Ethereum Liquid Staking Protocols Hit New Milestone Following Massive Inflows

Ethereum liquid staking platforms are making waves within the decentralized finance (DeFi) ecosystem. Current on-chain reviews have revealed that liquid staking protocols have recorded a brand new milestone within the variety of Ether (ETH) staked, reaching a staggering 12 million ETH mark in just some days.

Ethereum Liquid Staking Positive factors Momentum

With Ethereum 2.0 thriving, liquid staking protocols within the DeFi ecosystem have been rising quickly regardless of current market volatility.

Analysis information from DeFi TVL aggregator, Defillama, revealed on Monday, September 25, the large development of Ethereum holdings in liquid staking platforms. In accordance with the info, the ETH in liquid staking protocols has risen to roughly 12.31 million and should proceed rising.

Reviews uncovered {that a} staggering 370,000 ETH have been staked in simply 5 days, permitting liquid staking protocols to achieve their present 12 million mark. Liquid staking platforms like Lido, Rocket Pool, Coinbase, and Binance are among the many checklist of outstanding protocols that led to the current upsurge in Ether staking.

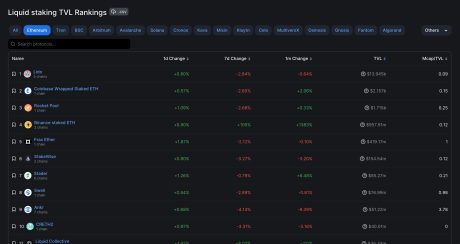

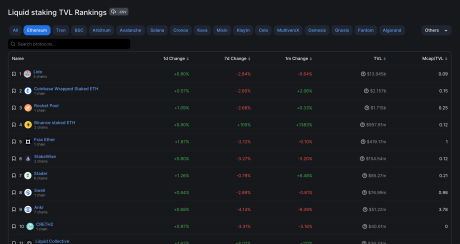

In accordance with Defillama TVL rankings, Lido holds the highest spot for the quantity of Ethereum staked with a TVL of $13.997 billion in liquid staking. The protocol secured over 8 million Ether on September 20, and one other 30,000 after that.

Lido Finance dominates ETH liquid staking | Supply: DeFiLlama

Coinbase is presently ranked second in Defillama’s TVL rankings, holding roughly $2.155 billion, a big hole from Lido’s TVL.

Coinbase has about 1.3 million Ether presently in its reserve. Whereas, Rocket Pool holds the third place in TVL rankings and has elevated its Ether holdings from 940,496 to 945,402.

Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driving drive behind the current spike in ether inflow in liquid staking protocols within the DeFi ecosystem.

In accordance with reviews, Binance added a startling quantity of ether to its already substantial ether reserves. The liquid staking platform which beforehand recorded 445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105 ETH. Analysis information have revealed that Binance amassed a substantial quantity of ETH tokens to assist its staking token, Wrapped Beacon ETH (WBETH).

Within the final three months, the DeFi ecosystem recorded a liquid staking valuation above $20 billion evaluating varied protocols within the DeFi ecosystem. Following this, Defillama’s September information revealed liquid staking protocols now maintain $20.5 billion in property, rising by a staggering 293% from earlier lows in June 2022.

Though the important thing protocols steering the surge are Lido, Binance, and Rocket Pool. Different upcoming liquid staking protocols like Davos and InQubeta are persisting, pushed by the Ethereum 2.0 improve and traders need to maximise their earnings by means of Ethereum staking.

ETH worth at $1,587 as liquid staking surges | Supply: ETHUSD on Tradingview.com

Featured picture from iStock, chart from Tradingview.com