Protocol’s Daily Active Addresses Spike, Will Prices Follow?

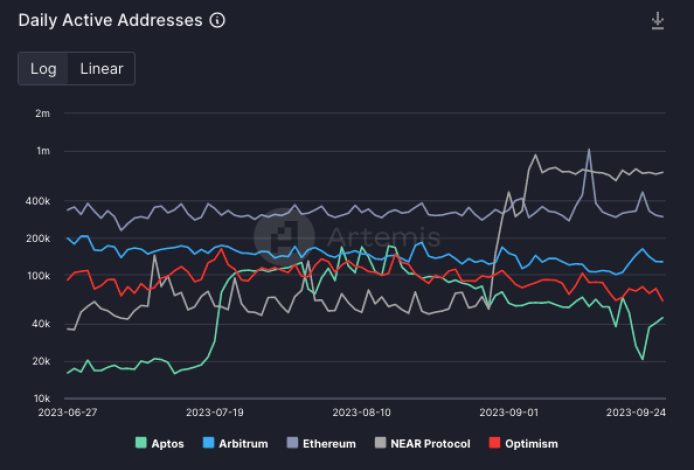

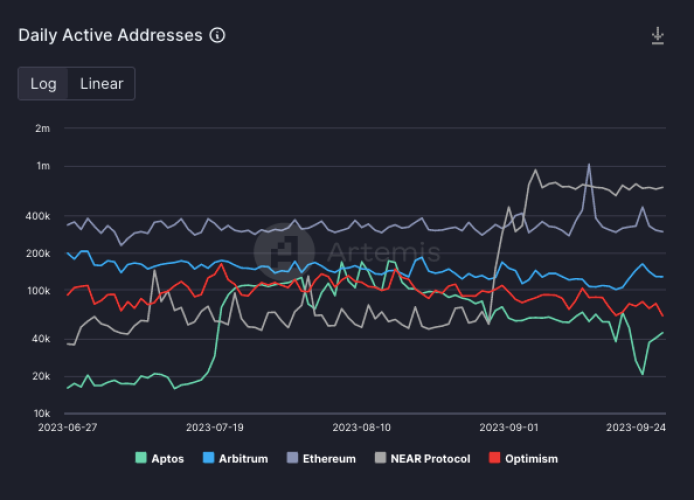

Prior to now month, there have been extra each day energetic addresses on the NEAR Protocol than in Ethereum and its layer-2 protocols, together with Arbitrum and OP Mainnet, Artemis information from September 25 reveals.

Artemis, an institutional information platform for digital property, exhibits that the variety of each day energetic addresses on NEAR Protocol has been constantly above the 400,000 stage in September.

Each day Energetic Addresses On NEAR Protocol Surging

Trying nearer on the information confirms that the variety of each day energetic addresses on Ethereum, the pioneer sensible contract platform that hosts most decentralized finance (DeFi) and non-fungible token (NFT) exercise, has been dropping.

For instance, the variety of each day energetic on Ethereum rose above 1 million in mid-September however has since greater than halved to under 400,000. The identical development may be seen in Arbitrum, which dropped from round 200,000 in late June to 150,000 when writing on September 25.

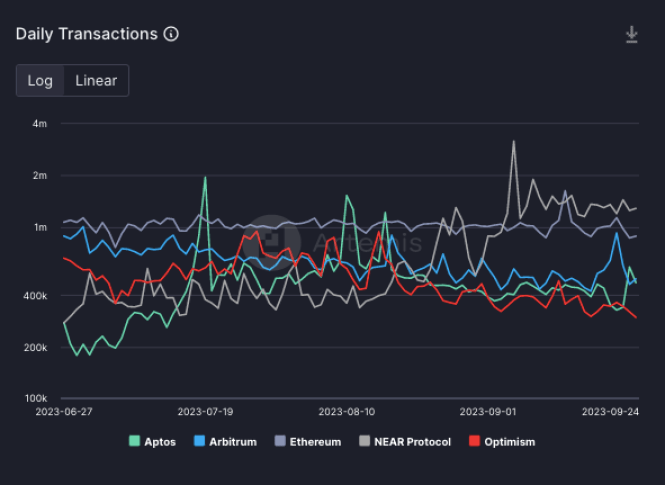

Throughout this time, NEAR Protocol’s each day energetic addresses have quickly spiked from round 40,000 in late June to above 400,000, outperforming Ethereum on this metric. With rising each day energetic addresses, there was a spike in each day transactions over the previous month. In response to trackers, the NEAR Protocol processes extra transactions than Ethereum.

Public ledgers like NEAR Protocol and Ethereum rely on a group of customers who actively transact—transferring worth or working protocols—or validators- to safe the community. Nevertheless, the variety of each day energetic addresses can present worthwhile insights into the extent of adoption, person engagement, and the community’s total well being.

Apart from person engagement, rising each day energetic addresses may also level to altering market sentiment, which might considerably impression costs.

Bears In Management As DEX Buying and selling Quantity Stays Comparatively Secure

When writing, NEAR, the native token of the NEAR Protocol, is buying and selling at round 2023 lows. Altering palms at $1.107, the coin is down 61% from 2023 highs and stays beneath strain.

The candlestick association within the each day chart factors to consolidation and stability above the first resistance stage at $1. Bears have the higher hand if costs stay under $1.23, a essential resistance stage marking the August 17 highs.

As proof exhibits, the community exercise and value motion diverge. Though the transaction depend additionally rose, the variety of distinctive addresses interacting with NEAR Protocol decentralized exchanges has principally been secure. Trying on the numbers, DEX quantity on the platform is considerably decrease than these registered in Ethereum and its standard layer-2 platforms.

Characteristic picture from Canva, chart from TradingView